Daily Chartbook

@dailychartbook

The day's best charts & insights, curated: https://t.co/Eq1KKRKE1u

ID:1550094509899489280

https://www.dailychartbook.com/about 21-07-2022 12:25:14

17,6K Tweets

14,4K Followers

300 Following

Follow People

'The calendar year 2024 earnings estimate is holding up like a rock at around 9%. Typically, it would be drifting lower at this stage, but we are only a few quarters into a new earnings up-cycle, so it makes sense for the estimates to hold up.'

Jurrien Timmer

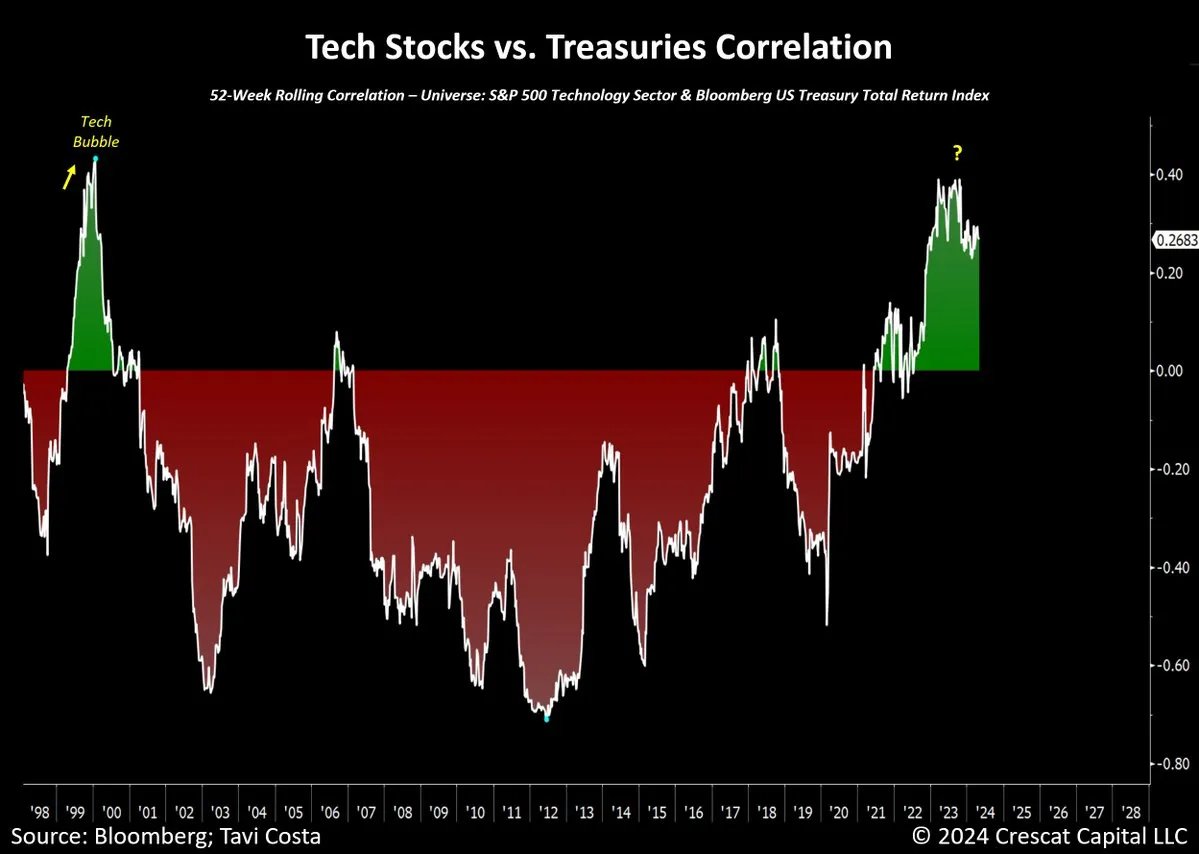

'The correlation between tech stocks and treasuries is now as positive as it was during the peak of the tech bubble in early 2000. This issue strikes at the heart of conventional 60/40 portfolios.'

Otavio (Tavi) Costa

'Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income.'

