Odeta Kushi

@odetakushi

Deputy Chief Economist @firstam | Real Estate & Housing Finance | Data + Econ + Housing | Co-host of REconomy Podcast | Albanian-American | Views are my own

ID: 59319269

https://firstam.us/OdetaKushi 23-07-2009 01:31:15

4,4K Tweet

9,9K Followers

449 Following

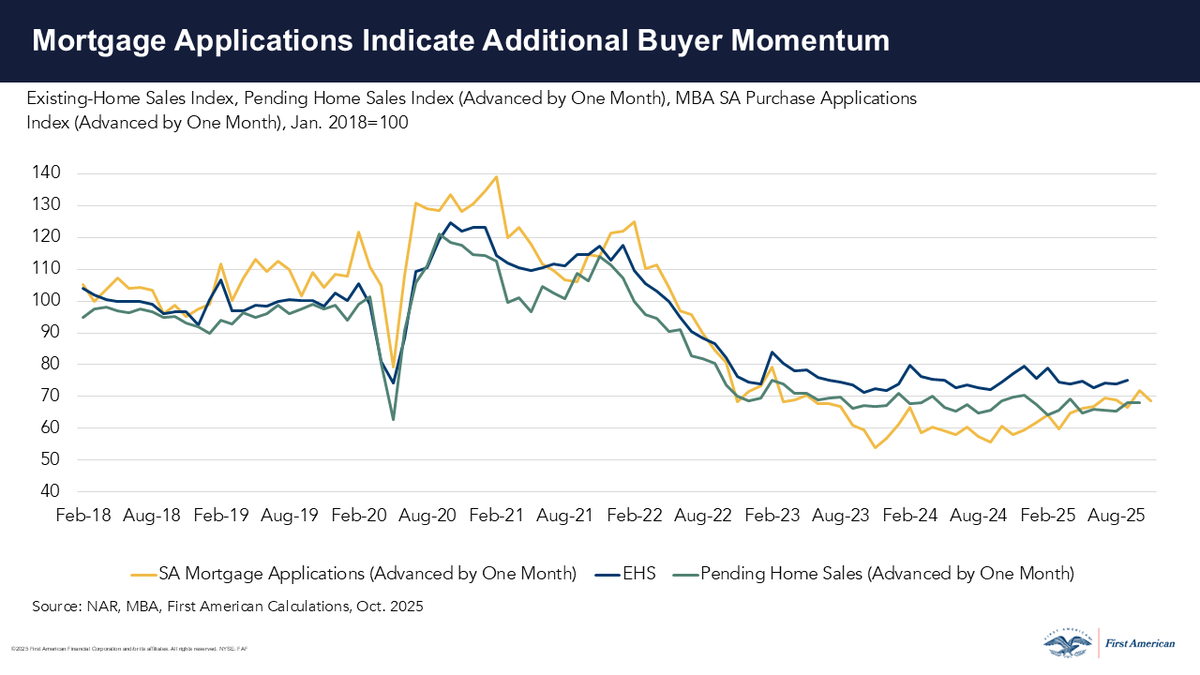

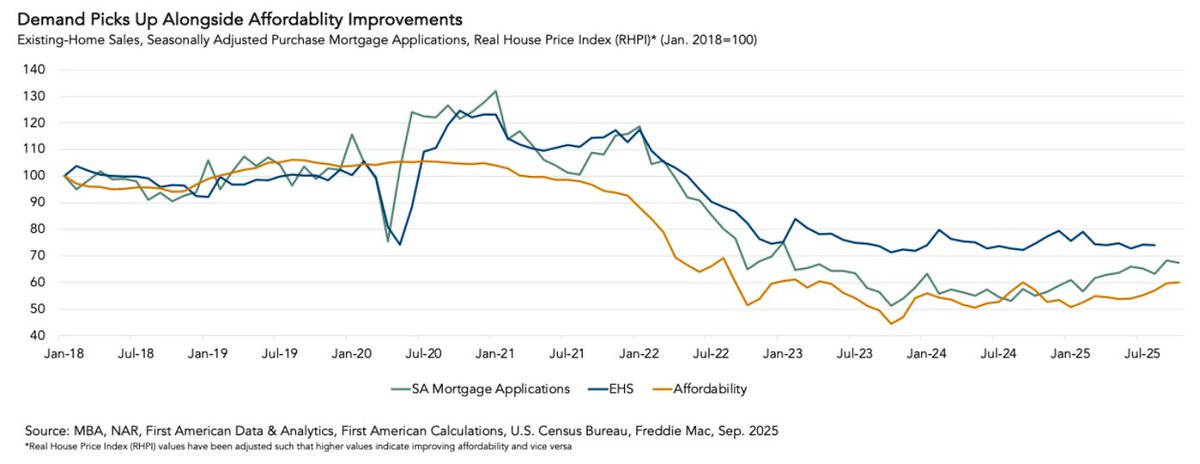

Are “life events” kick-starting a housing market recovery? After years of subdued activity, the U.S. housing market may finally be inching toward normalcy. As Odeta Kushi explains in her latest analysis, First American’s Real House Price Index is indicating that easing mortgage

In this episode of the REconomy Podcast, we break down whether the commercial real estate market has reached peak distress, explaining why shifts in debt maturities, delinquency rates and sales activity across asset classes may offer a glimmer of optimism. blog.firstam.com/reconomy-podca…

Are we at peak CRE distress? On Ep. 127 of The REconomy Podcast, Odeta Kushi and I dig into the data: -- Office CMBS delinquencies hit a record 11.6% in August before easing ~50 bps in September. -- Multifamily distress is concentrated in private label CMBS & CLO loans (which

Always enjoy our conversations, Mike Simonsen 🐉!

I recently had the opportunity to connect with Gordon Lamphere J.D. 🏭 CRE on his Real Finds podcast to discuss trends in Midwestern industrial markets. Among the topics we discussed:

“Progress without a breakout.” This, in essence, is what to expect of the housing market in 2026. In Odeta Kushi latest, she covers First American's housing outlook for 2026. It'll be characterized by a slow improvement in affordability via slower price growth and rising