Michele

@nicolimichelegp

Finanza, Ciclismo e Formula 1

I ❤️ Cravatta 👔👔

ID: 941042468140789766

13-12-2017 20:29:42

552 Tweet

23 Takipçi

360 Takip Edilen

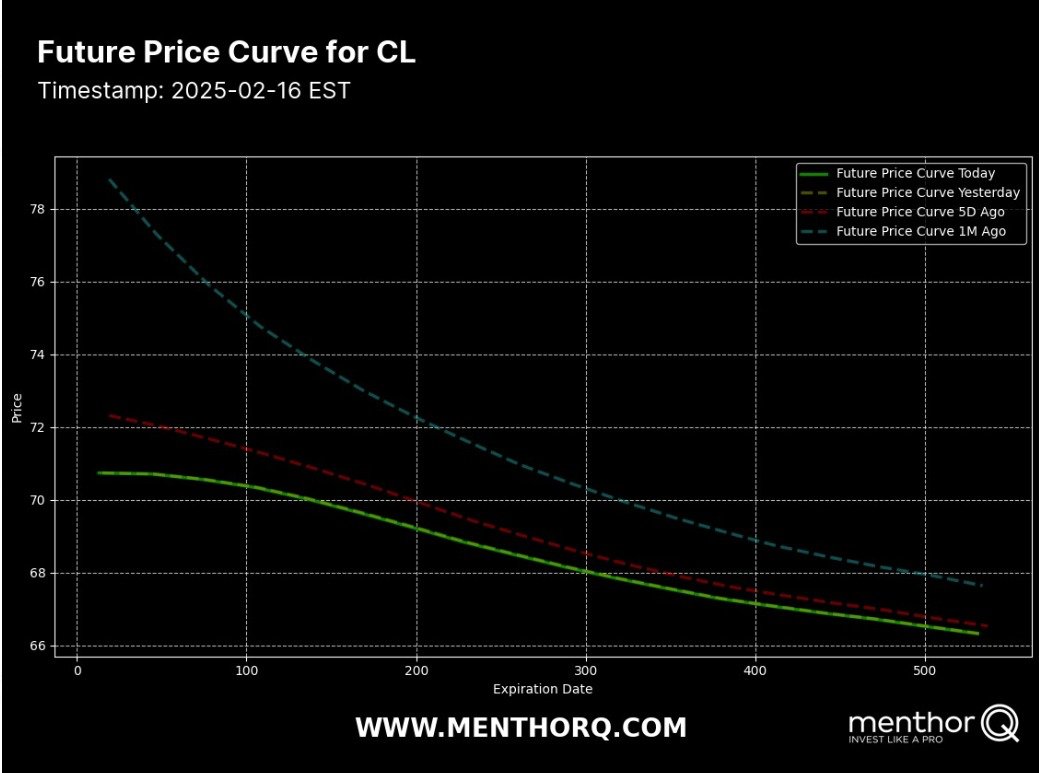

