Peter Walker

@PeterJ_Walker

Head of Insights @Cartainc | prev: @COVID19Tracking, @PublicRelay, @CovidWh

Using data visualization to illuminate our world

ID:1238615498754949120

https://carta.com/subscribe/data-newsletter-sign-up/ 13-03-2020 23:58:47

4,7K Tweets

8,4K Followers

366 Following

In this episode of HR Heretics: Nolan Church and kelli dragovich chat all things “startups data from Carta” with Peter Walker, Head of Insights at Carta.

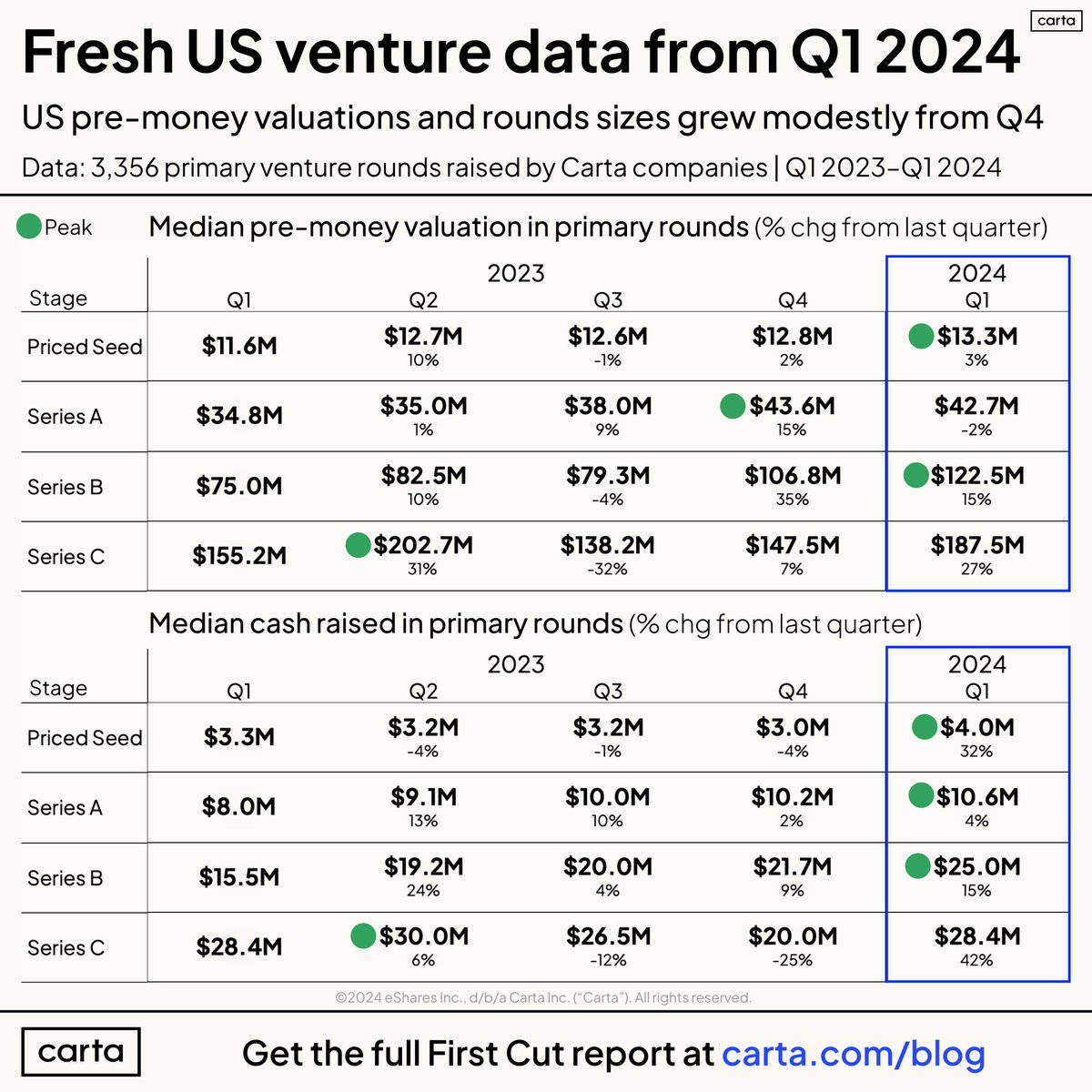

They discuss Carta’s comprehensive report on startup compensation trends in H2 of 2023 influencing the flow of “dry…

