GlobalData.TSLombard

@ts_lombard

Independent macro, strategy and political research. Request a trial (investment professionals only) info.tslombard.com/request-a-free…

ID: 510529116

http://tslombard.com 01-03-2012 17:01:12

7,7K Tweet

9,9K Takipçi

752 Takip Edilen

Congrats to Rory Green for his seriously impressive OpEd in the FT yesterday! China’s savings glut. Government finally getting serious on boosting on consumption ft.com/content/2ce75a…

HAS THE BULL CASE FOR EUROPE FIZZLED OUT? No! Dario Perkins. Europe’s fundamentals are improving, the economy is starting to respond to lower interest rates, and Germany’s stimulus will show up in Q1. Europe will participate fully in a 2026 reflation trade.

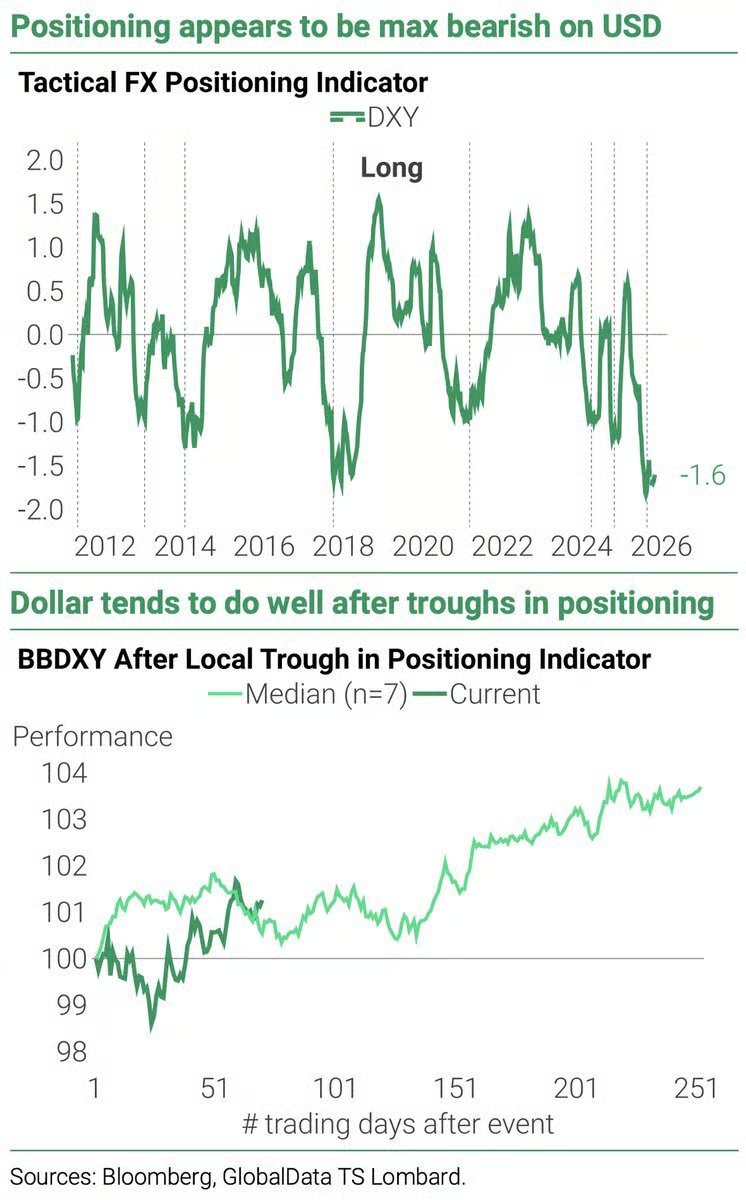

"USD positioning still appears to be overwhelmingly bearish, which, usually, is not a favourable backdrop for doubling down on dollar shorts." Daniel von Ahlen Andrea Cicione GlobalData.TSLombard

great to see the great Daniel von Ahlen quoted here

PODCAST: THE BIG FED CONSPIRACY. Fed Cut, AI and The UK Budget Dario Perkins and Freya Beamish Apple: podcasts.apple.com/us/podcast/the… Spotify: open.spotify.com/episode/04MKIj…

