Willie Delwiche, CMT, CFA

@williedelwiche

@HiMountResearch founder | Teaching Econ/Finance at @insidewlc | Urban farmer & vintner

All models are wrong - some are useful

ID: 1900667678

https://himountresearch.substack.com/ 24-09-2013 14:28:51

22,22K Tweet

24,24K Takipçi

290 Takip Edilen

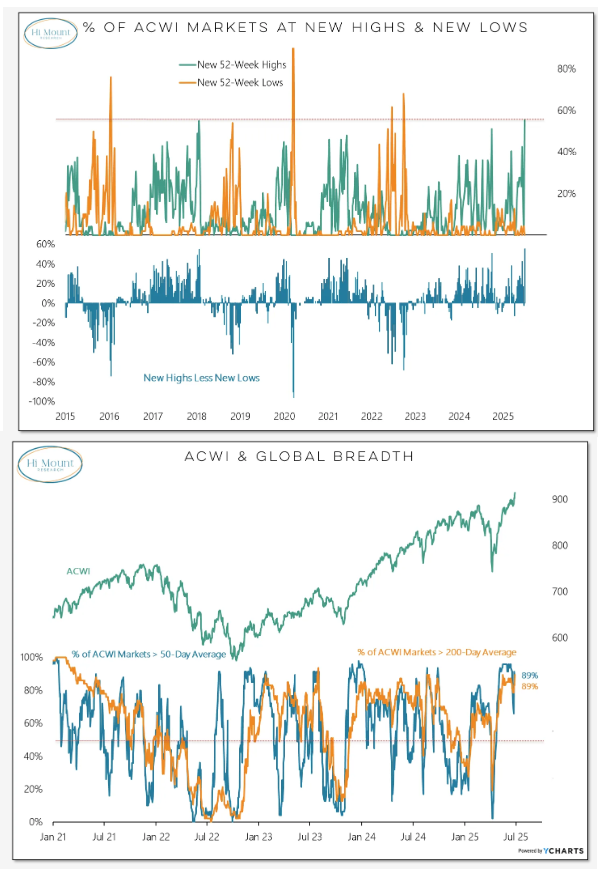

Broke this down in more detail in this week's update from Hi Mount Research: himountresearch.substack.com/p/global-marke…

