ISABELNET

@isabelnet_sa

Advanced Stock Market Forecast for Professionals & Individuals available on isabelnet.com • 95% Correlation since 1970 • R² = 0.90 • Tweets ≠ Advice

ID: 1098994585815171073

https://www.isabelnet.com/ 22-02-2019 17:15:02

56,56K Tweet

60,60K Followers

19,19K Following

📌 Earnings Recent weeks have seen a sustained rise in S&P 500 earnings sentiment, driven by strong corporate results and a persistent trend of earnings beats 👉 isabelnet.com/blog/ h/t Daily Chartbook $spx #spx

🇺🇸 S&P 500 Goldman Sachs still forecasts the S&P 500 will climb to 6,100 by year-end and 6,500 within a year, driven by stronger economic growth, improved corporate earnings, and reduced trade and recession risks 👉 isabelnet.com/?s=S%26P+500 h/t Goldman Sachs $spx #spx #equities

🇺🇸 Equity Americans' love for stocks has driven household equity allocations to historic highs, increasing wealth but also sparking concerns about market stability and the risks of shifting investor sentiment 👉 isabelnet.com/?s=equity Goldman Sachs $spx #spx #equities #stocks

🇺🇸 Earnings Despite market volatility and a rocky start to the year, the "Magnificent Seven" tech giants are projected to continue their dominance in earnings growth throughout 2025, significantly outpacing the rest of the S&P 500 👉isabelnet.com/?s=earnings J.P. Morgan Asset Management $spx #spx

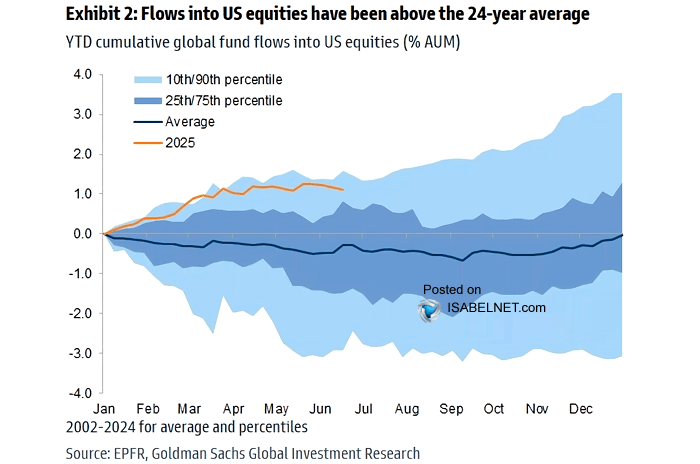

🇺🇸 Flows Despite some volatility and brief periods of outflows, flows into US equities in 2025 have been running above the 24-year average, with projections pointing to a record year for inflows 👉 isabelnet.com/blog/ ht Goldman Sachs $spx #spx #equities #stocks #ETF #funds

📌 Oil While oil prices remain highly sensitive to geopolitical risks, particularly in regions like the Middle East, the market has so far avoided the kind of sustained shock that would trigger broader inflation 👉 isabelnet.com/blog/ h/t Deutsche Bank #oil #brent #crude

📌 Sentiment Market sentiment indicators still point to a neutral market, with no clear dominance of either bullish or bearish sentiment 👉 isabelnet.com/?s=sentiment Goldman Sachs $spx #spx #equities #stocks #bonds #vix

🇺🇸 Valuation Overvaluation in the S&P 500, especially among tech and AI stocks, is a legitimate concern in light of downward revisions to earnings estimates for 2025 and the high degree of index concentration 👉 isabelnet.com/?s=valuation h/t Lance Roberts $spx #spx #valuation

🇺🇸 Fed Fewer cuts are expected in 2025, but chances of greater easing in 2026 have risen. This reflects caution amid inflation and policy risks, and leaves room for stronger monetary support if economic conditions worsen 👉 isabelnet.com/blog/ h/t Daily Chartbook Thomas (Tom) Lee (not drummer) FSInsight.com

📌 Equities US households now allocate about 49% of their assets to equities, a level that reflects strong market optimism and a significant appetite for risk 👉 isabelnet.com/blog/ h/t Vincent Lequertier $spx #equities #household