The Conference Board

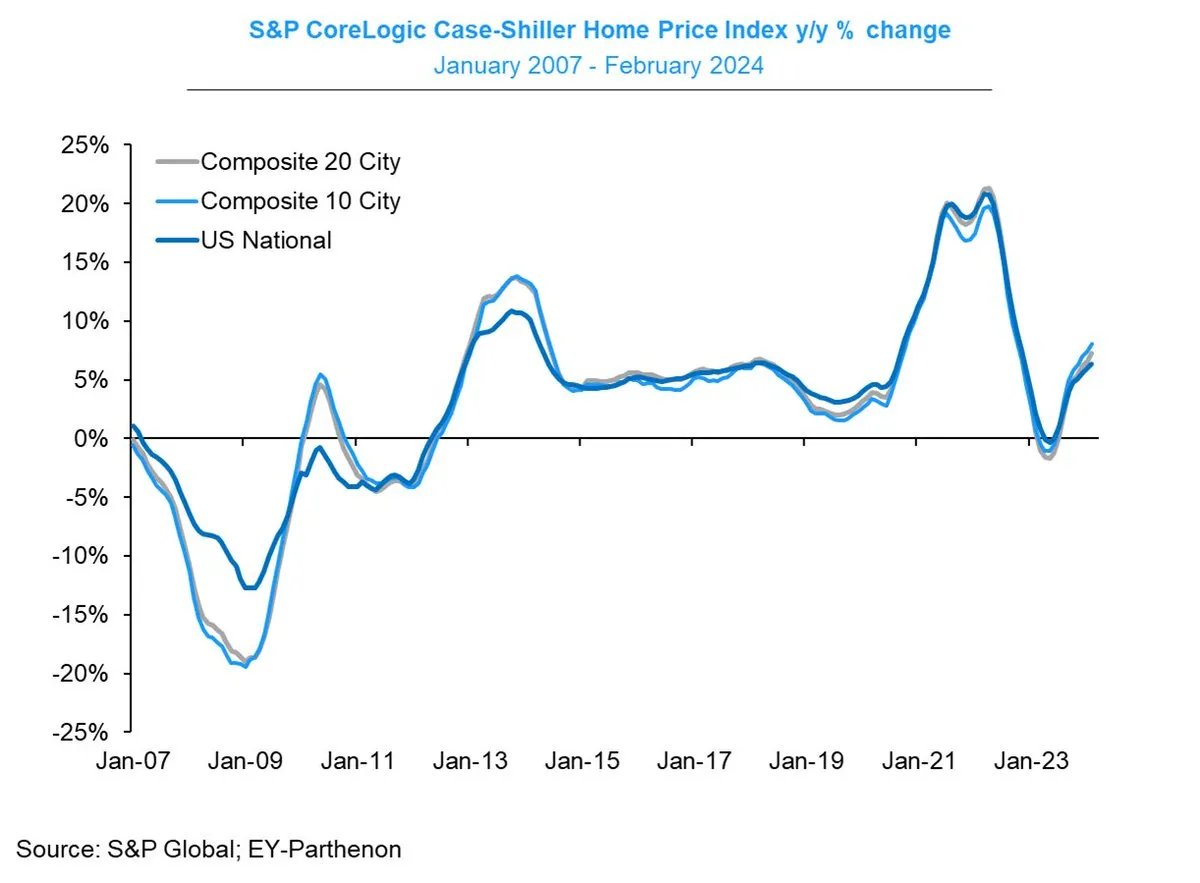

The 20-city home price index jumped 0.9% MoM in February to 7.3% YoY (vs. 6.7% est). The former is the largest increase since June 2023 while the latter is the largest since October 2022.

chart Gregory Daco

FHFA House Price Index:

'FHFA home prices rose 1.2% MoM in February (most since April 2022) to 6.8% YoY'. - Daily Chartbook

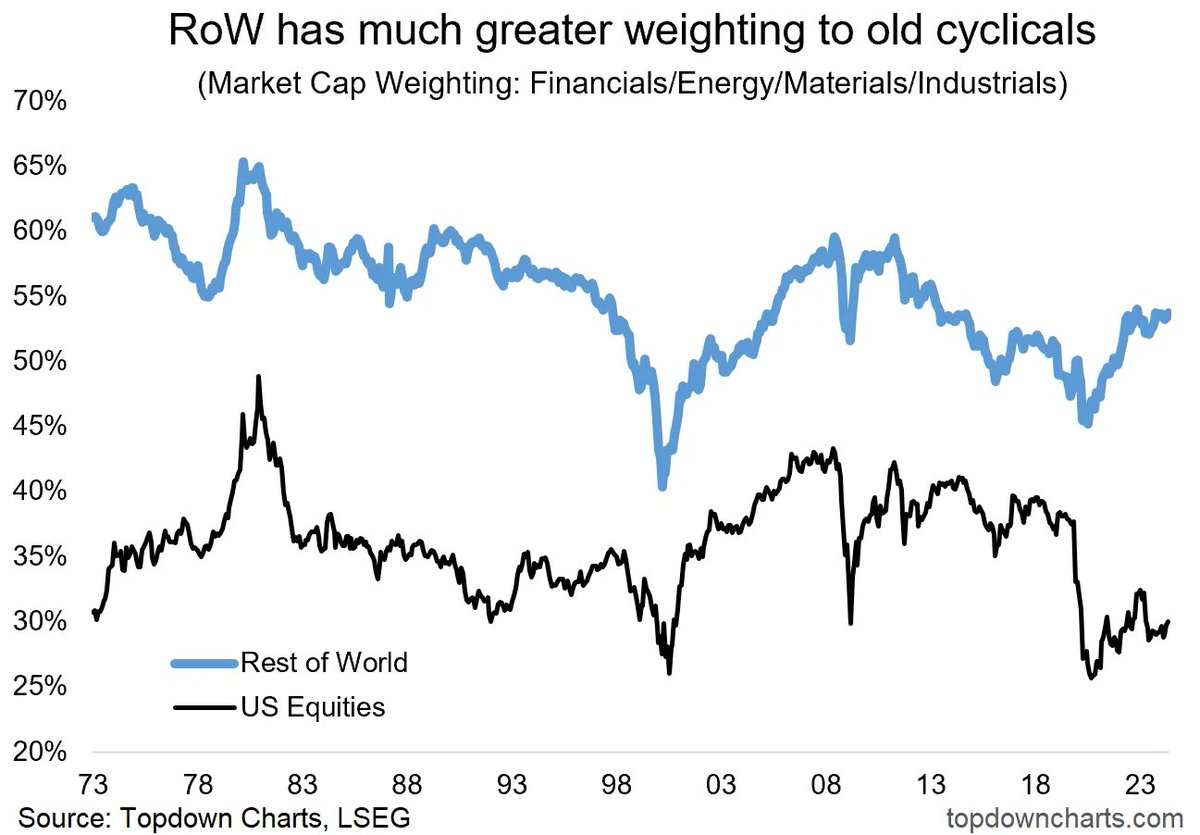

Global stocks have twice the weighting to 'Old Cyclicals' (Energy, Materials, Financials, Industrials) compared to the US.

Callum Thomas Topdown Charts