Kaleb Nygaard

@kalebnygaard

Centralverse | The Reserve Podcast | currently @Visa | previously @YPFSatYale @chicagofed

ID: 1117750422

http://www.centralverse.org/FedWatcher 24-01-2013 21:12:15

3,3K Tweet

1,1K Takipçi

254 Takip Edilen

I had the chance to join David Beckworth on his podcast to discuss the nuanced legacy of Arthur Burns, the Fed Chair for much of the chaotic 1970s. mercatus.org/macro-musings/…

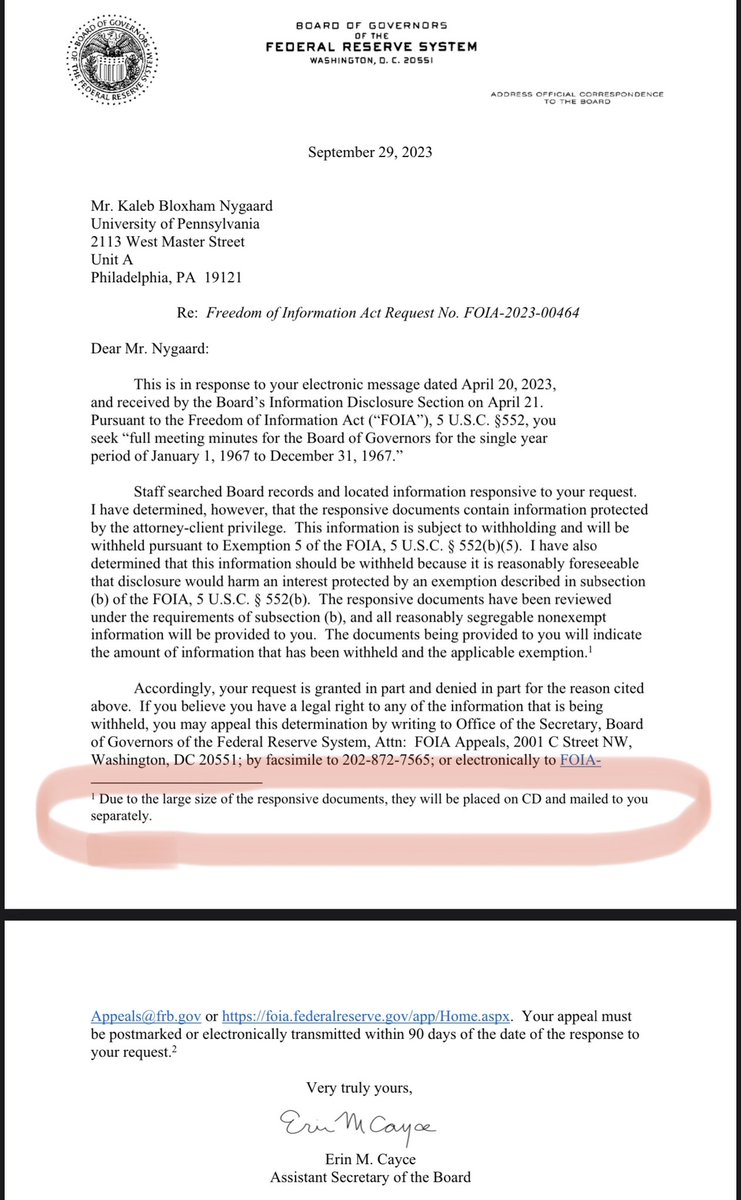

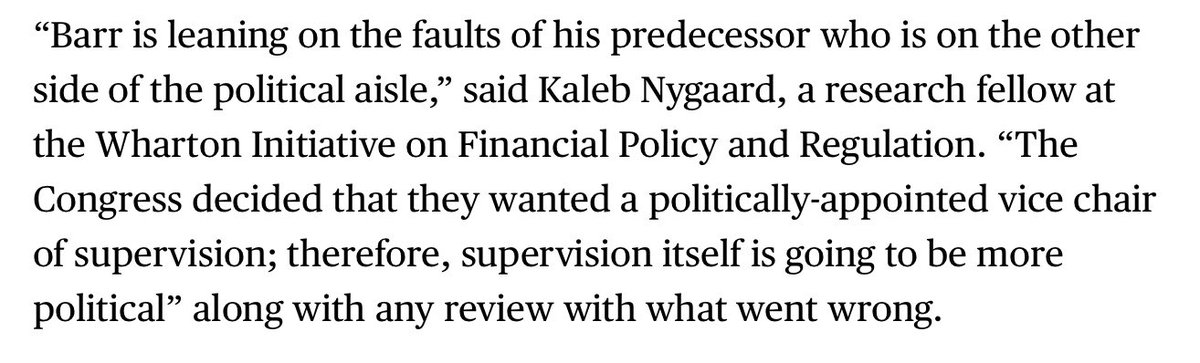

The politicization of bank supervision and regulation takes its next logical step. Like I told Craig Torres when the report first came out. bloomberg.com/news/articles/…

Kaleb Nygaard Craig Torres Her nod to the “expedited timeframe” also seems to be echoing your earlier comment expressing concern about the choice of deadline for the report:

Zoltan announces to Tracy Alloway and Joe Weisenthal that he’s starting his own firm: bloomberg.com/news/articles/… And this tweet officially comes full circle: