Larry Cheng

@larryvc

Co-Founder of Volition Capital. Internet Investor. Boards: $GME, $GROV, US Mobile, Rounds, others. Christian. Journaling general business thoughts as they come.

ID:26281090

https://www.volitioncapital.com 24-03-2009 17:36:15

3,5K تغريدات

50,6K متابعون

950 التالية

Today's sermon at Aletheia Church:

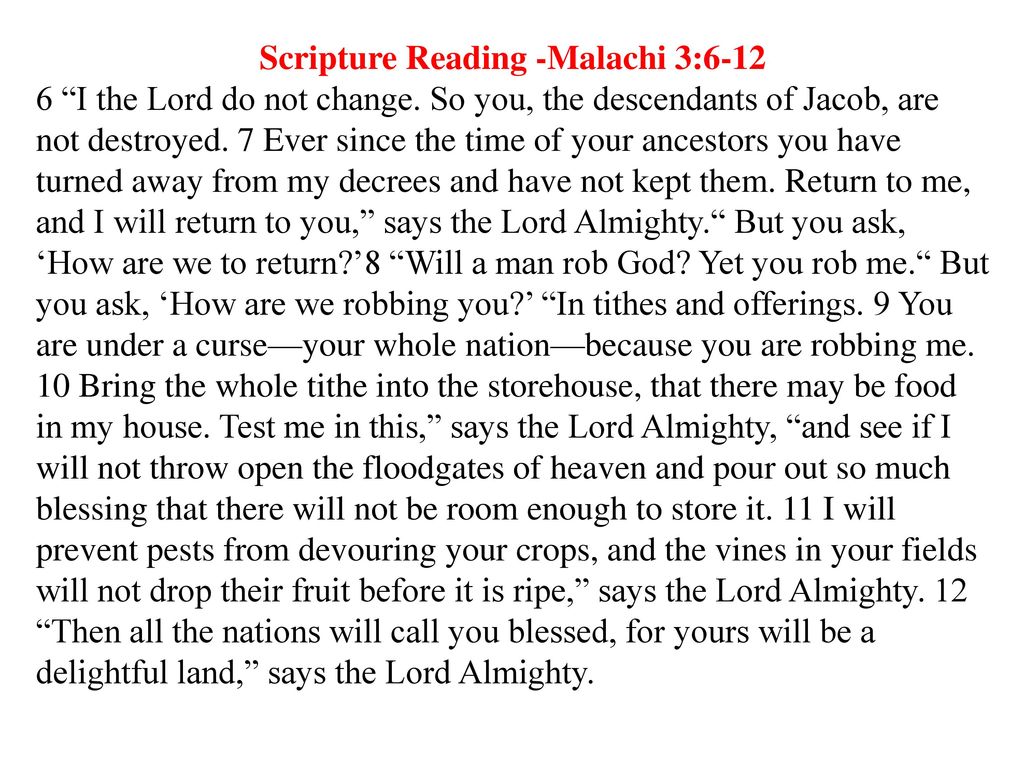

The sermon series is Moneology, and today's message was about tithing coming out of Malachi 3:6-12 by Adam Mabry.

It was the best sermon on tithing I've ever heard probably because it was about tithing but also so much more.

Today’s Sermon from Aletheia Church:

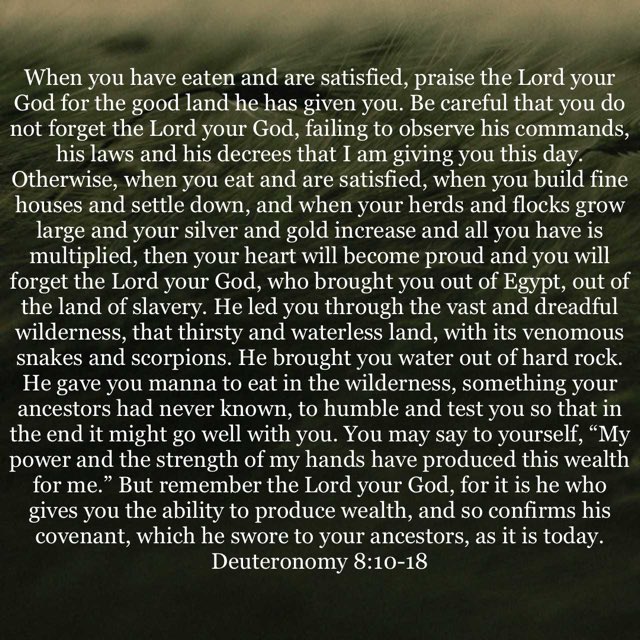

Passage: Deuteronomy 8

Speaker: Adam Mabry (@adammabry)

Series: Moneyology

Summary: Remembering God is the foundational key to getting money right in your life.

Reaction: So good, so on point with the passage, superb message.

Missional big vision mindset - to make all software cheaper… There’s such a clear opportunity to take every 80% gross margin commodity software category and turn it into a 40% gross margin category that better serves customers and take the market. Maybe Jason Fried will do it.

Good article from Retail Dive catching-up with Grove Collaborative’s CEO, Jeff Yurcisin. $GROV

Great unpaid review of US Mobile by Business Insider and Antonio Villas-Boas. I agree!

US Mobile review: Exceptional budget phone plans with unique flexibility

“If you're looking for the best cell phone plan on a budget, your search may end with US Mobile.”

businessinsider.com/guides/tech/us…

A great example of a smart digital-out-of-home (DOOH) ad. Savvy marketers are using data and context to create highly levered DOOH ad units. Old school marketers simply rely on commodity ad units and inefficient Facebook/Google ad spend. Screenverse