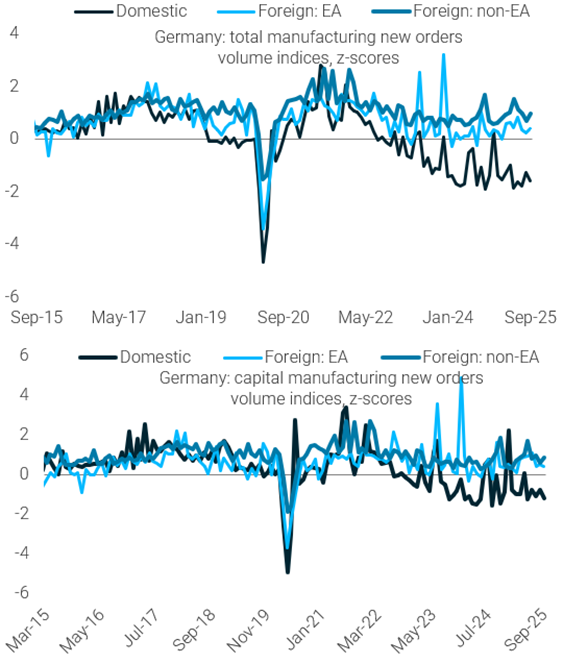

Great Martin Sandbu in Financial Times on 🇩🇪 stagnation (links below). It’s not all down to exports/energy cost. A lot of weakness is *domestic* - my longstanding view 🇩🇪must reform and manage the inevitable downsizing of legacy industries. But, meanwhile fiscal stimulus will be effective 1/

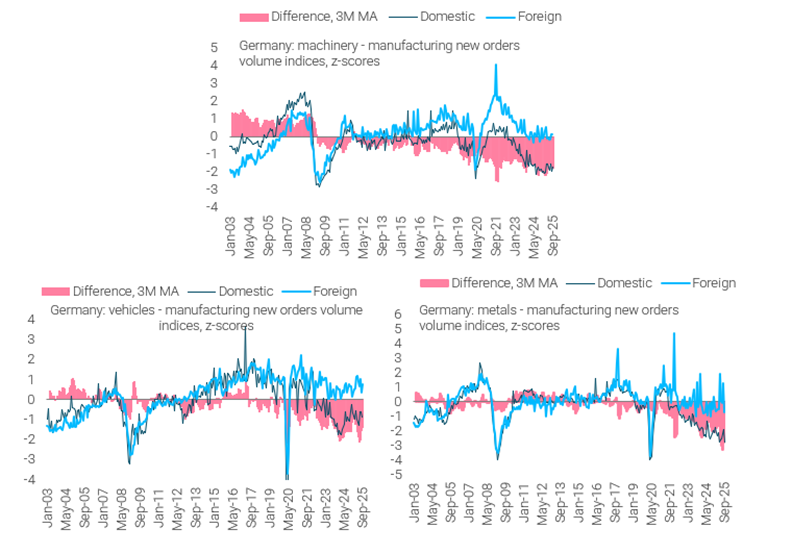

Martin Sandbu Financial Times Everyone acknowledges that “China Shock 2.0”, US tariffs and energy cost are strong headwinds for 🇩🇪 manufacturing, but data show the decline in domestic demand has been much stronger than that in foreign demand. Eg. look at factory orders – volume indices 2/

Martin Sandbu Financial Times This holds true also for intermediate goods, and for important sub-sectors such as machinery and cars and even metals, just to mention a few. 3/

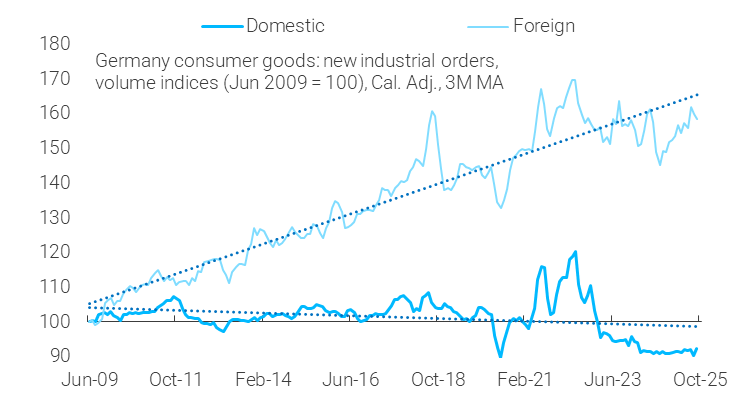

Martin Sandbu Financial Times The most glaring example of domestic demand deficiency comes from consumer goods. Foreign orders are near trend, but the shortfall in domestic orders is much bigger than that recorded during the GFC/EA debt crisis and it’s stuck at Covid lows. 4/

