Tax Foundation

@TaxFoundation

The world's leading nonpartisan tax policy 501(c)(3) nonprofit. Learn more about the principles of sound tax policy: https://t.co/5Pg5iwqGvL…

ID:16686673

https://taxfoundation.org/tax-newsletter 10-10-2008 18:13:37

53,4K Tweets

54,5K Followers

805 Following

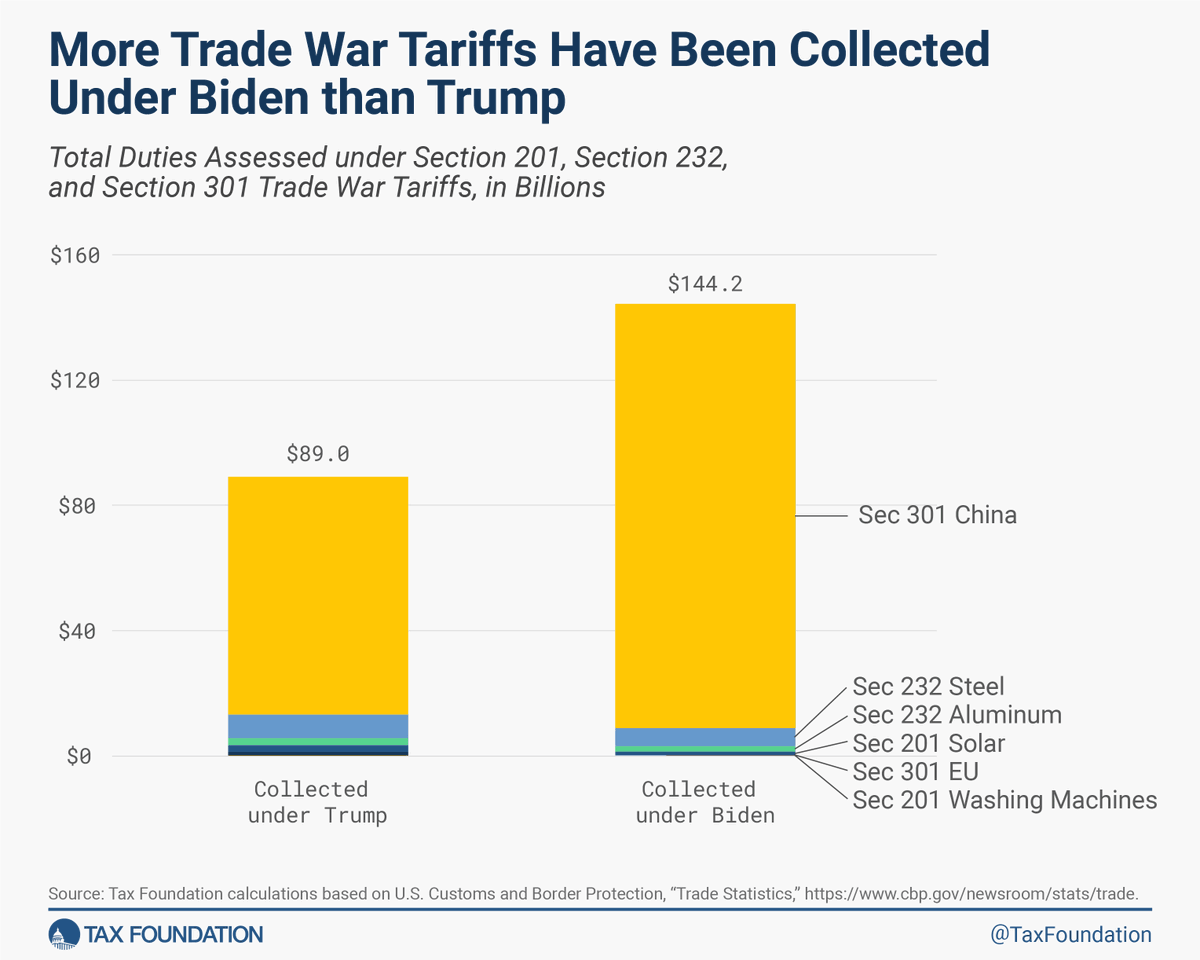

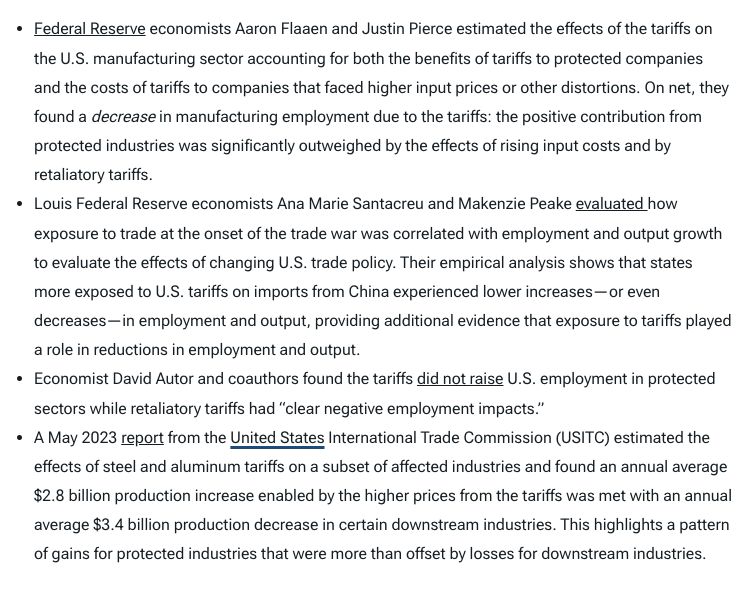

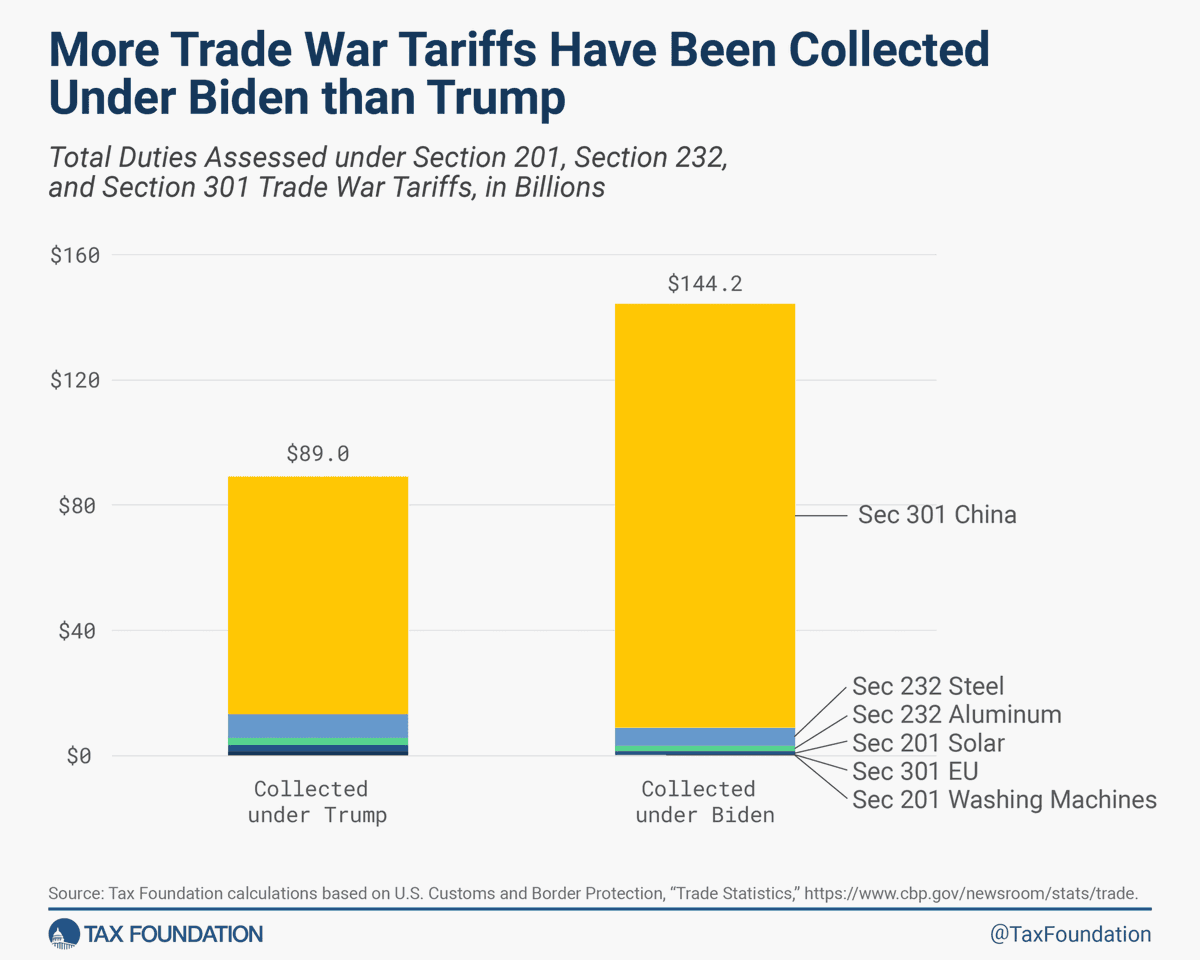

Unfortunately, when it comes to the trade war tariffs, it seems both candidates support higher taxes on American consumers and the increased economic distortions that follow.

