stablecoin p

@piotr_saczuk

Building @stablewatchHQ. YBS enjoyer. YPO profiter.

ID: 1440352815403069447

https://www.stablewatch.io/ 21-09-2021 16:30:55

890 Tweet

2,2K Followers

895 Following

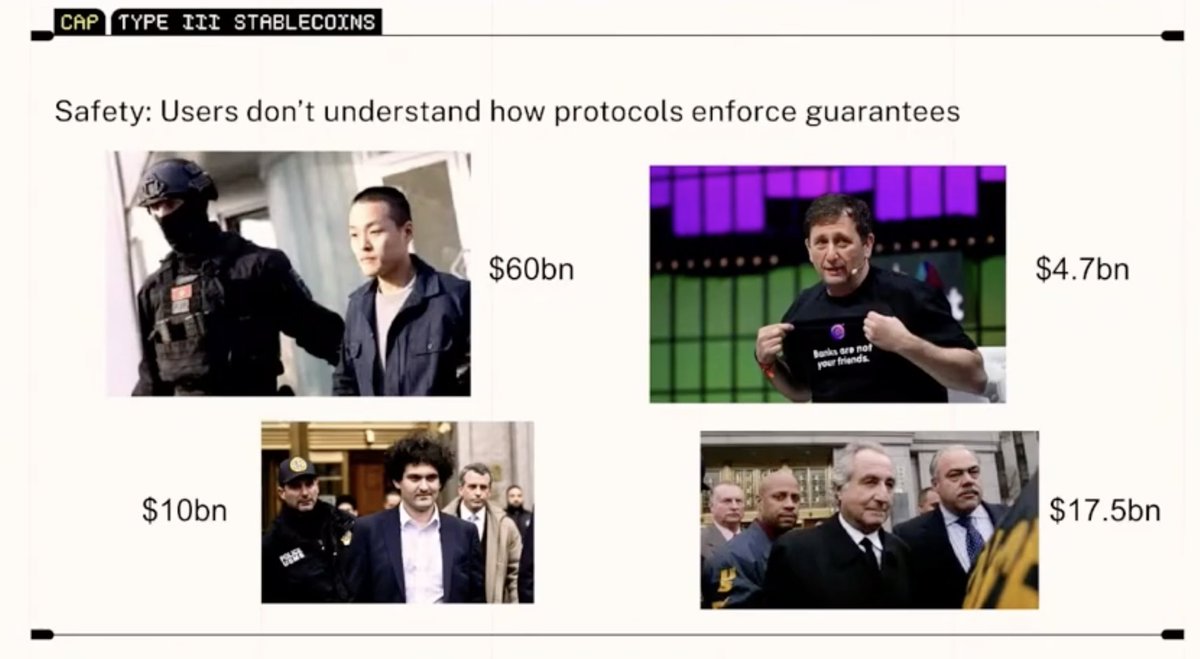

I think of this slide from Benjamin | cap a lot. Excited that users will soon understand all the risks behind stablecoin yields through stablewatch.

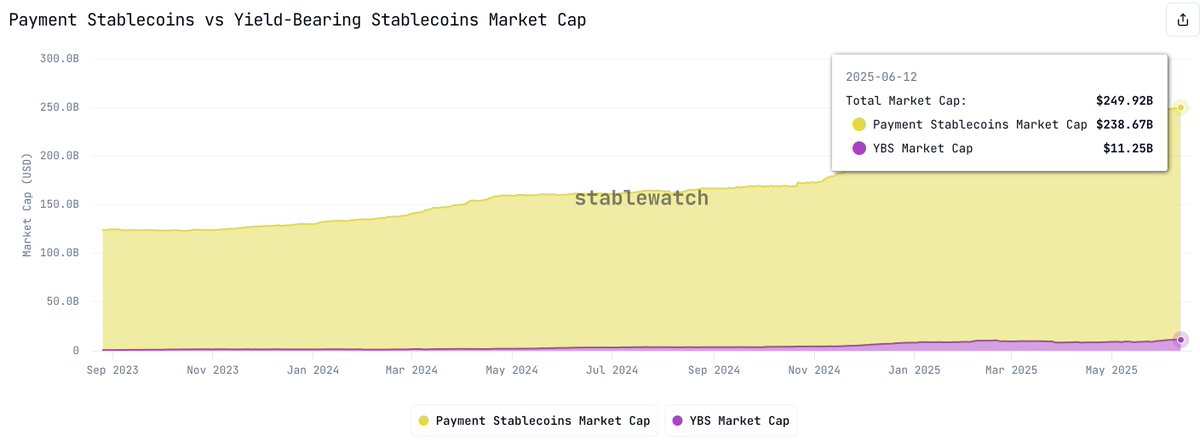

Stable coins have grown from 150M to 250M over the last 12 months. Yield bearing stable coins have grown from 2B to 10B over the same period. I expect the YBS share to keep growing of an ever larger becoming pie. syrupUSDC. Data by stablewatch.

Shoutouts to Resolv Labs being prolly the only delta-neutral synthetic position protocol that openly states the risks and runs an insurance layer. Miles ahead of the competition in ackownedging this risk and being transparent

Euler story is so inspiring for me, the dedication and drive this team have is out of this world. I’m proud we can serve their amazing product with our API. Much more to come also. You are not bullish enough on stablewatch.

So happy so many OGs are using our platform <3 For those who don't know us yet - we've only been live for 1 month. You're not bullish enough on stablewatch.

Happy to bring whole stablewatch team here. Poland strong.

Can't wait for you to play it at our secret workshop at Stable Summit 🦫^^