Mady Mills

@MadisonMills22

Anchor @yahoofinance 10 am hour. Formerly @business @nytimes.

Stocks go up.

ID:527914276

https://www.yahoo.com/author/madison-mills/ 17-03-2012 22:52:51

7,2K Tweets

6,5K Followers

4,0K Following

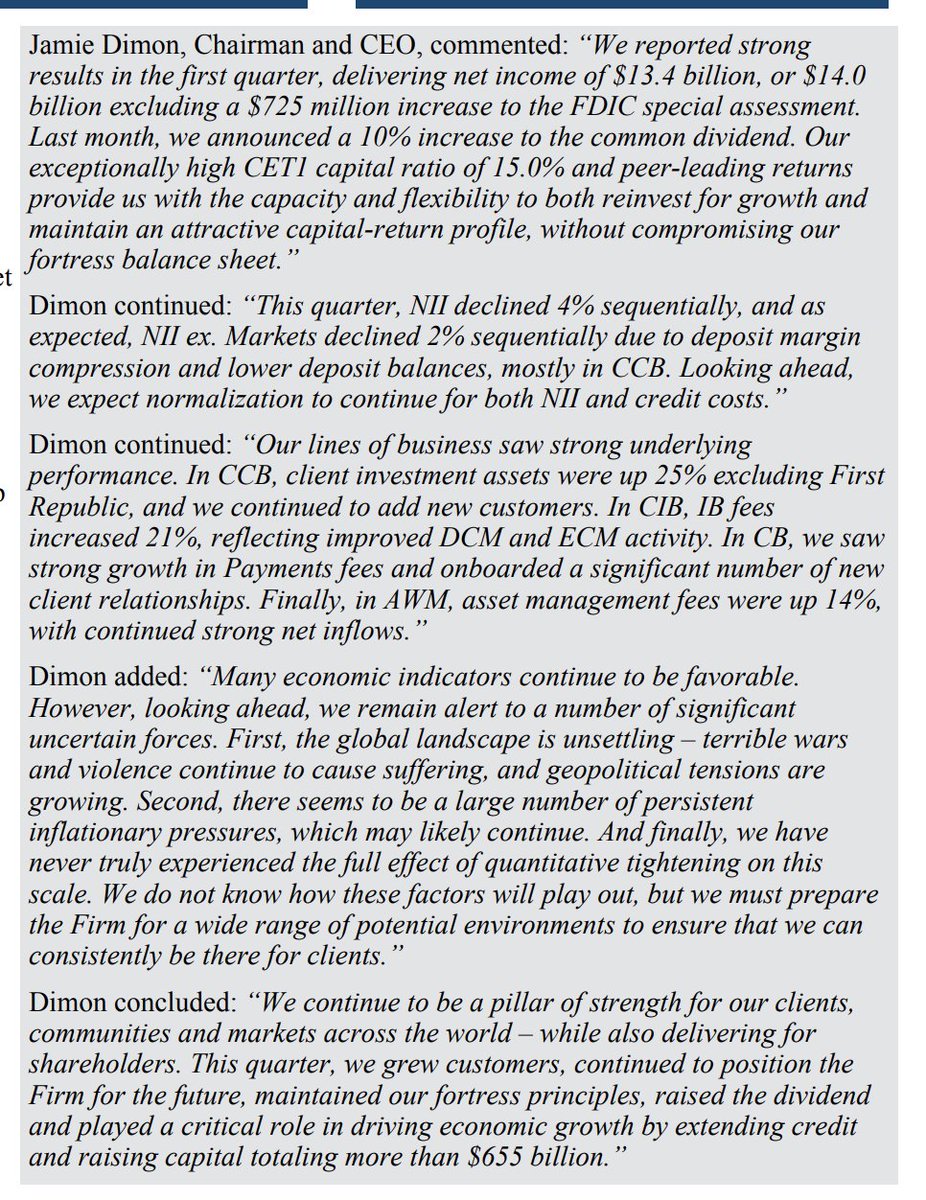

Our own David Hollerith points out that $JPM's NII was based off 3 cuts, and the bank hasn't factored in changes from this week's data, so that number could be revised up.

