Ricardo Correa

@rcorrea_econ

Economist. Views are my own.

ID: 1242473411772899328

https://sites.google.com/view/ricardocorrea/home 24-03-2020 15:28:59

292 Tweet

796 Followers

688 Following

Hi #EconTwitter! 🌐Exciting #Webinar Alert! 📚Join us on Friday Jan 17 @11AM EST/5PM CET for an illuminating #AMLEDS Webinar featuring Thomas Drechsel (U. of Maryland) 🎓We're delving into the intriguing realm of "Identifying Monetary Policy Shocks: A Natural Language Approach" 1/n

🌐Don't miss this! Join the exciting #AMLEDS #Webinar on Jan 19 at 11 AM EST/5 PM CET featuring Thomas Drechsel from Univ. of Maryland 🎓Explore "Identifying #Monetary #Policy Shocks" with #NLP and #ML. 📈 Register now: lnkd.in/egTakd2 #EconTwitter #MachineLearning #Economics

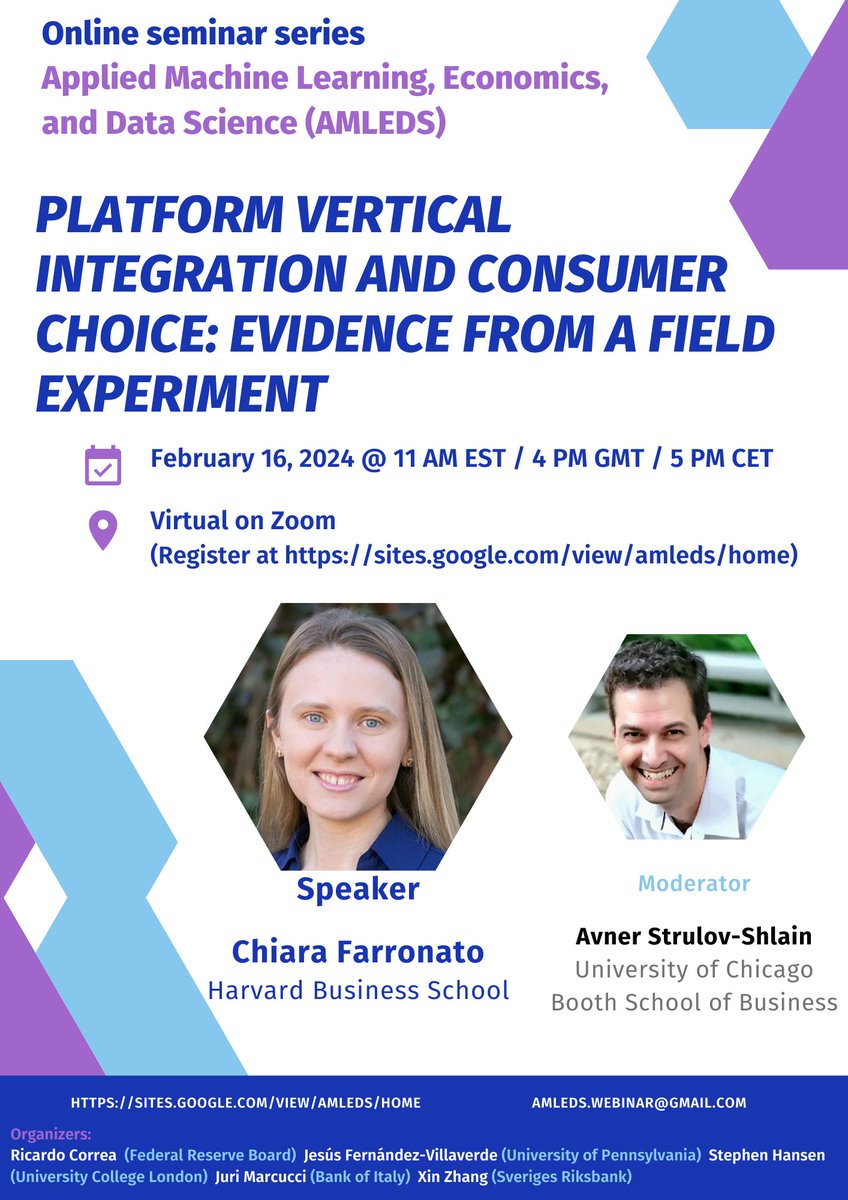

🌟 Exciting #Webinar Alert! 📚 Join us on Friday, Feb 16 @ 11 AM ET / 5 PM CET for a captivating #AMLEDS #Webinar with Chiara Farronato from Harvard Business School! 🎓 She'll discuss "Platform Vertical Integration & Consumer Choice: Evidence from a Field Experiment" #EconTwitter 1/5

🌟 Exciting #Webinar Alert! 📚 Join us on Friday, Feb 16 @ 11 AM ET / 5 PM CET for a captivating #AMLEDS #Webinar with Chiara Farronato from Harvard Business School! 🎓 She'll discuss "Platform Vertical Integration & Consumer Choice: Evidence from a Field Experiment" #EconTwitter 1/5

Trade uncertainty is bad for domestic loans. New evidence VoxEU 🔗cepr.org/voxeu/columns/… cc: CEPR New York Fed Research Federal Reserve

Banks reduce lending to all sectors of the #economy when uncertainty rises in a particular sector, amplifying the original #shock. Ricardo Correa Federal Reserve, Julian Di Giovanni New York Fed, Linda S. Goldberg New York Fed, @CMinoiu Atlanta Fed ow.ly/9eaw50QQ5UY

