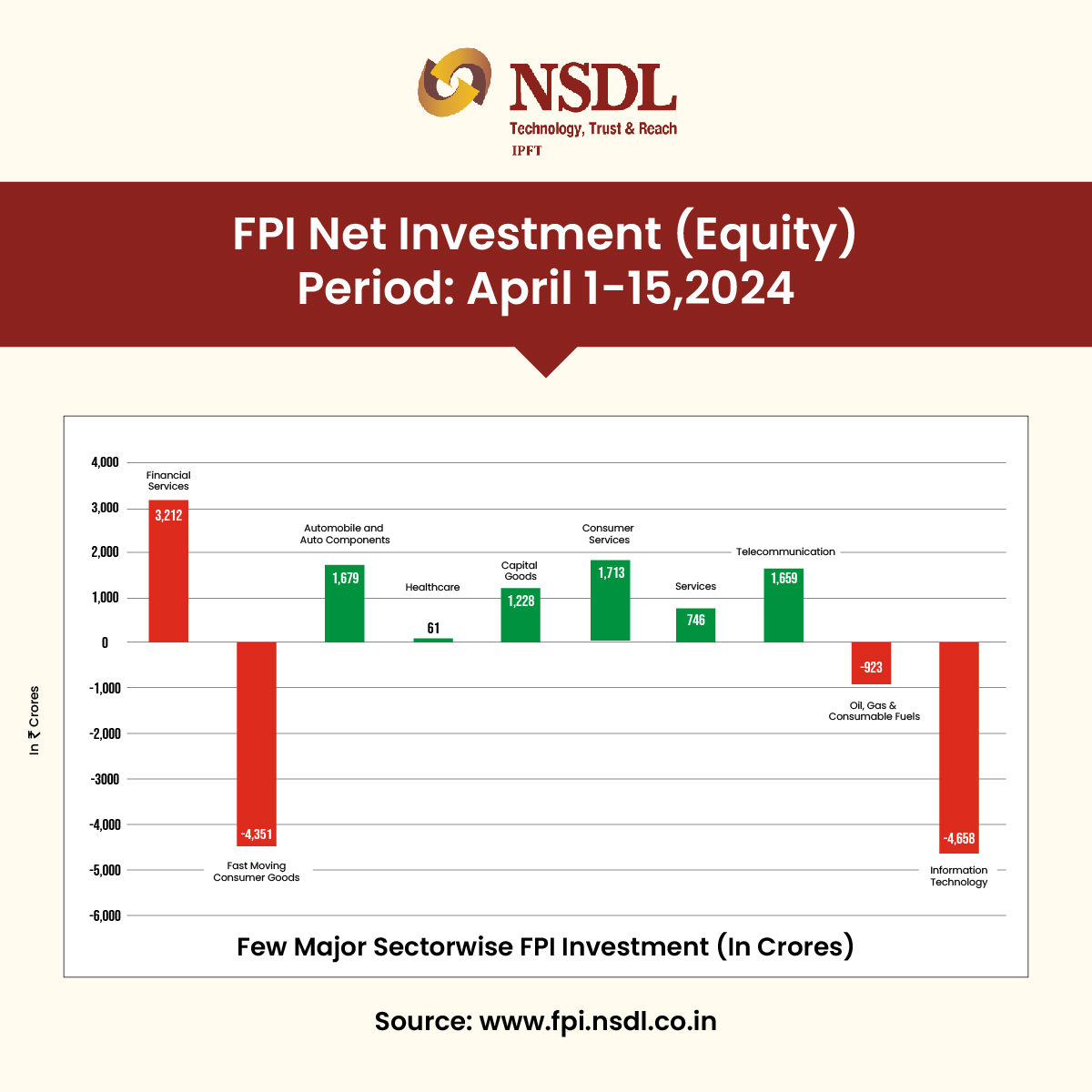

Between Apr 1 to 15, FPIs inflow were highest in #power

#IT remains to be the laggard

Shift is basically frm Commodity consump to Manufacturing

#BreakoutStocks #Stockideas #stockmarkets #Investment #OptionsTrading #Optionselling #Nifty #banknifty #stockmarketindia #investing

Reuters reports SEBI found 12 offshore funds breaching disclosure rules, exceeding investment limits in Adani Group.

#adani #sebi #adani group #fpis #reuters #GlobalInvestmentFund #shareholders #investment #bizzbuzz

#LeadStoryOnET | Once #Adani -heavy #FPIs want to settle an issue #Hindenburg exposed | tinyurl.com/23fmdz2v

while in downtown la forgot theres a lot of police vehicles

not seen very often was an unmarked #FordPoliceInterceptorSedan ( #FPIS ) taurus

this model should have the 3.5l #EcoBoost V6

emblem indicated it was awd

#PoliceInterceptor badge was missing 🙁

📉📈 #MarketToday | Nuvama Institutional Equities in its latest derivatives note said foreign portfolio investors (FPIs) have adopted a cautious approach. In contrast, HNIs and retail investors have significantly increased their long positions in both index and SSF (single stock…

#NewsFlash | RBI notifies investment limits in debt by FPIs for FY25

Keeps FPI gilt invest limit unchanged at 6% of outstanding FY25

Here's more👇

Again Short Buildup by FIIs today. Net OI of FIIs in Index Futures is -99K

Sensibull - India's No:1 Options Trading Platform NIFTY OI change of FIIs is missing, can you correct please? The sum is not adding up cc Abid Hassan 🇮🇳

#FIIs #DIIs #PROs #FPIs #BANKNIFTY