Avatar Financial Group

@avatarhardmoney

Avatar Financial Group provides real estate bridge loans for borrowers with capital needs that are not being met by traditional lenders. Let's connect!

ID: 2284553833

http://www.avatarfinancial.com 10-01-2014 04:48:13

170 Tweet

52 Takipçi

23 Takip Edilen

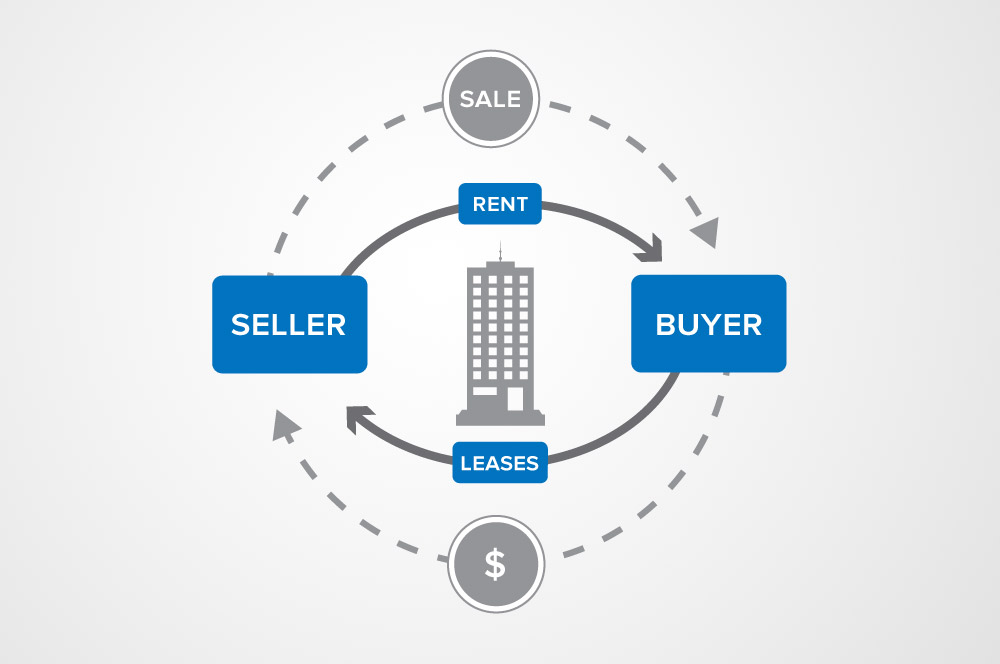

Private lenders are optimistic that the GFC will not repeat itself reports Commercial Observer. There are still opportunities to make money in a distressed down cycle. Takeaway: Debt funds are prepared to deploy #capital. hubs.la/Q01LPzvq0 #AvatarFinancialGroup #CRELending

