Anton Shapoval

@shapoval3224

Individual investor. Focused on global macro & electrification metals. Shorting the USD — From Russia with love.

ID:4866819863

31-01-2016 16:27:44

569 Tweets

27 Followers

170 Following

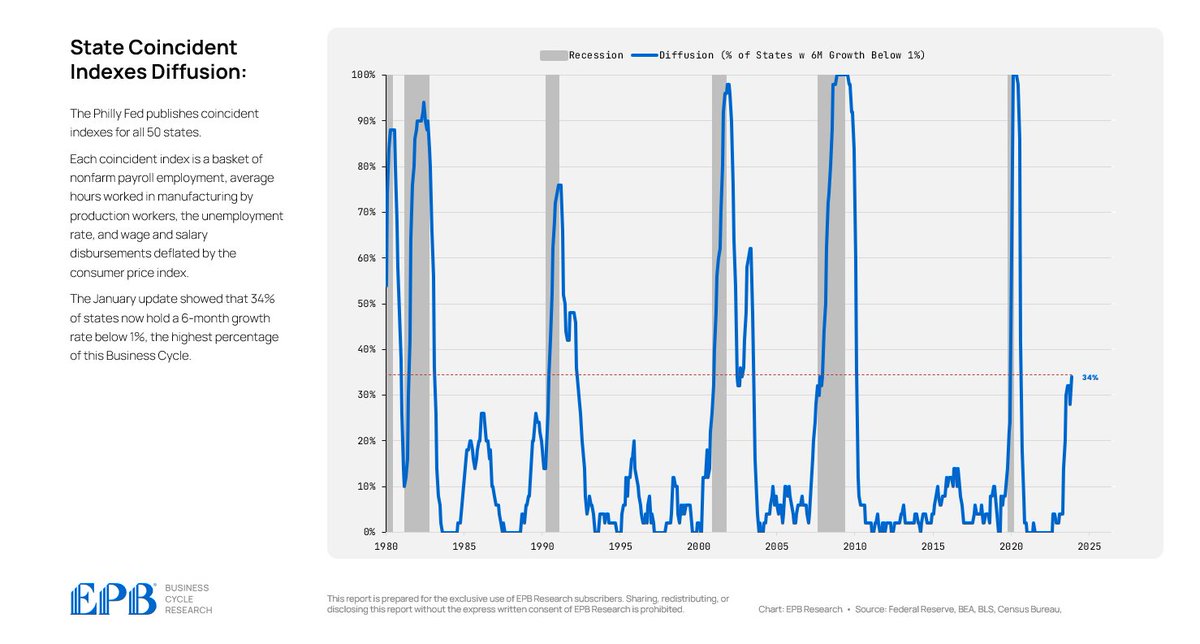

🇺🇸 US Leading Economic Index -7% YoY.

GDP growth QoQ +3.3% annualized.

Unprecedented divergence!

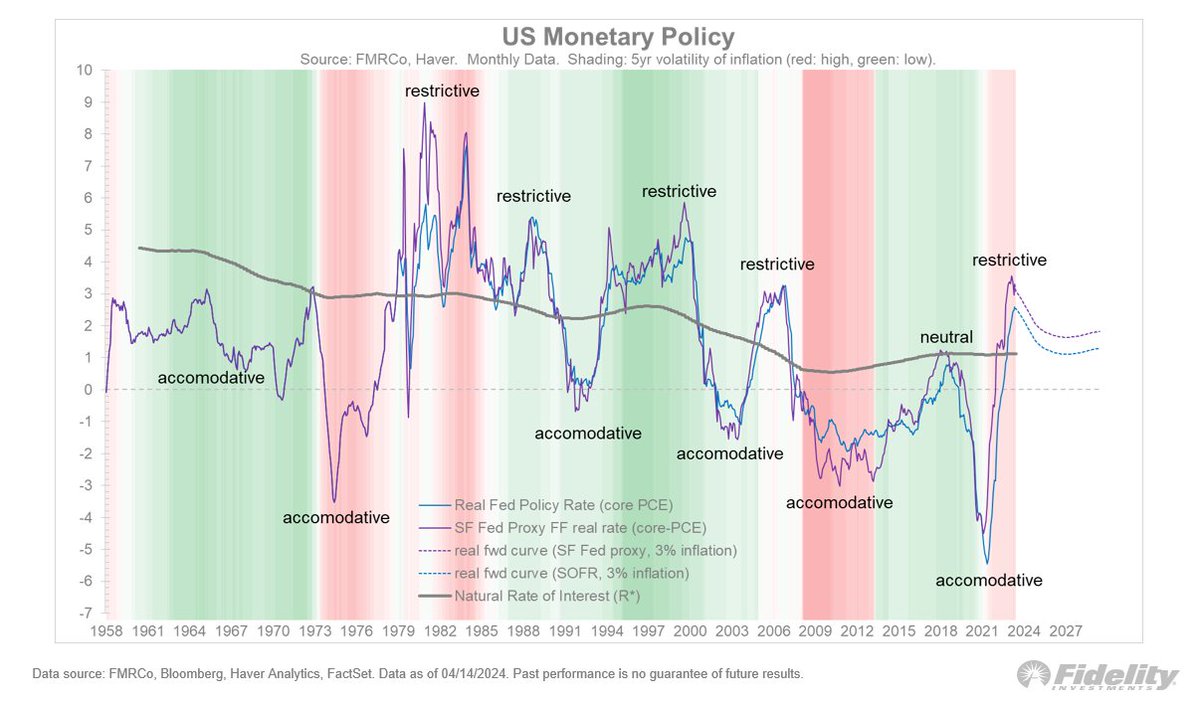

Excess fiscal stimulus deficits of 6.3% of GDP in 2023 probably working against monetary tightening, keeping the economy out of #recession .

