Jonathan Chang

@thechangj

ucla alum // working with startups @brexhq & investing @daydreamvc

ID: 1015813710

https://beacons.ai/venturecapitalguy 16-12-2012 18:39:38

6,6K Tweet

12,12K Takipçi

2,2K Takip Edilen

Mining is a $2T market that powers AI, energy, and defense, yet operations still run on tribal knowledge and legacy tools. Discipulus founder Elliot F. Poirier & the Watoga Technologies team are building the AI operating system for mines, starting with drill and blast, to REINDUSTRIALIZE

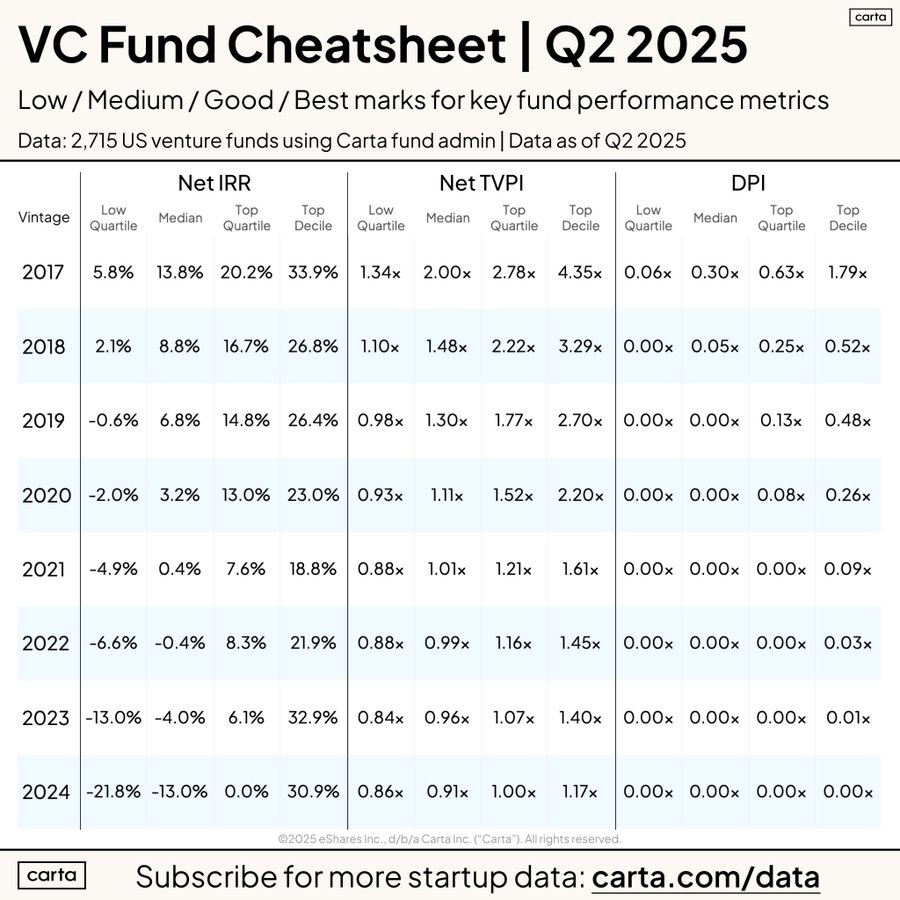

Some interesting data on venture fund performance since 2017 by Peter Walker Wonder how some of these 2020-2022 vintages will look in the next 5 years