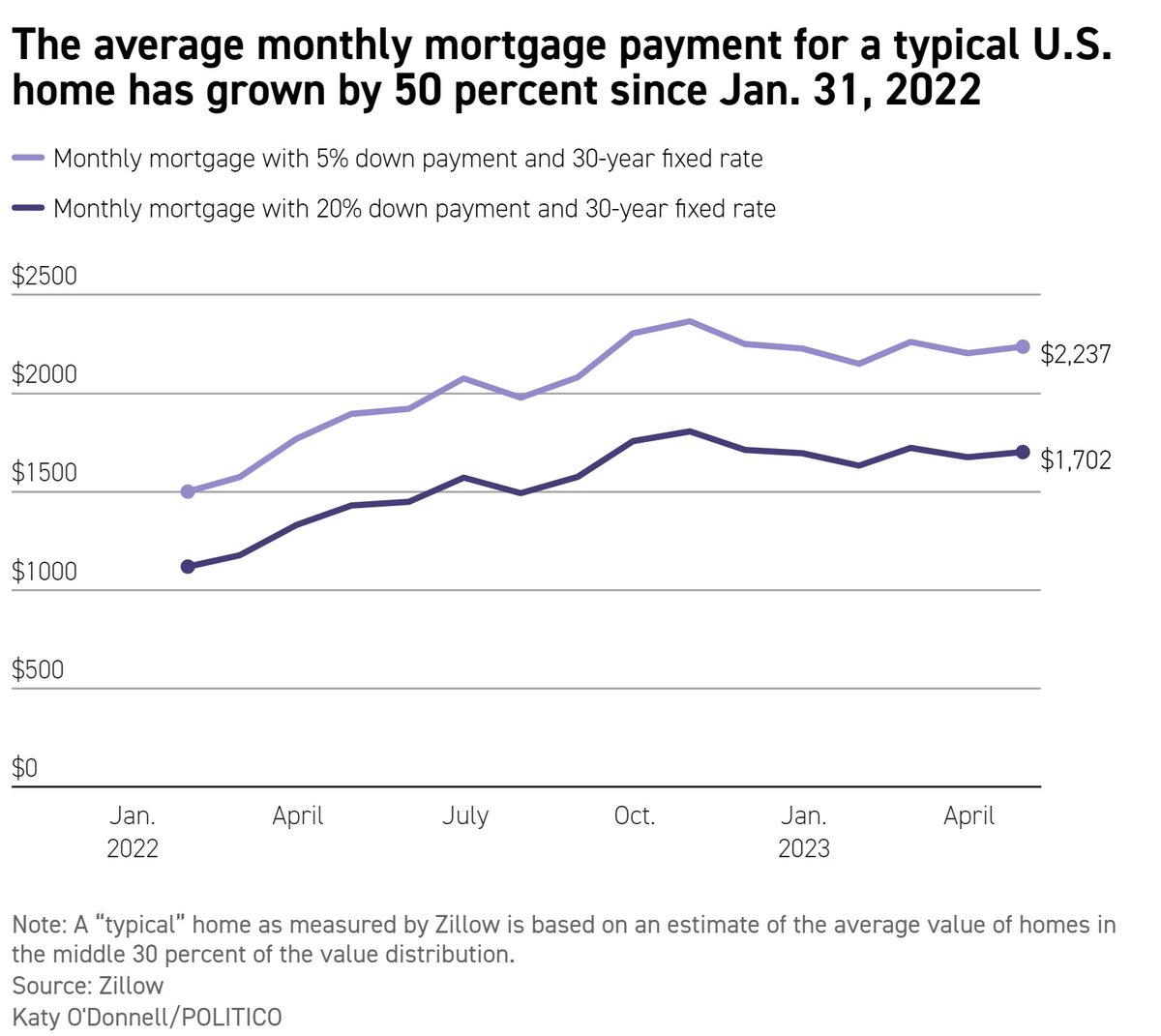

The economy (GDP) expanded at a 1.1% pace in Q1 2023 versus the expected 1.9% The Wall Street Journal. Growth is slowing, still, solid consumer spending drove Q1 growth, with declines in business and housing investment. hubs.la/Q01MZXkZ0 #AvatarFinancialGroup #Economy #Q12023

Volatile trading in regional bank stocks has made it clear that the fallout from the banking crisis is not over The New York Times bringing new constraints on banks. Enter a wave of #AltLenders willing to fill the gap. hubs.la/Q01Pg3dL0 #AvatarFinancialGroup #CRE #BridgeLoan

The #debt market is shifting as traditional lenders contract, and #nonbanklenders fill the void to capitalize on increased #dealflows. #AvatarFinancialGroup's TR Hazelrigg predicts continued retrenchment as new funds arrive in the space. hubs.la/Q01T6bq-0 Connect Commercial Real Estate

The property industry is facing a #challenge as banks #tightengrip. 54% drop in #lending y-o-y according to #CBRE LMI. #AltLenders are stepping up but facing obstacles. #Mezzanine financing will grow as more cash is needed to refinance loans. tinyurl.com/2t7zesxn The Wall Street Journal