🌟 Exciting Webinar Alert #EconTwitter! 🌟 Join us on Fri May 24 at 11AM EDT/5PM CEST for an insightful AMLEDS #Webinar with Anastassia Fedyk 🇺🇦 from Haas School of Business! 🚀 She'll discuss "#ArtificialIntelligence and Firms' Systematic Risk." Don't miss it! #AI #Finance 1/n

🌟 Exciting Webinar Alert #EconTwitter! 🌟 Join us on Fri May 24 at 11AM EDT/5PM CEST for an insightful #AMLEDS #Webinar with Anastassia Fedyk 🇺🇦 from Haas School of Business! 🚀 She'll discuss "#ArtificialIntelligence and Firms' Systematic Risk." Don't miss it! #AI #Finance 1/n

🌐 Hi #EconTwitter! Excited for the next #AMLEDS #Webinar! Join us on Jun 21 at 11AM EDT as Jon Danielsson (LSE) discusses "#AI in financial regulations and its impact on stability" with A. Uthemann (Bank of Canada & LSE). 🔗 Link to paper: papers.ssrn.com/sol3/papers.cf…

🌟 Unlock the Power of #Economic Data with #LLMs! 🌟 Join us for the #AMLEDS #Webinar on Friday Nov 22 at 11 AM ET / 5 PM CET with @Ogoun from the Federal Reserve presenting "Unlocking Economic Data with Large Language Models: An Update." #EconTwitter #MachineLearning #AI 1/5

Hi #EconTwitter! 🌟 Join us on Jan 24 at 11AM EST /5PM CET for an exciting #AMLEDS #Webinar with Yucheng Yang from the University of Zurich! 🎓 He’ll present "#DeepLearning for Search and Matching Models." #MachineLearning #AI

📢 Can threats alone move markets? Join us Friday, June 20 @ 11 AM EDT / 5 PM CEST for a #AMLEDS #Webinar with Antonio Coppola (Stanford Graduate School of Business) presenting: 🧾 Geoeconomic Pressure 🔗 papers.ssrn.com/sol3/papers.cf… #EconTwitter #LLM #NLP #ML #Text #Economics #AI 1/7

Prudential instruments and the recent inflationary episode Eugenio Cerutti IMF, Ricardo Correa Ricardo Correa Federal Reserve, Linda S. Goldberg New York Fed, Anni Norring Suomen Pankki ow.ly/5hsZ50WUmc0