Michel Geolier

@michelgeolier

Investing @equationcapital // Founder @Betterfront

ID: 2438901324

http://michelgeolier.com 11-04-2014 18:19:56

438 Tweet

140 Followers

276 Following

👏 Congrats to our amazing customer Acton Capital for raising #ACTON6 👏 thanks for your trust Dominik Alvermann

The presidents of Harvard University, Massachusetts Institute of Technology (MIT), and Penn were all asked the following question under oath at today’s congressional hearing on antisemitism: Does calling for the genocide of Jews violate [your university’s] code of conduct or rules regarding bullying or harassment? The

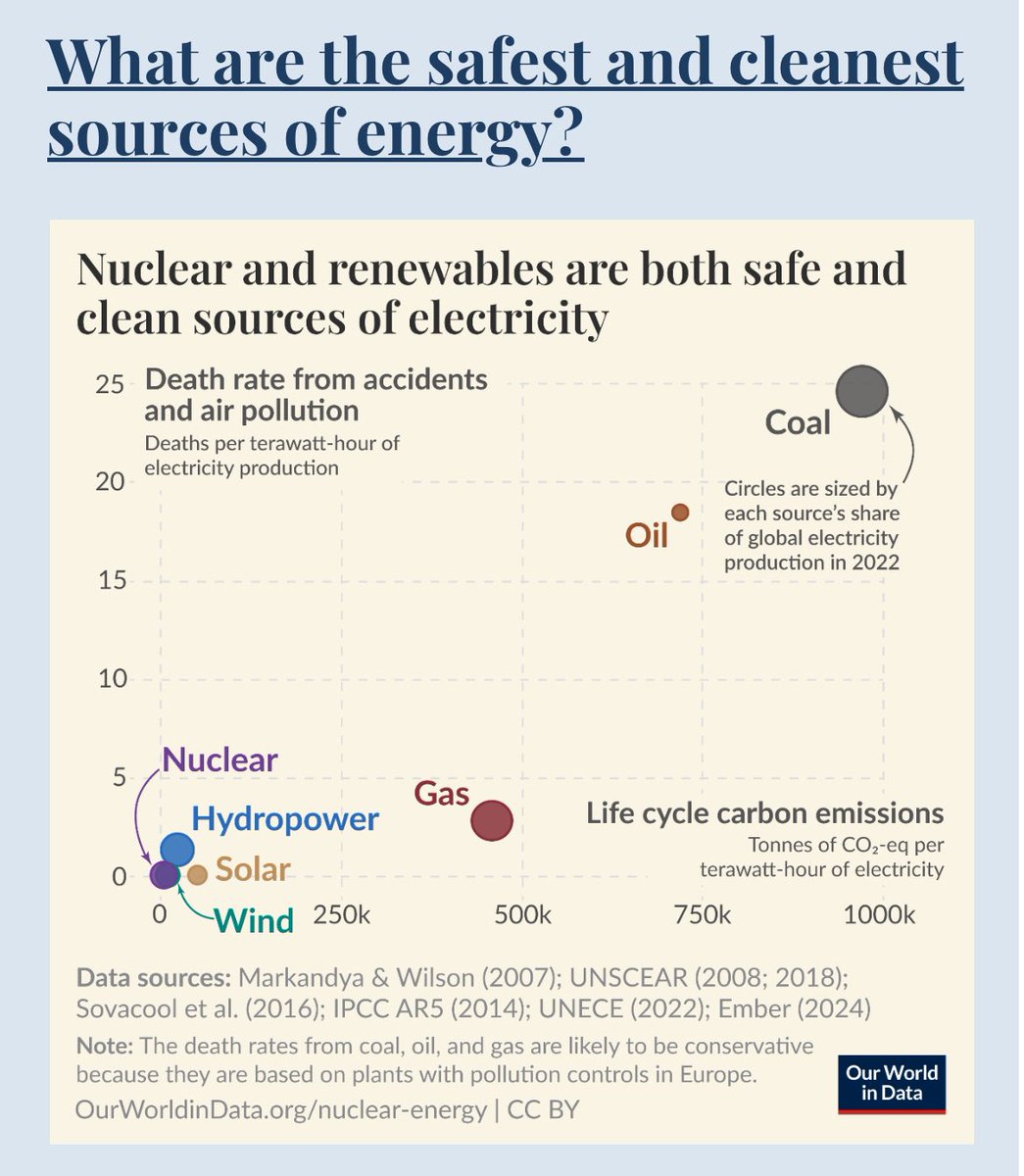

Germans won't like it... From Hannah Ritchie Our World in Data What are the safest and cleanest sources of energy? ourworldindata.org/safest-sources…