(((The Daily Shot)))

@soberlook

The Daily Shot is a graphical, no-hype global financial and economic newsletter (see sample: thedailyshot.com/the-daily-shot…).

ID: 423769635

http://TheDailyShot.com 28-11-2011 22:34:43

31,31K Tweet

161,161K Followers

268 Following

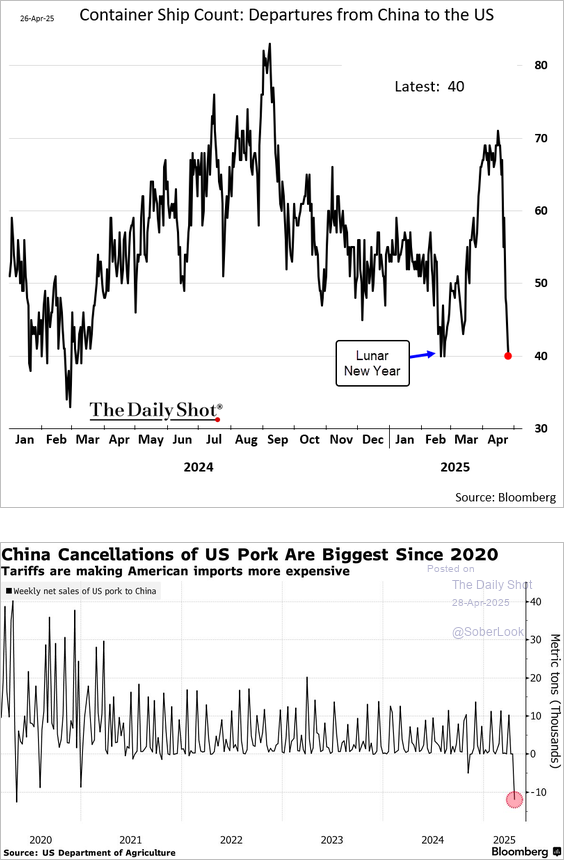

The number of container ships departing from China to the US declined further in recent days as businesses canceled orders, while China is also canceling some US imports. Source: Bloomberg Economics

From @soberlook Downward earnings revisions for S&P 500 firms have spiked to levels not seen since the pandemic or the Global Financial Crisis Charles Schwab Corp @factset

Both business optimism and capital spending expectations in the U.S. have plunged, marking one of the steepest two-month declines since the pandemic. Goldman Sachs Gunjan Banerji

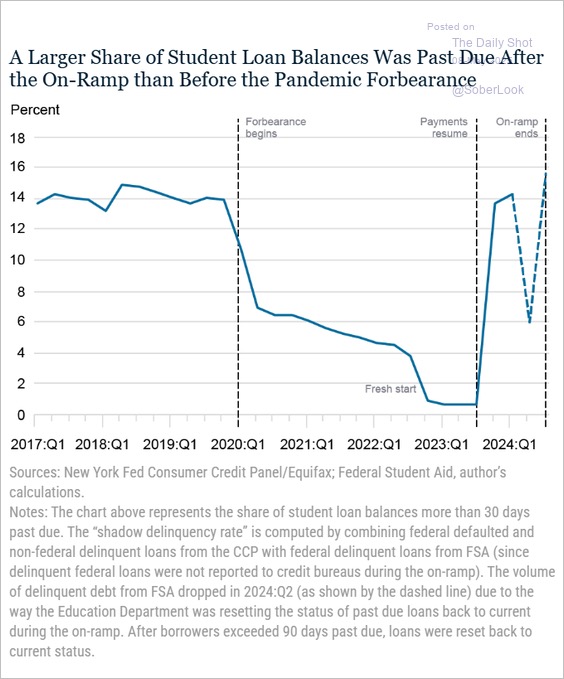

Student loan delinquencies (30+ days past due) surged to 15.6% post-on-ramp, exceeding pre-pandemic levels, signaling heightened repayment stress and potential impending credit score impacts. Source: New York Fed

Equities: Goldman’s positioning indicator, deeply in negative territory, suggests there is room for stocks to rally. (((The Daily Shot))) dailyshotbrief.com

“Long gold” is now considered the most crowded trade for the second month in a row (1), and a record 45% of fund managers now view gold as overvalued—the highest reading in the survey’s 17-year history (2). Source: Bank of America Business Insights

Equities: On a long-term basis, the US equity-bond correlation has trended more positive since COVID. ty (((The Daily Shot))) dailyshotbrief.com

Rates: The X-date is projected to fall in late August or early September. ty (((The Daily Shot))) May: $BBB passes House June: Senate susses it out July: Reconciliation August: Trump inks it dailyshotbrief.com

Goldman’s Twitter-based sentiment indicator has surged, diverging from consumer confidence. Goldman Sachs Mike Zaccardi, CFA, CMT 🍖