Read more: hubs.ly/Q02tn0gK0 Erica York

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

Will McBride explains more: hubs.ly/Q02s_VXr0

Recent evidence from the academic literature suggests that the link between state income taxes and decisions regarding where to live and work may be strong.

hubs.ly/Q02s_PqQ0 Andrey Yushkov #migration

Tax season is a dreaded time for many, in large part due to the complexity involved in filing. Among the tax rules Americans understand the least—and also comply with the least—are nonresident income tax filing laws.

Read more: hubs.ly/Q02s_V500 Katherine Loughead

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

hubs.ly/Q02tcn6l0 Daniel Bunn

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

hubs.ly/Q02s_VXd0 Alex Muresianu

By violating the principles of simplicity, neutrality, and stability, and failing to raise significant revenue, worldwide combined reporting at the state level is doomed to fail.

hubs.ly/Q02s_NKR0 Andrey Yushkov

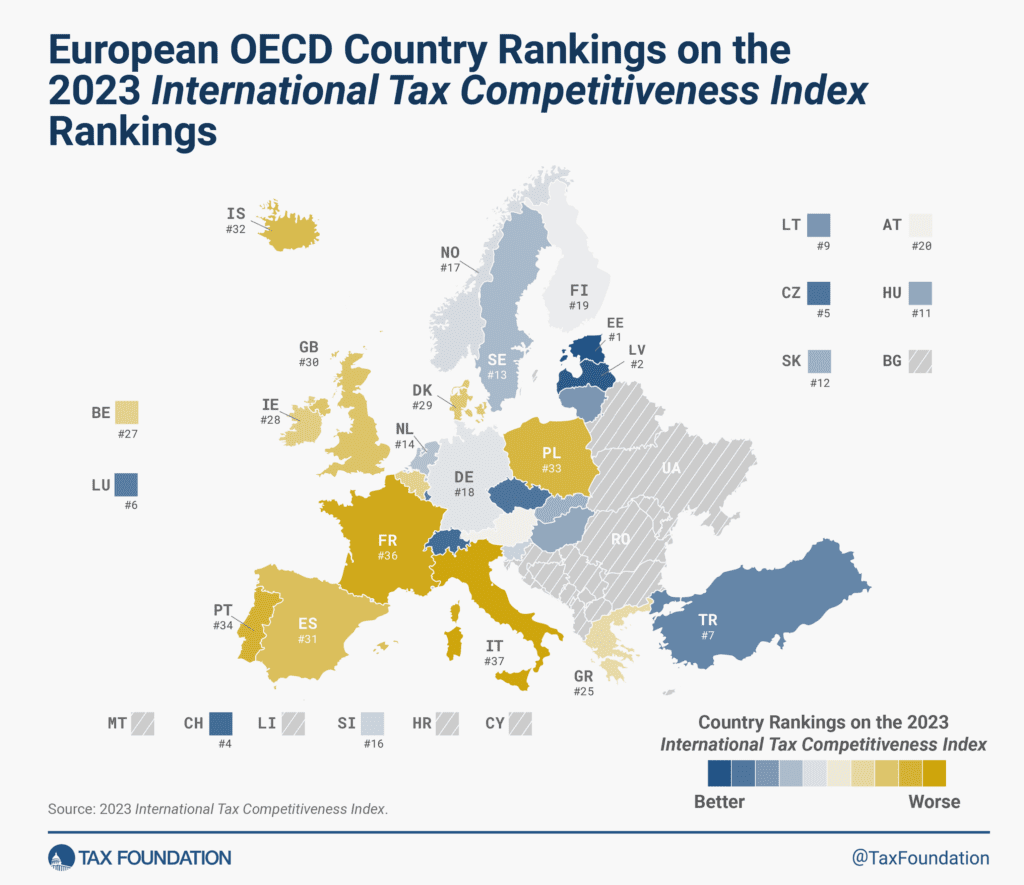

Tomorrow at 2pm, Estonian Embassy US is hosting an event where I'll be giving keynote remarks about the International Tax Competitiveness Index and Stan Veuger will be moderating a discussion on pro-growth tax policy. You can register here: taxfoundation.wufoo.com/forms/qnzt3cl1…

State tax revenues are declining from record highs, raising questions about the affordability of recent tax cuts. Is there cause for concern?

The empirical data strongly suggest that the answer is no.

hubs.ly/Q02s_THx0 Jared Walczak