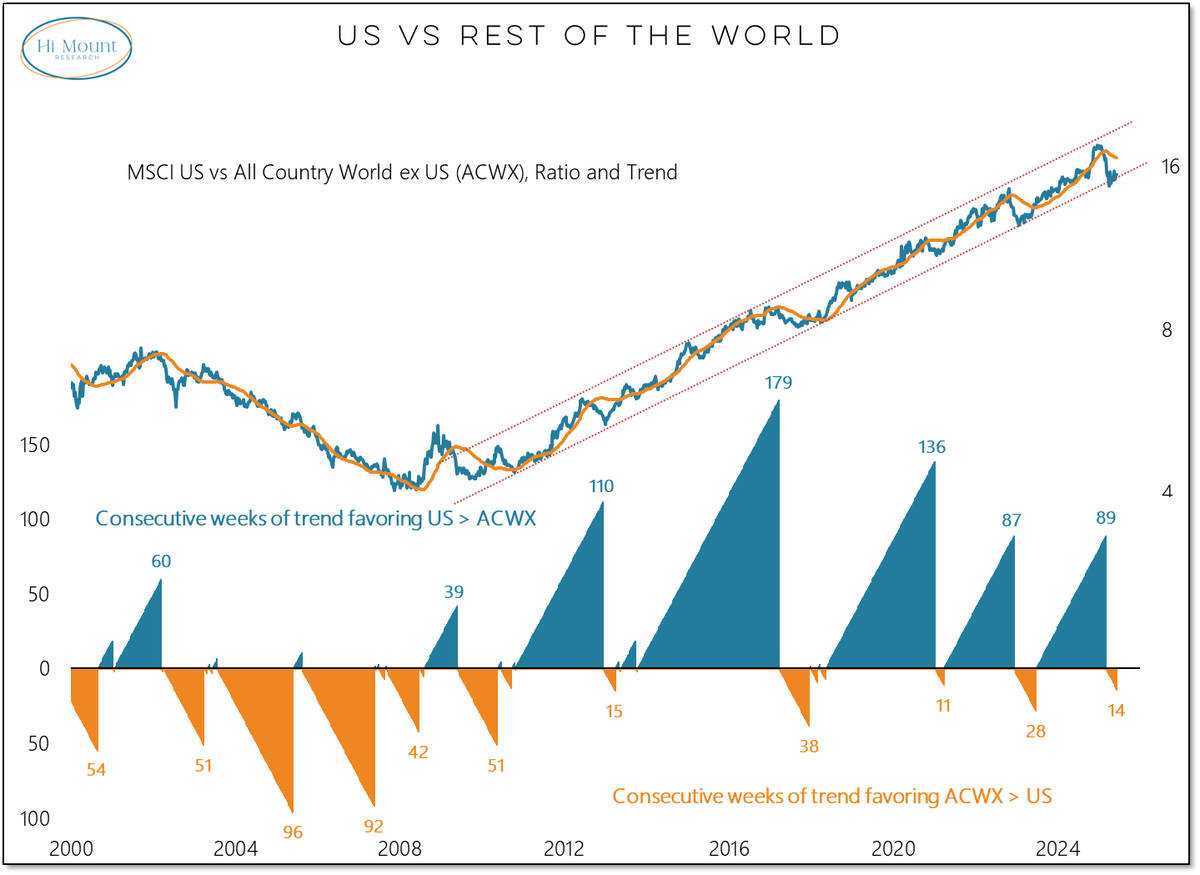

Question on every investor's mind is whether 14 years of US leadership is still intact or if 14 weeks of global strength is just the beginning. The latest update from Hi Mount Research: himountresearch.substack.com/p/global-marke…

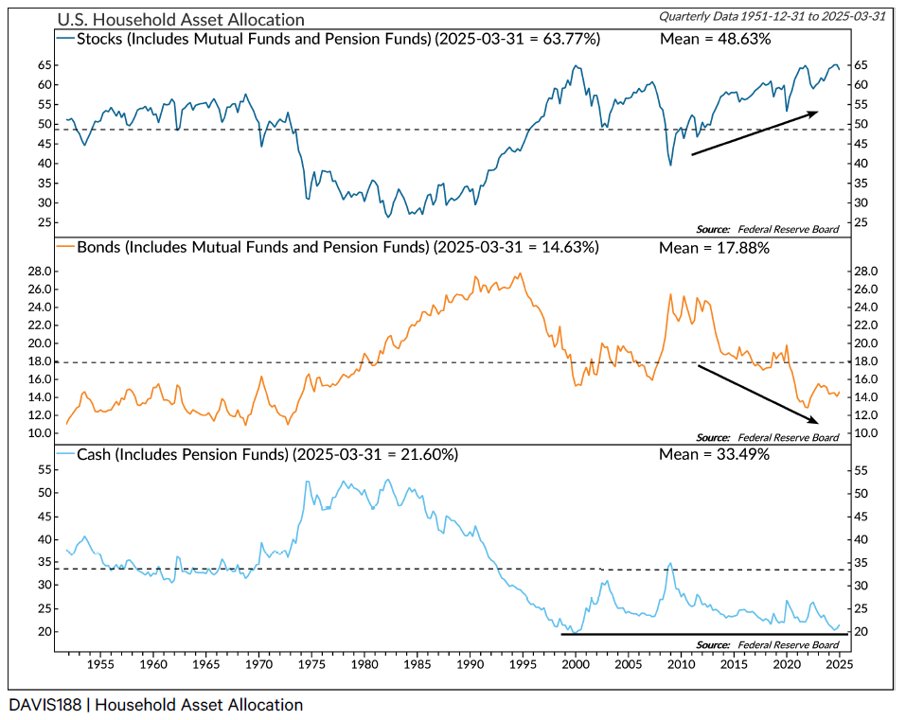

Data from Ned Davis Research shows households with historically high exposure to stocks & historically low levels of cash.

In the reading queue for this week: "The Serviceberry" by Robin Wall Kimmerer & "How Not to Invest" by Barry Ritholtz.

One thing I like about Daily Chartbook's daily email is they put the link to the post, so you can click through to get more detail. One from Monday's email was to the always interesting Willie Delwiche, CMT, CFA's post (link below). "Evidence of this increased appetite for risk can be