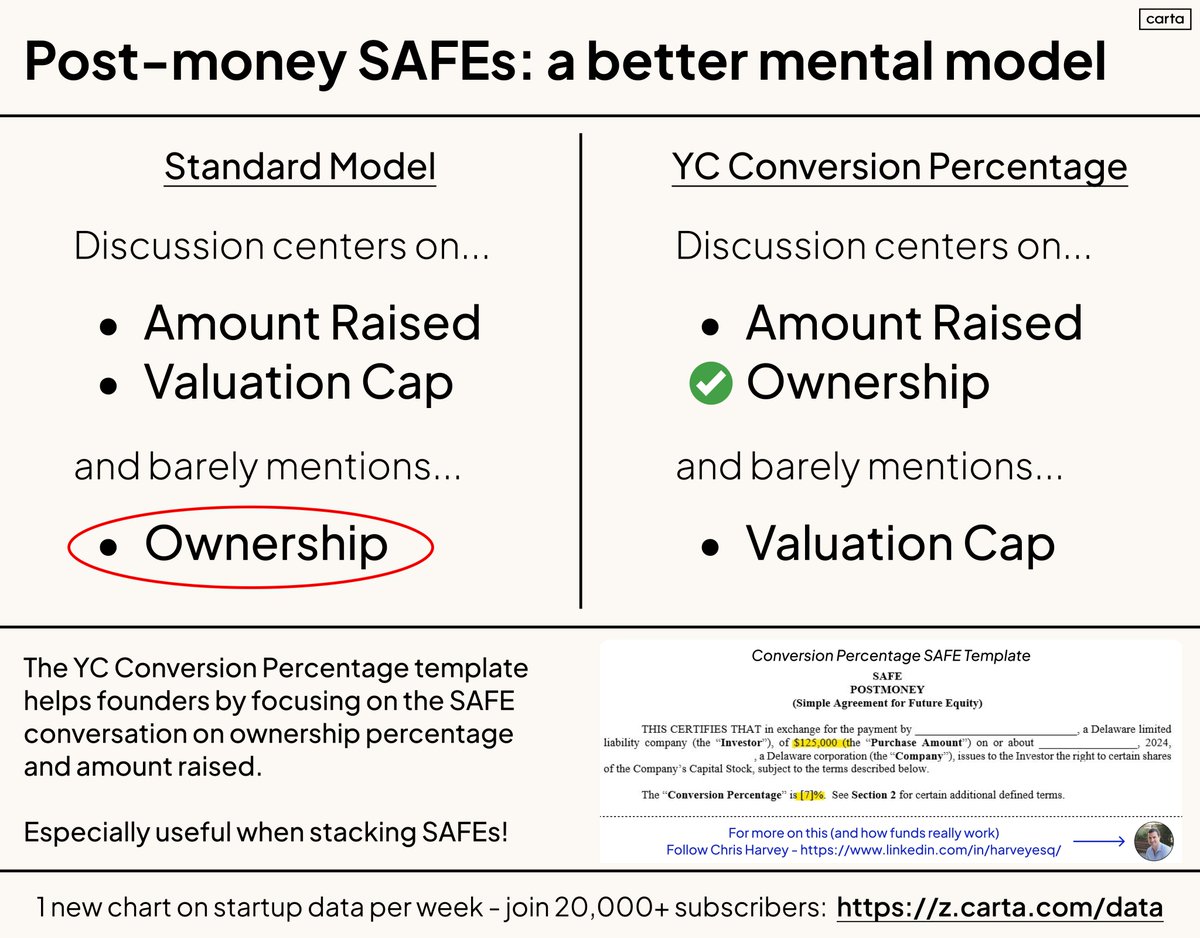

Mental model for SAFEs - instead of focusing on valuation cap, perhaps the discussion should center on ownership?

Good thinking from Chris Harvey. More founders would benefit from taking a conversion percentage model for their SAFEs vs the standard post-money template