📌 Flow While rapid AI growth and an infrastructure boom have driven strong inflows into the technology sector, the energy and health care sectors have experienced outflows during the past year 👉 isabelnet.com/blog/ h/t J.P. Morgan #tech $ndx $qqq $spx #spx #equities #stocks

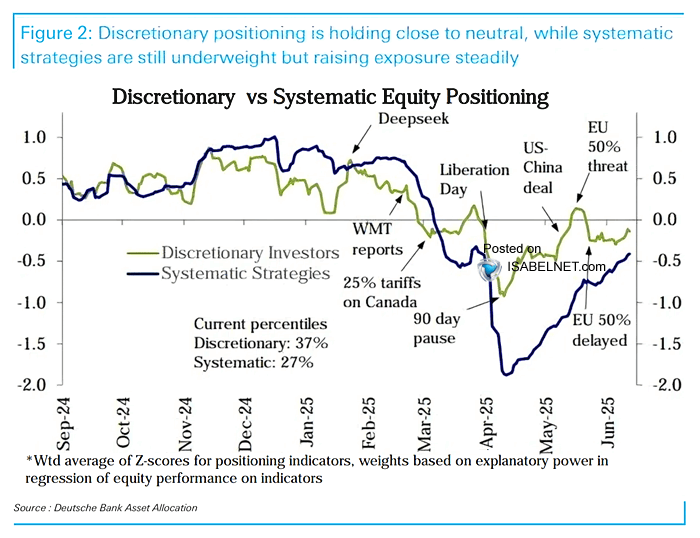

📌 Equity Discretionary investors are keeping a near-neutral stance at the 37th percentile, while systematic strategies are gradually raising exposure but are still underweight 👉 isabelnet.com/blog/ h/t Deutsche Bank $spx #spx #sp500 #equities #stocks

🇺🇸 Margin Debt So far, US margin debt as a share of market capitalization remains elevated, which reflects ongoing confidence in the market 👉 isabelnet.com/blog/ h/t Goldman Sachs $spx #spx #sp500 #equities

🇺🇸 FCI While the easing of US financial conditions bodes well for economic growth—by supporting consumers and businesses—ongoing attention to inflation risks is still required 👉 isabelnet.com/blog/ Goldman Sachs #sp500 $spx #spx #highyield #bonds #dollar #fedfunds

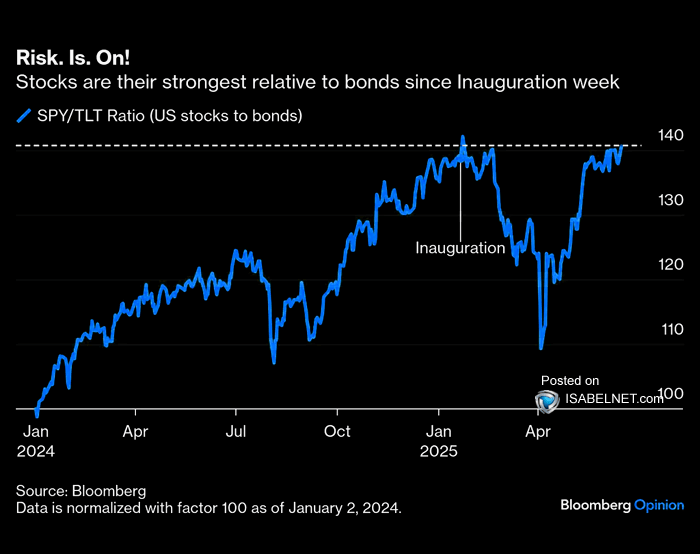

🇺🇸 Stocks/Bonds US stocks are at their strongest relative to bonds since Trump's inauguration, supported by persistent risk appetite and the perception of US market resilience amid global uncertainty 👉 isabelnet.com/blog/ ht Bloomberg Opinion $spx #spx $tlt #stocks #equities #bonds

🇺🇸 GDP The New York Fed's Q3 2025 GDP Nowcast has been revised upward to 2.50%, up from 2.40% the previous week 👉 isabelnet.com/?s=GDP h/t New York Fed #markets #recession #GDP #realGDP #economy