Will McBride

@econowill

Chief Economist and Stephen J. Entin Fellow in Economics @TaxFoundation

ID: 399488156

27-10-2011 15:35:30

5,5K Tweet

1,1K Followers

903 Following

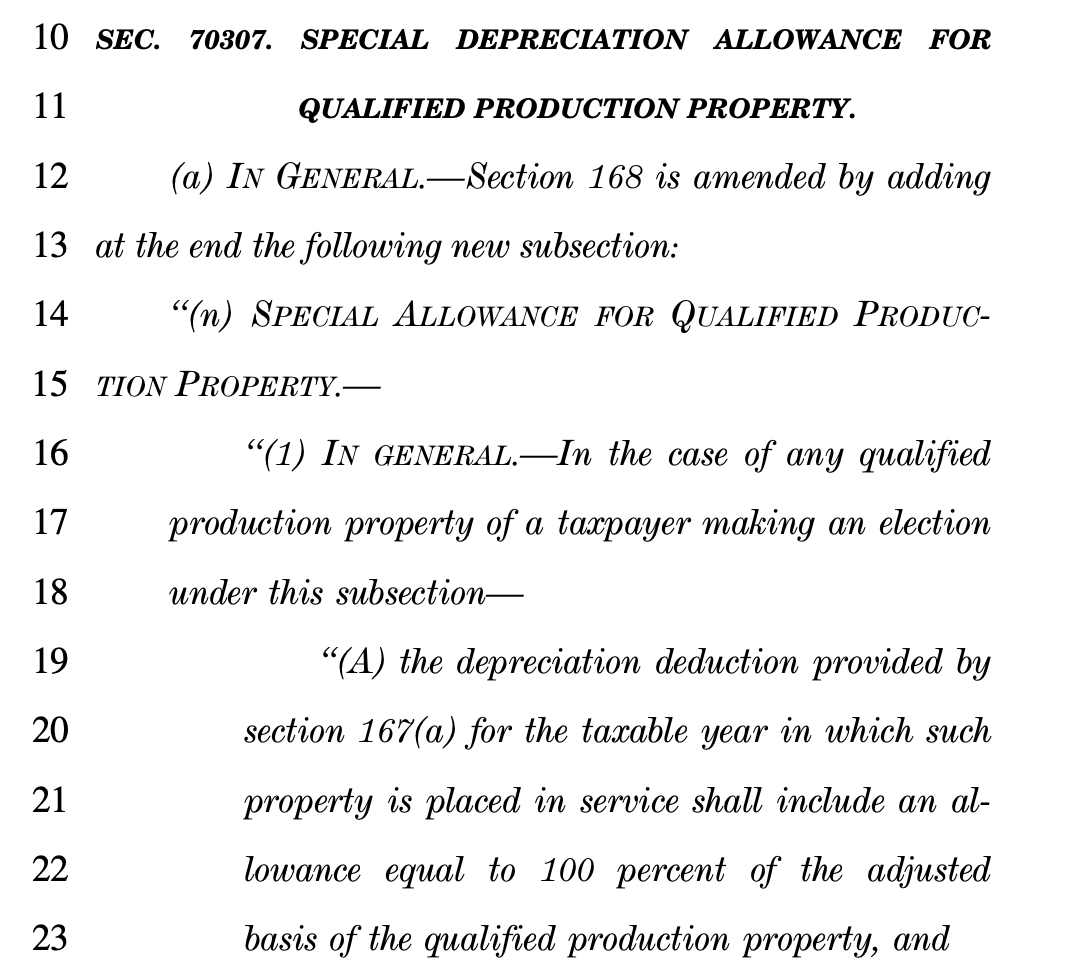

Erica York Alex Durante To generate the most economic growth with the least fiscal cost, lawmakers should prioritize permanent full expensing of capital investment and slim down the cost of the bill by closing tax loopholes and reducing spending. taxfoundation.org/blog/big-beaut… Will McBride

Btw - Tax Foundation has this to say about The Budget Lab macro analysis: ""Similar to JCT’s and CBO’s qualitative analysis of the long run, PWBM and TBL both estimate negative GDP impacts of the bill after three decades, due to strong assumptions..."

New comparison of OBBB econ/dynamic estimates. In brief Council of Economic Advisers report overstates econ effects by ignoring many of the tax hikes while other groups mix in assumptions about interest rates, expectations, and other factors that tend to mute results and obscure effects of tax policy.

