Marcel van Oost

@oost_marcel

Ajax, Amsterdam, and Connecting the dots in FinTech… Follow me so I don’t have to look for an actual job. Thanks.

ID: 1158047058932228101

http://www.connectingthedotsinfin.tech 04-08-2019 16:08:29

9,9K Tweet

3,3K Takipçi

1,1K Takip Edilen

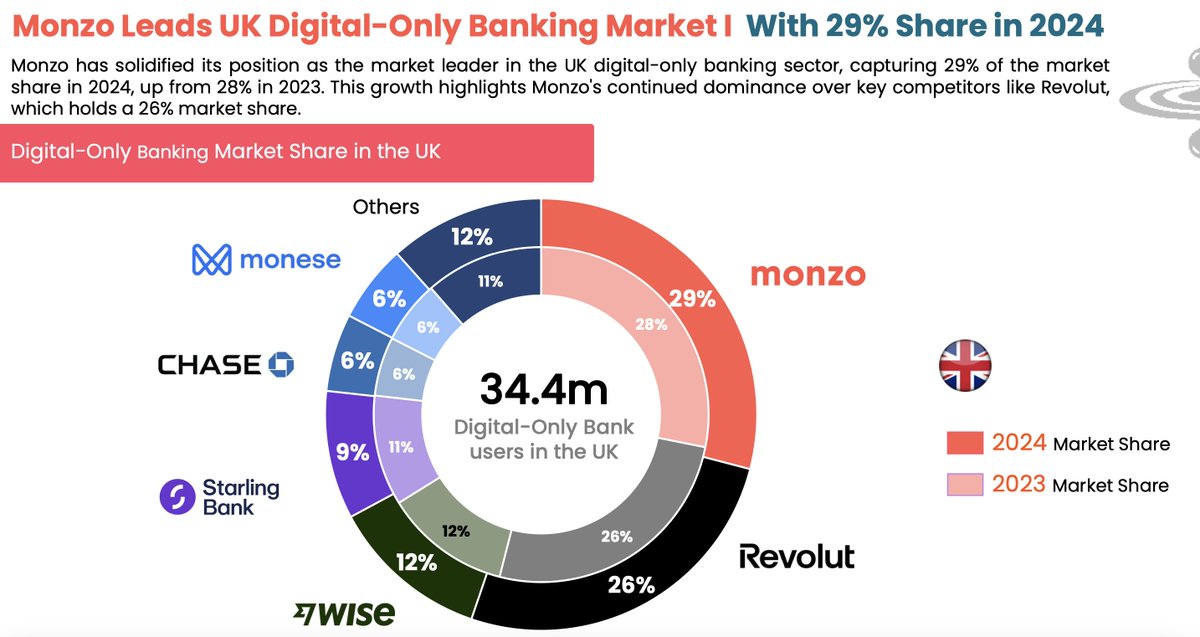

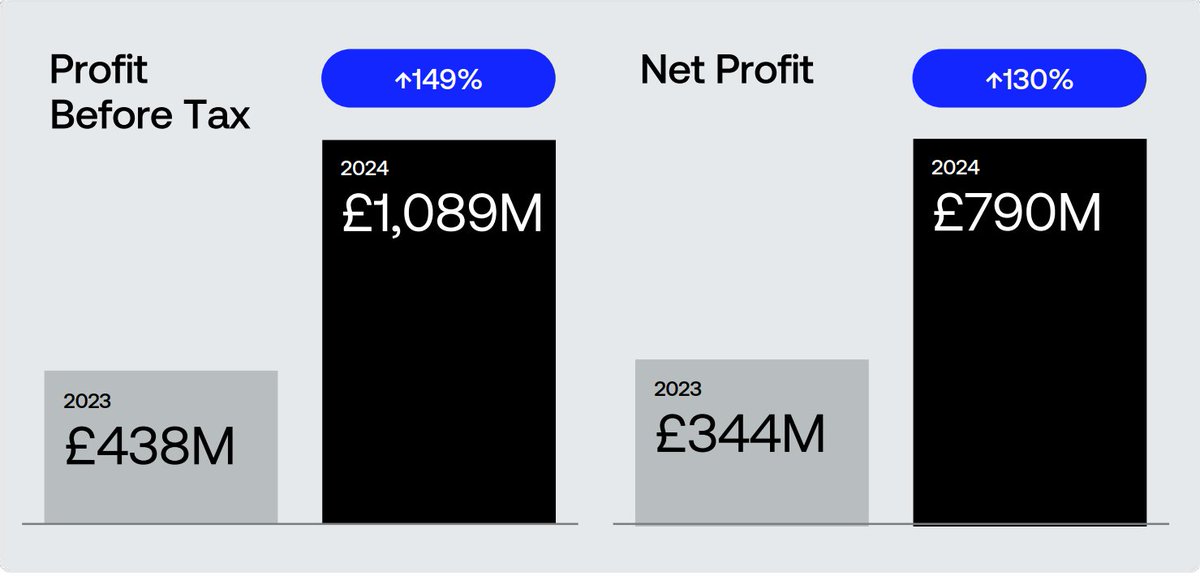

Monzo Bank today announces that it has surpassed 𝟭𝟮 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers: finextra.com/pressarticle/1… That’s 1 in 5 UK adults — and more than 600,000 business customers, or 1 in 9 UK businesses. Source graphic: C-Innovation