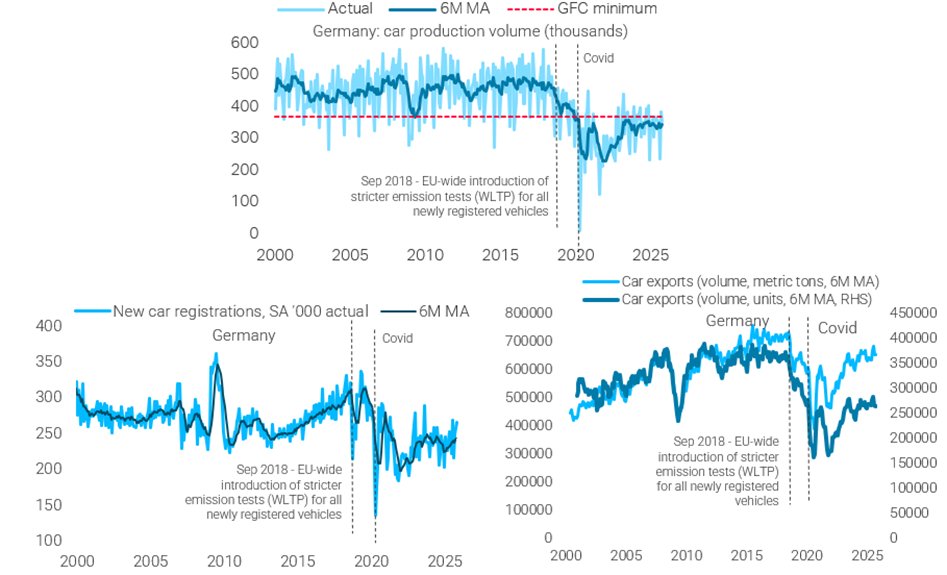

Martin Sandbu Financial Times The auto sector with sprawling supply chain is a key drag on domestic activity. But the loss-of-competitiveness diagnosis is not enough to explain what happened. Export volumes have been stabilizing/recovering since '22. Regulatory factors since 2018 and domestic demand matter 5/