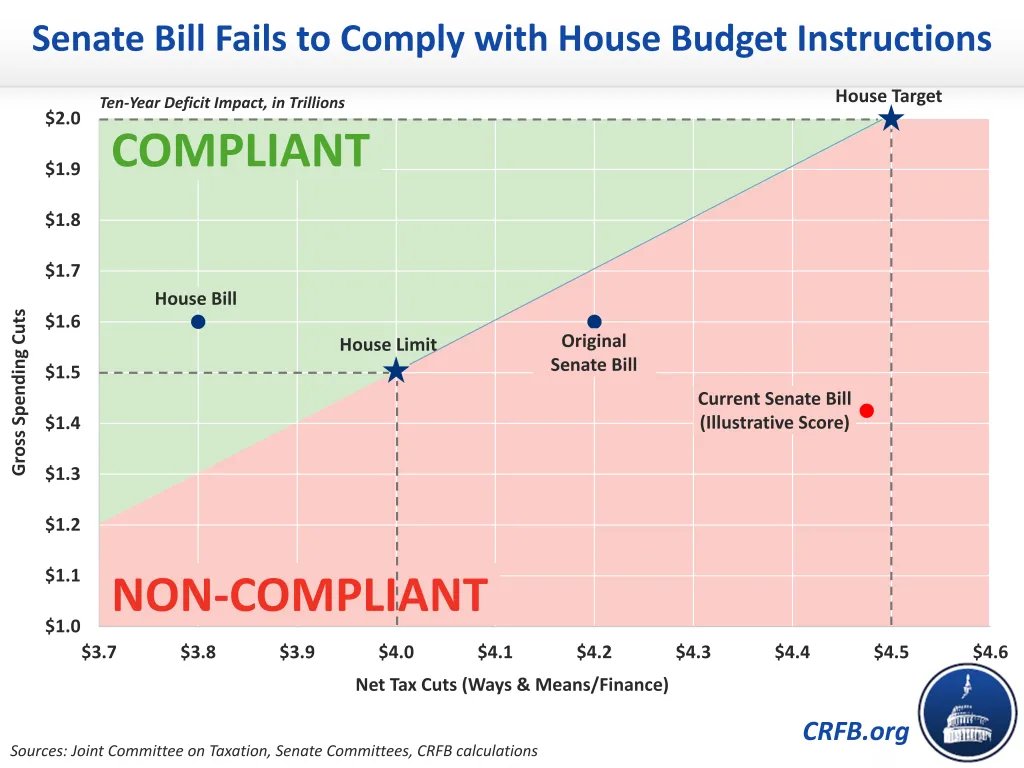

The Senate bill massively violates the House "Rep. Lloyd Smucker rule" requiring $2t of spending cuts or offsetting tax cut adjustments. It's not even close!

Scapegoating The Fed Chair for Interest Rates Won’t Fix the Economy cato.org/commentary/sca… via Cato Institute

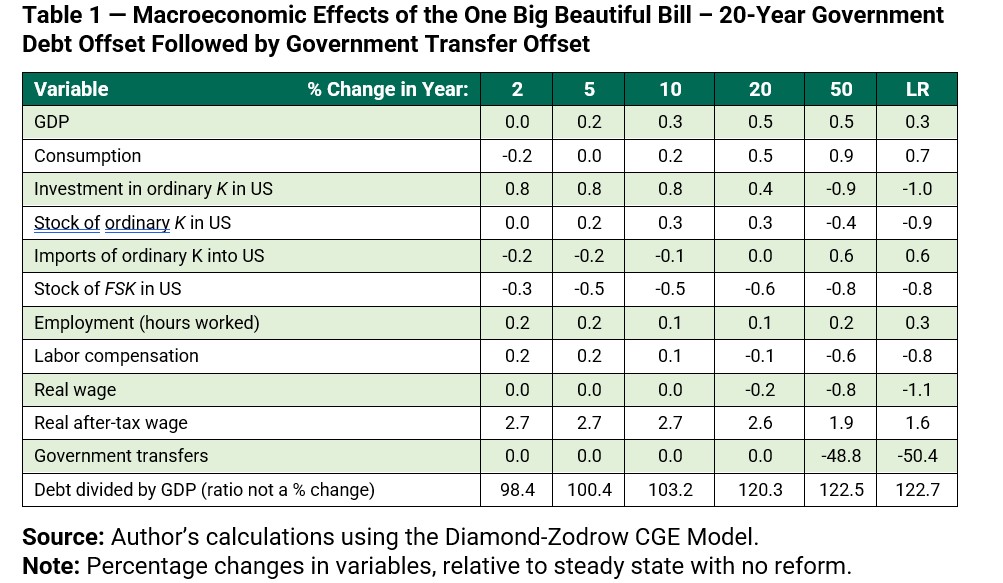

A link to my paper on the macroeconomic effects of the BBB. It is not as Pollyannaish as the Council of Economic Advisers dynamic analysis, but is roughly consistent with other reasonable estimates. The results indicate crowding out is a problem. A little (ok, maybe a good bit) nip-and-tuck could make

New op ed: ‘Big, beautiful bill’ will raise both growth and deficits washingtonexaminer.com/restoring-amer… via Washington Examiner

OBBBA will bring about higher economic growth and higher debt and deficits. Read Tax Foundation's analysis below.