Chart: Randy Woodward

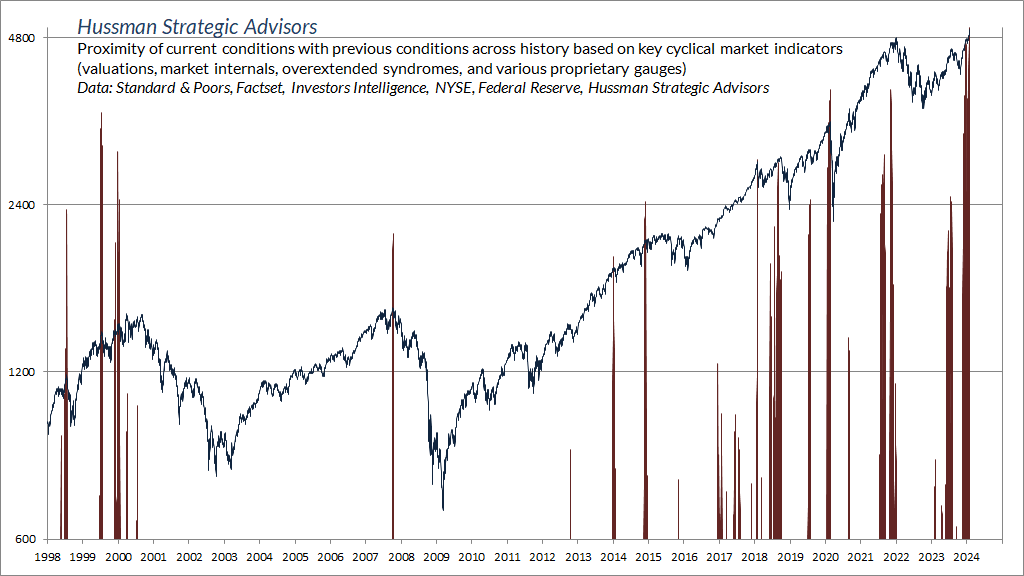

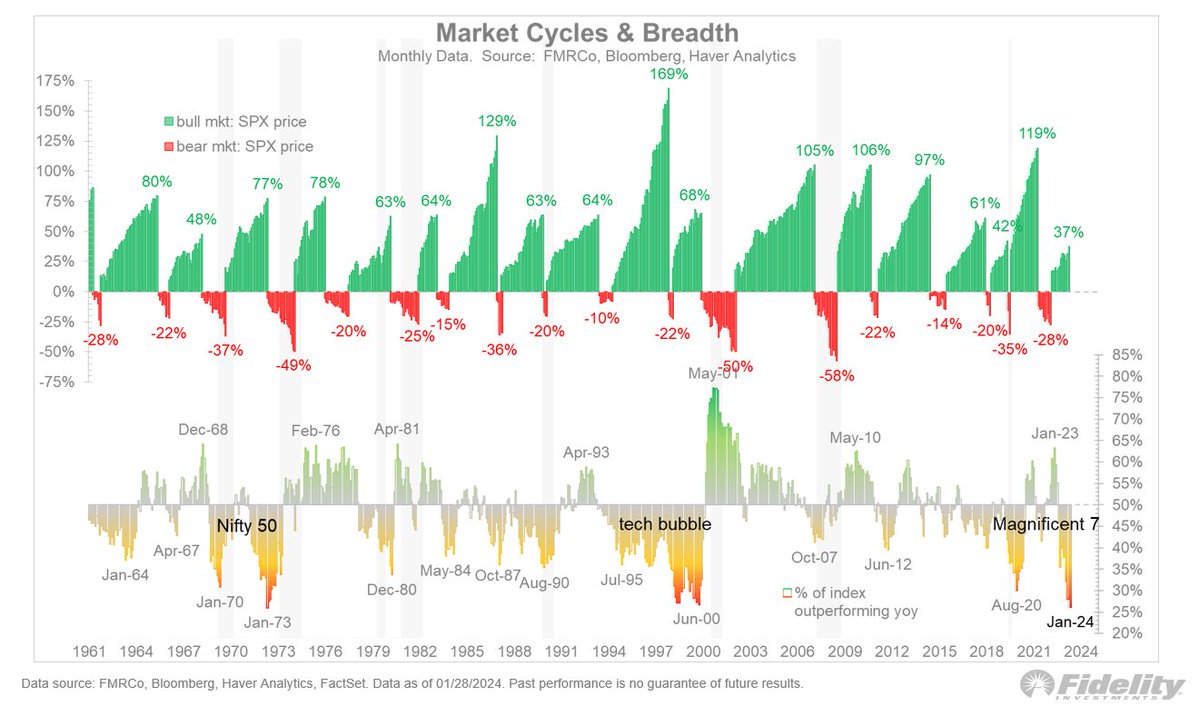

'We estimate that current market conditions now 'cluster' among the worst 0.1% instances in history, typically followed by abrupt market losses of 10%-30% over the next 6-10 weeks.' hussmanfunds.com/comment/mc2402… by John P. Hussman, Ph.D.