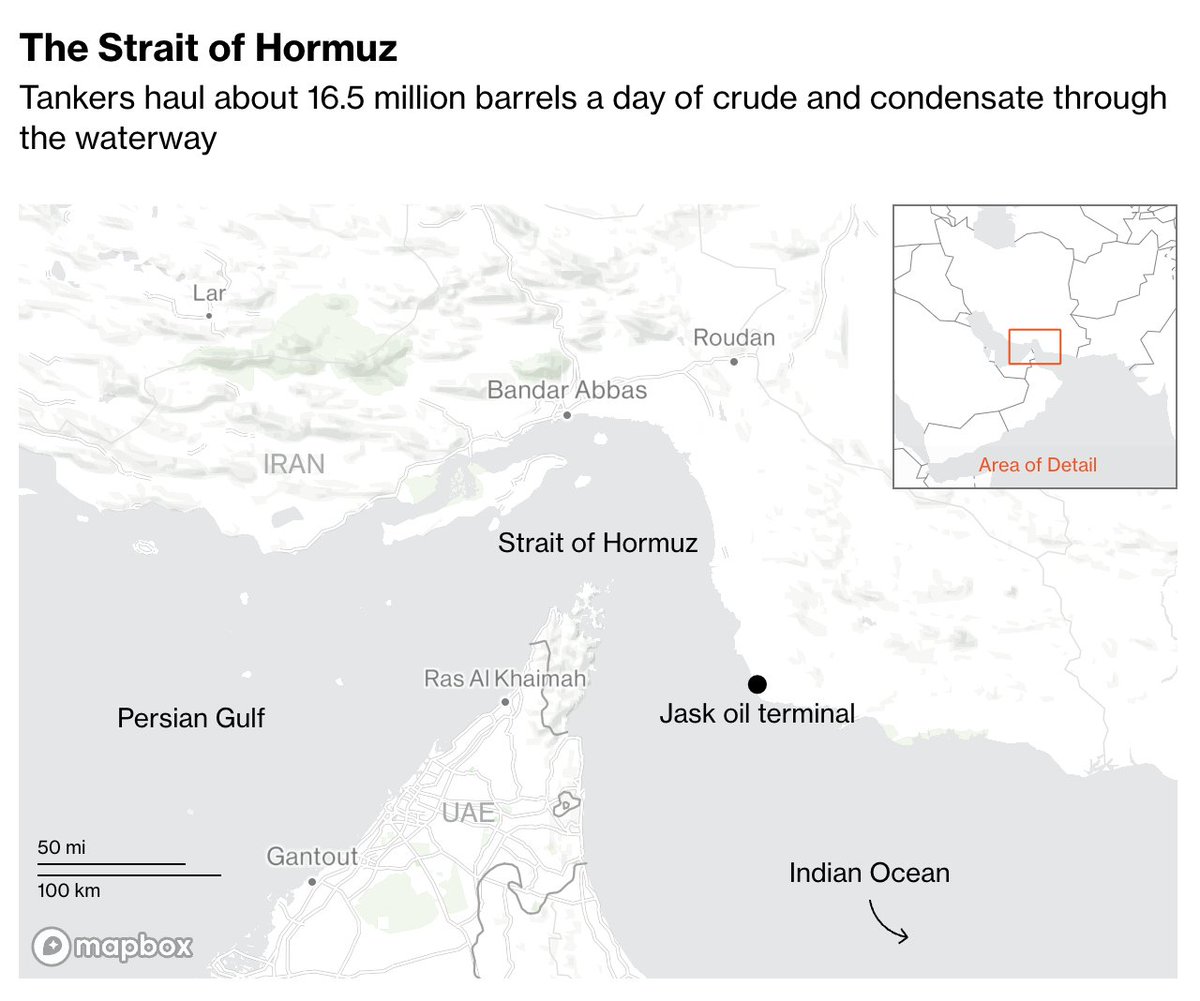

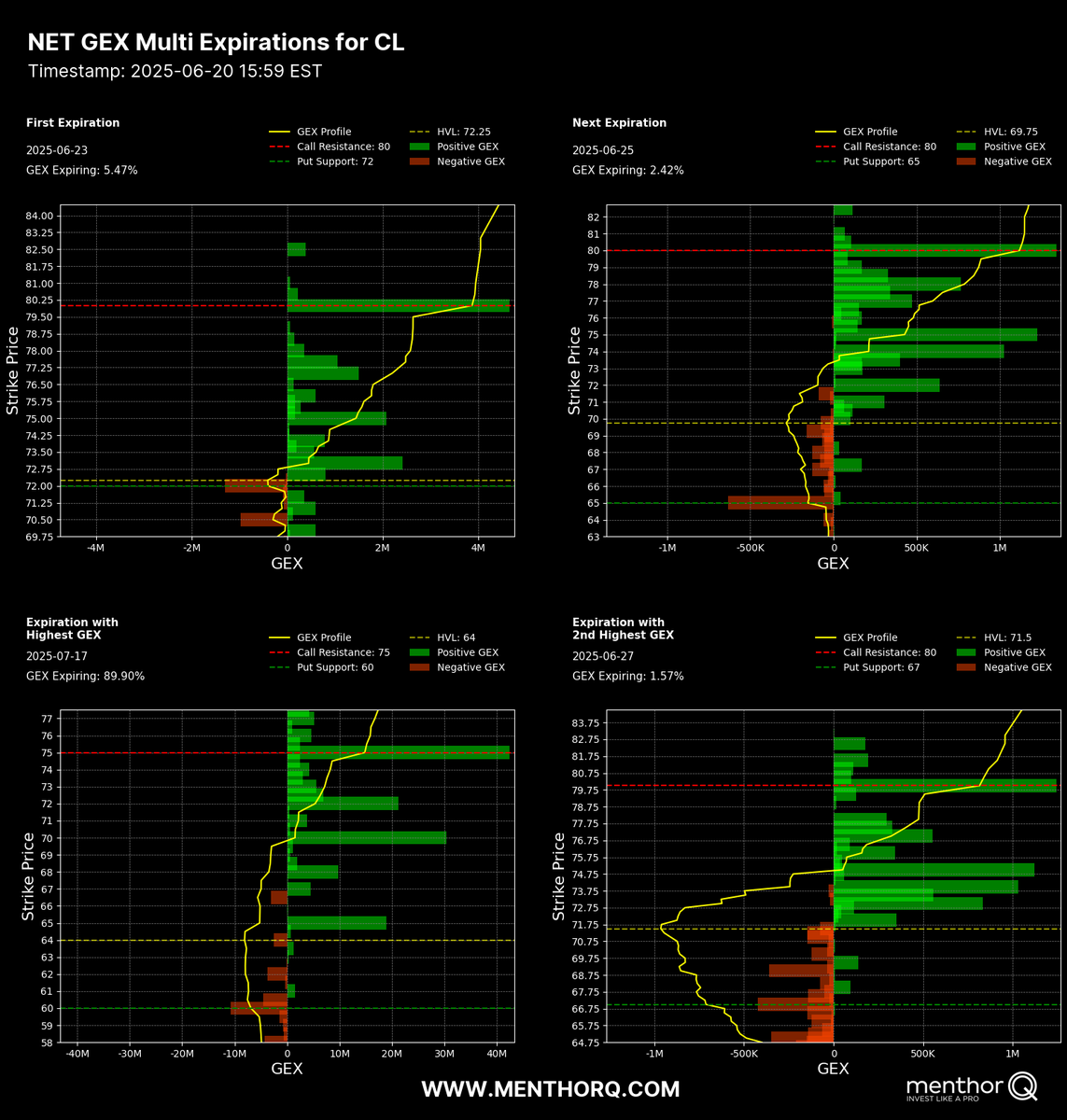

EIA has global oil demand at 105.17mbpd, global oil supply at 103.92mbpd in February 2025. Giovanni Staunovo🛢