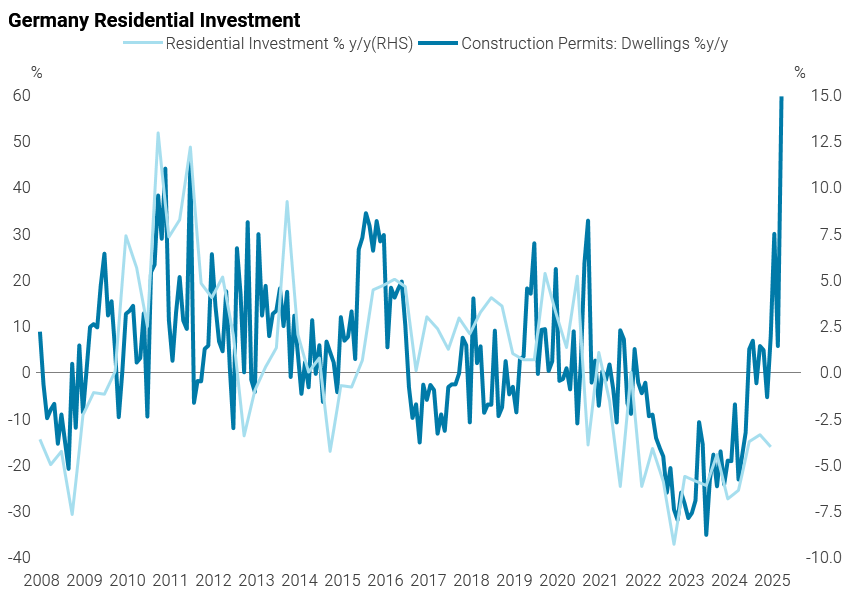

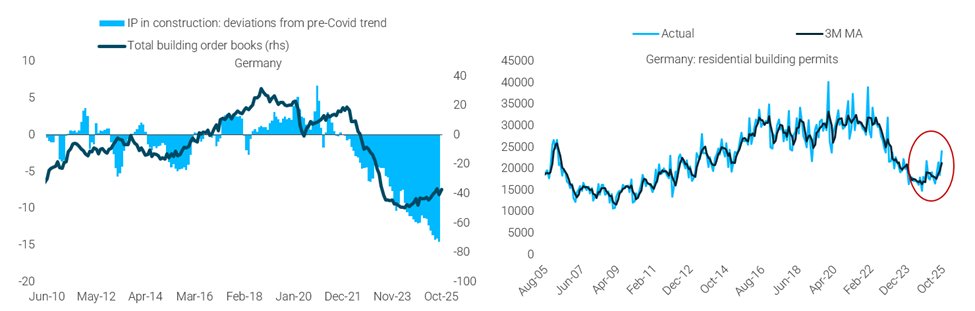

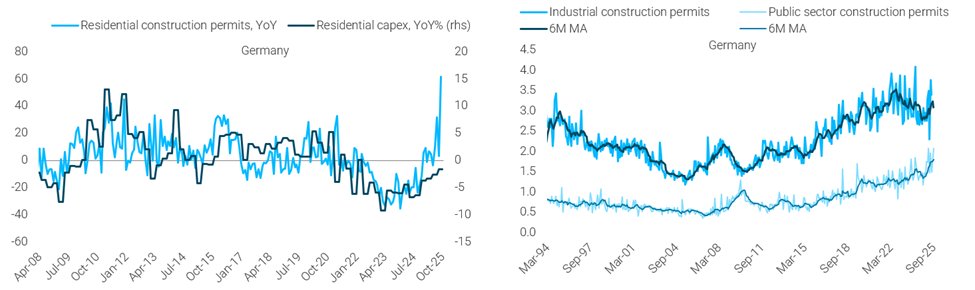

Martin Sandbu Financial Times But there is more. An adage says “housing is the business cycle”. We doent need to go so far to see how the collapse of construction since 2022, owing to ECB hikes and surging cost of living, has impacted a key source of domestic demand for all sorts of manufactured products 6/

Martin Sandbu Financial Times Construction orders have now bottomed and building permits are on the rise again, thanks to the lagged effect of ECB cuts. Infrastructure stimulus should provide a booster exactly where needed most. 7/

So this podcast was really good! Dario Perkins makes the case that #Powell intentionally has weakend the #Fed chairman role since he knows it will be someone loyal to #Trump

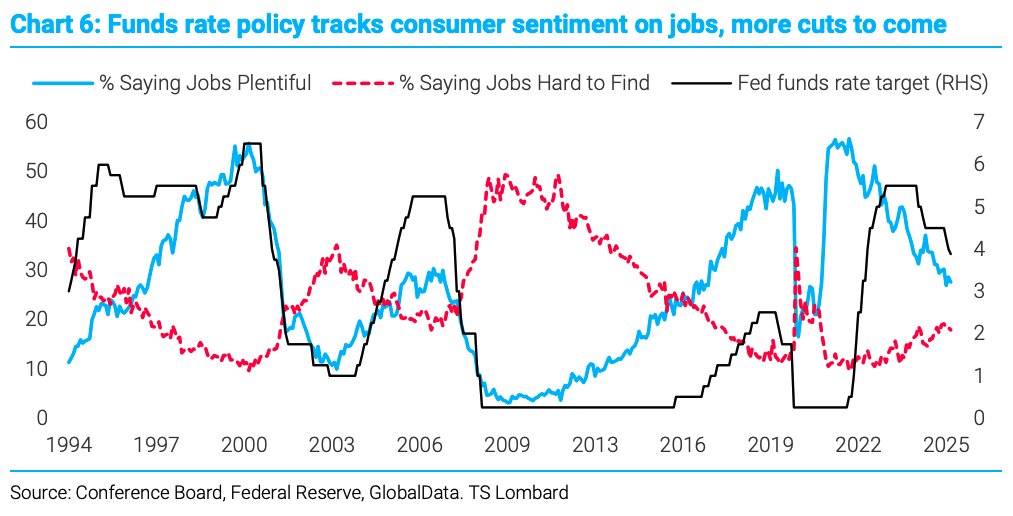

"What has the FOMC traditionally done when the assessment of the current job market deteriorates? It eases." steven blitz GlobalData.TSLombard

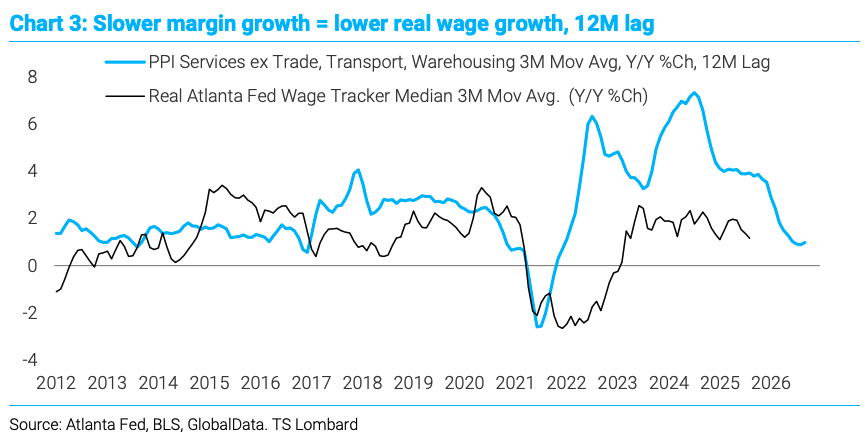

"The drop in margin growth, as evidenced in the September PPI data, will slow real wage growth in the year ahead." steven blitz GlobalData.TSLombard