And Sonali Basak smartly pointing out that you have an upward adjustment of $JPM's full year expenses - higher for longer could become the story over NII

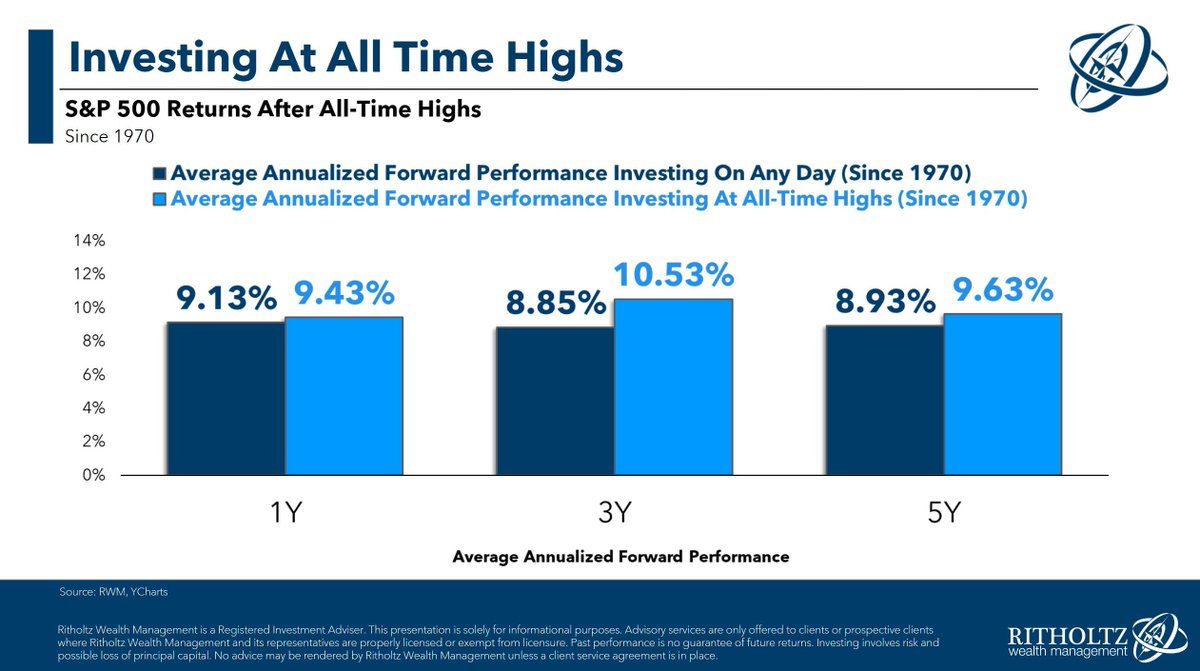

Don't Be Afraid

'On average since 1970, the S&P 500 has done better 1, 3, and 5 years after making an all-time high than picking a random day.'

