Luca Russignan

@lucarussignan

#Insurance analyst. #InsurTech mentor. Passionate about #digital technologies. Market Insights Insurance Director @Capgemini.

ID: 109216289

http://www.linkedin.com/in/lucarussignan 28-01-2010 09:54:54

103 Tweet

47 Followers

37 Following

+25% CAGR #smartphone usage from 2010. Scary stat from Scott Galloway What will happen when #superapps or the #metaverse becomes more tangible in the US and Europe? Has does #financialservices and #insurance need to evolve in this world? Elias Ghanem Chirag Thakral

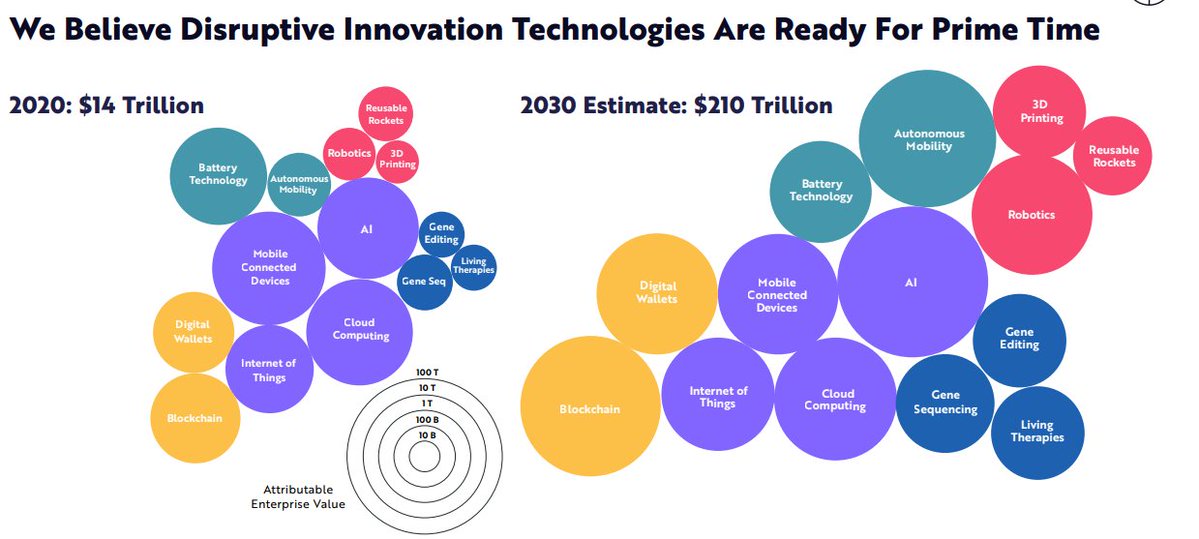

From ARK Invest #BigIdeas2022: industry #convergence and expected 8 year CAGR for #AI 26%, #Blockchain 43%, #Robotics 51%, #Genesequencing 40%! To adapt #financialservices and #insurance need to think differently about innovation. Elias Ghanem Chirag Thakral Seth Rachlin

Interesting study on increase in floods losses in the US. The #insurance industry should evolve risk models and response capabilities to prepare for an increase in extreme #climate events. Stay tuned for Capgemini Insurance insights on this theme Seth Rachlin

Insured #NatCat losses are up 250% in the last 30 yrs. To find out how insurers can prevent such losses, take a look at our new World Property & Casualty #Insurance Report 2022 , bit.ly/3NfBp6m #WPCIR22 @Efma_news #ESG #sustainability Elias Ghanem Capgemini Insurance

#Insurers need better #data to improve #riskmodels, tackle #climatechange and increase their resiliency to extreme #NatCat events. Download the #WPCIR22 report for more insights, bit.ly/3NfBp6m #ESG #sustainability Elias Ghanem Capgemini Insurance

#Insurers must leverage the rise of wellness among policyholders. Per our World Life and Health Insurance Report 2022 60%+ customers are interested in physical & financial wellness, respectively. For more insights, visit bit.ly/3KHPwBx #WLHIR22 dacadoo | health & wellbeing Elias Ghanem

How does this change the way you work? Elias Ghanem Chirag Thakral