buff.ly/49yeu0V

by Michael Batnick

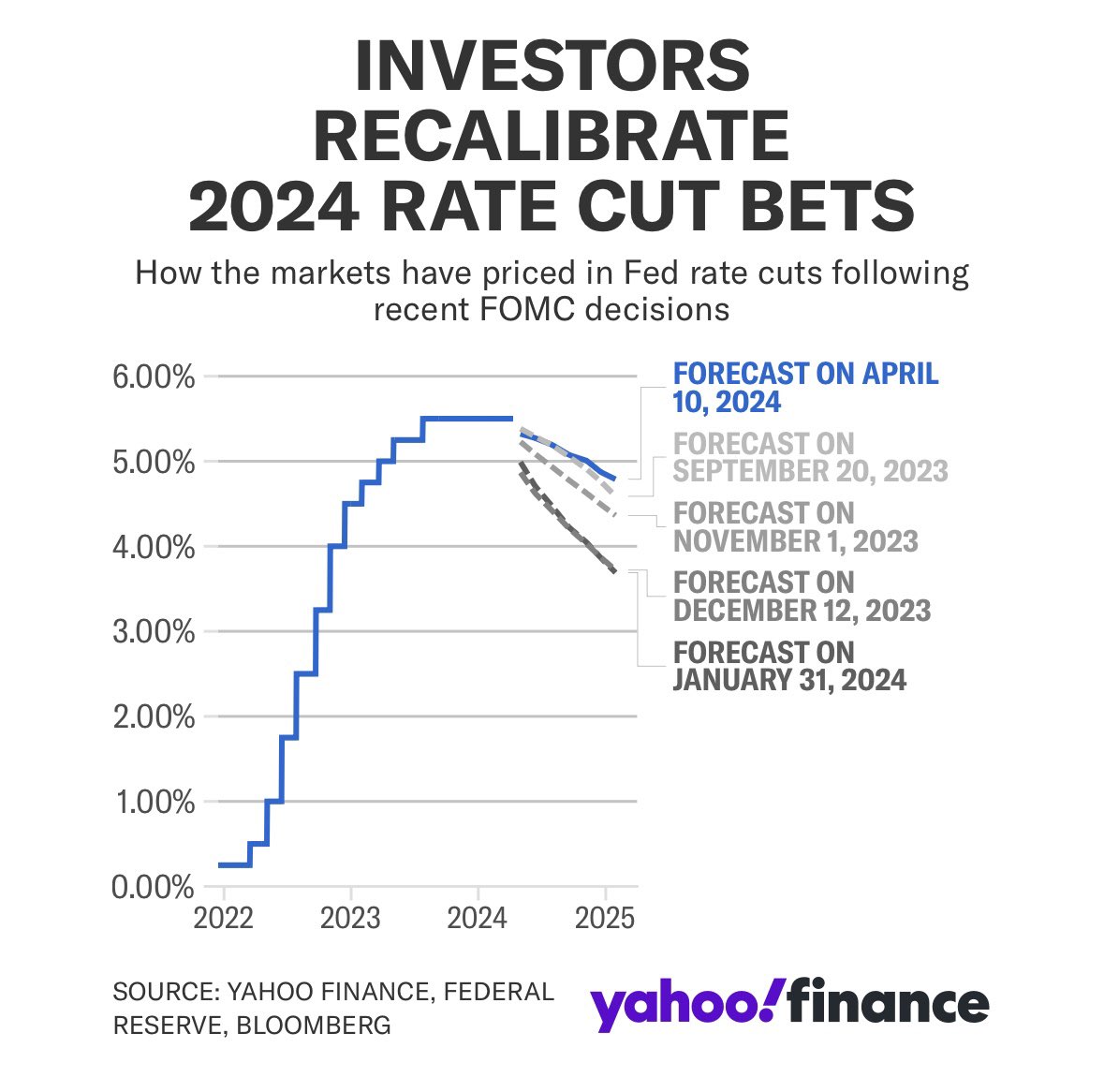

Today’s Yahoo Finance Chart of the Day: Investors are scaling back rate cut expectations.

This hasn’t weighed too heavily on the stock market rally, though. We asked strategists why and if it can continue:

yahoo.trib.al/K9FK3in

US credit-card delinquency rates were the highest on record in the fourth quarter, according to a Federal Reserve Bank of Philadelphia report. bloomberg.com/news/articles/… via Bloomberg Economics

'The MSCI Emerging Markets Index rose for a third day, cementing its strongest level since June 2022.'

Srini Sivabalan

'Earnings upgrades from analysts have outnumbered downgrades in the first quarter, according to a Citigroup Inc. index.'

John Viljoen

Real news in today's Federal Reserve minutes is on balance sheet reduction. Staff briefed options for tapering. Policymakers:

'Generally favored' reducing $60b monthly cap by half;

Saw no need to trim $35b MBS runoff;

'Vast majority' favored tapering 'fairly soon.'

1/2

![Carl Quintanilla (@carlquintanilla) on Twitter photo 2024-04-12 12:54:21 WELLS: “.. We lower our FY deliveries to -12% (flat prior). .. We est. ~160K cars could be in inventory adding to [pricing] risk. Low leasing also raises concerns.” Cuts target to $120. Reiterate Underweight. $TSLA WELLS: “.. We lower our FY deliveries to -12% (flat prior). .. We est. ~160K cars could be in inventory adding to [pricing] risk. Low leasing also raises concerns.” Cuts target to $120. Reiterate Underweight. $TSLA](https://pbs.twimg.com/media/GK90oYJXQAAVS2N.jpg)