Paul Damon

@keramasmarcomms

Sharing insights & news on funds, investments, markets & economics. Helping asset managers w/ PR, Content, Marketing & IR when not surfing. President, Keramas.

ID: 2190649124

http://www.keramas.net 12-11-2013 16:27:55

5,5K Tweet

811 Followers

1,1K Following

“Everyone will be creating their own truth" -- Derek Tang, economist at LHMeyer / Monetary Policy Analytics on private economic data becoming "quite the cottage industry" (Joe Brusuelas, chief economist at RSM), via Claire Jones Myles McCormick Financial Times ft.com/content/3c8906…

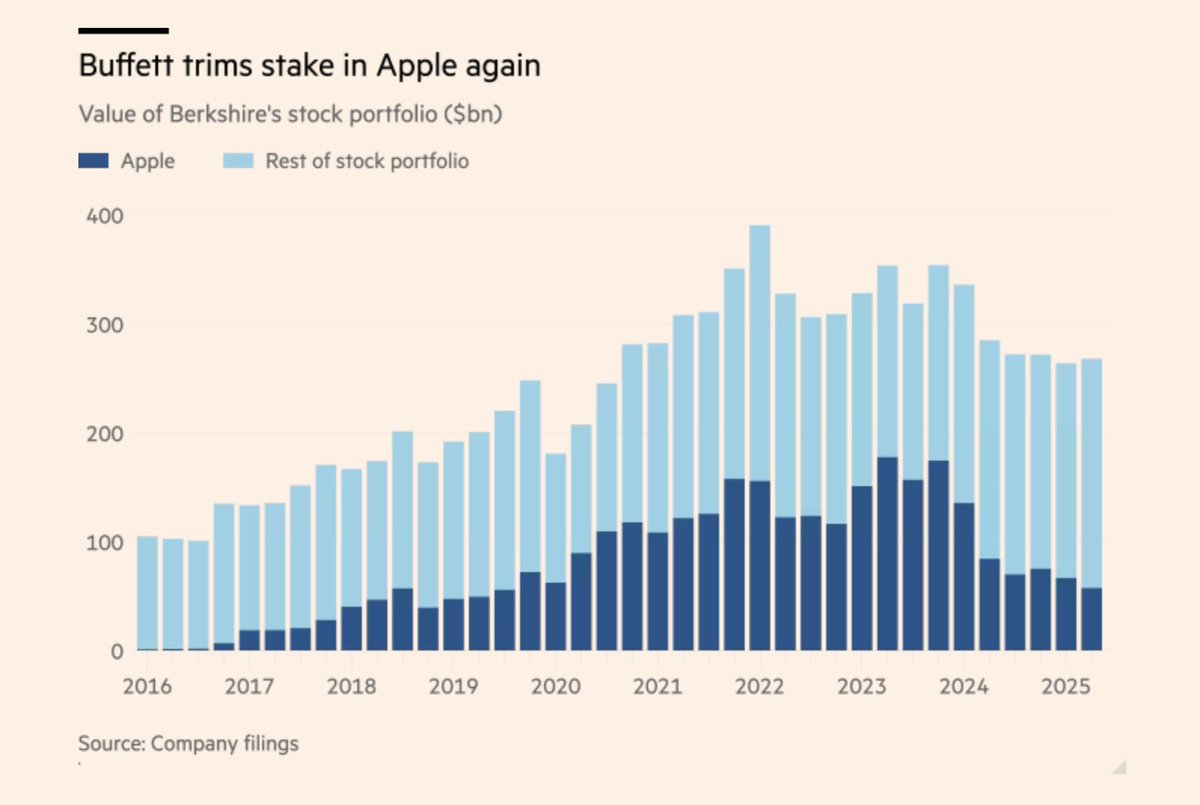

Great visualization of $BRK's allocation to $AAPL via Eric Platt Financial Times Buffett & Co continued to trim in Q2 ft.com/content/8c4d49…

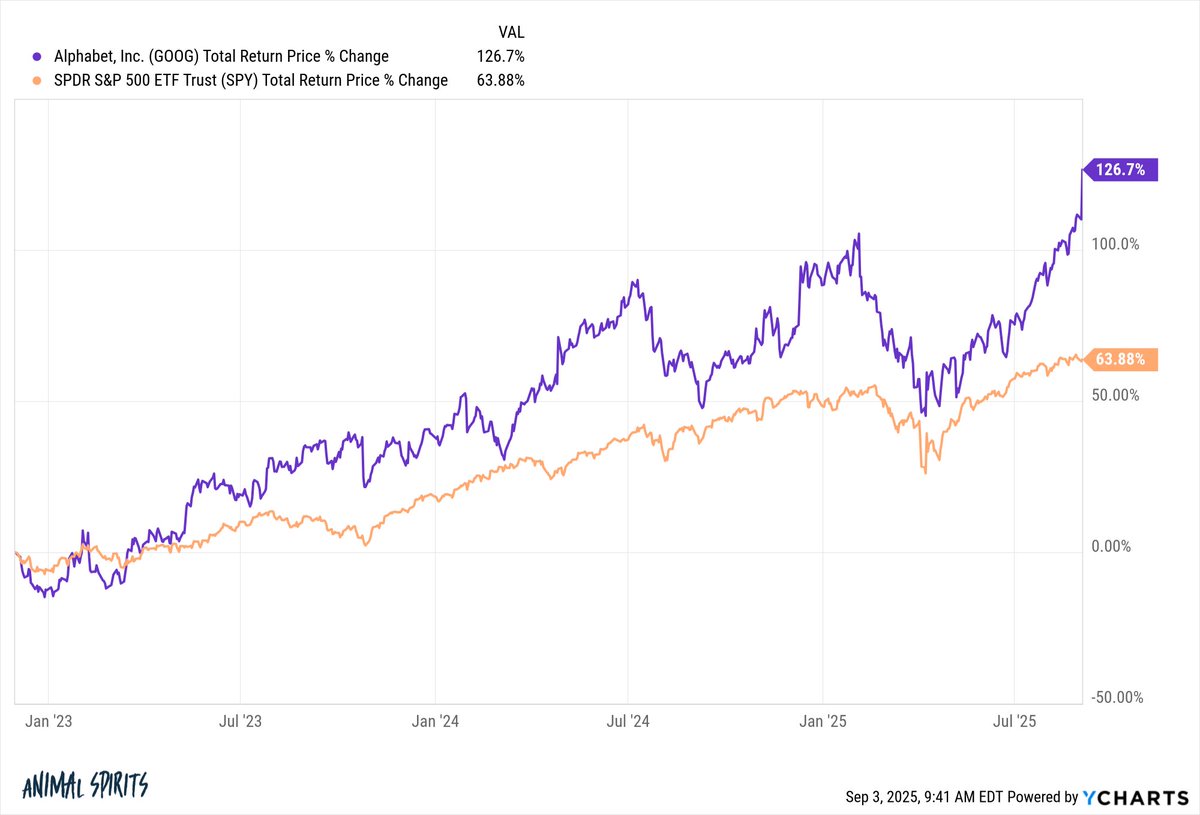

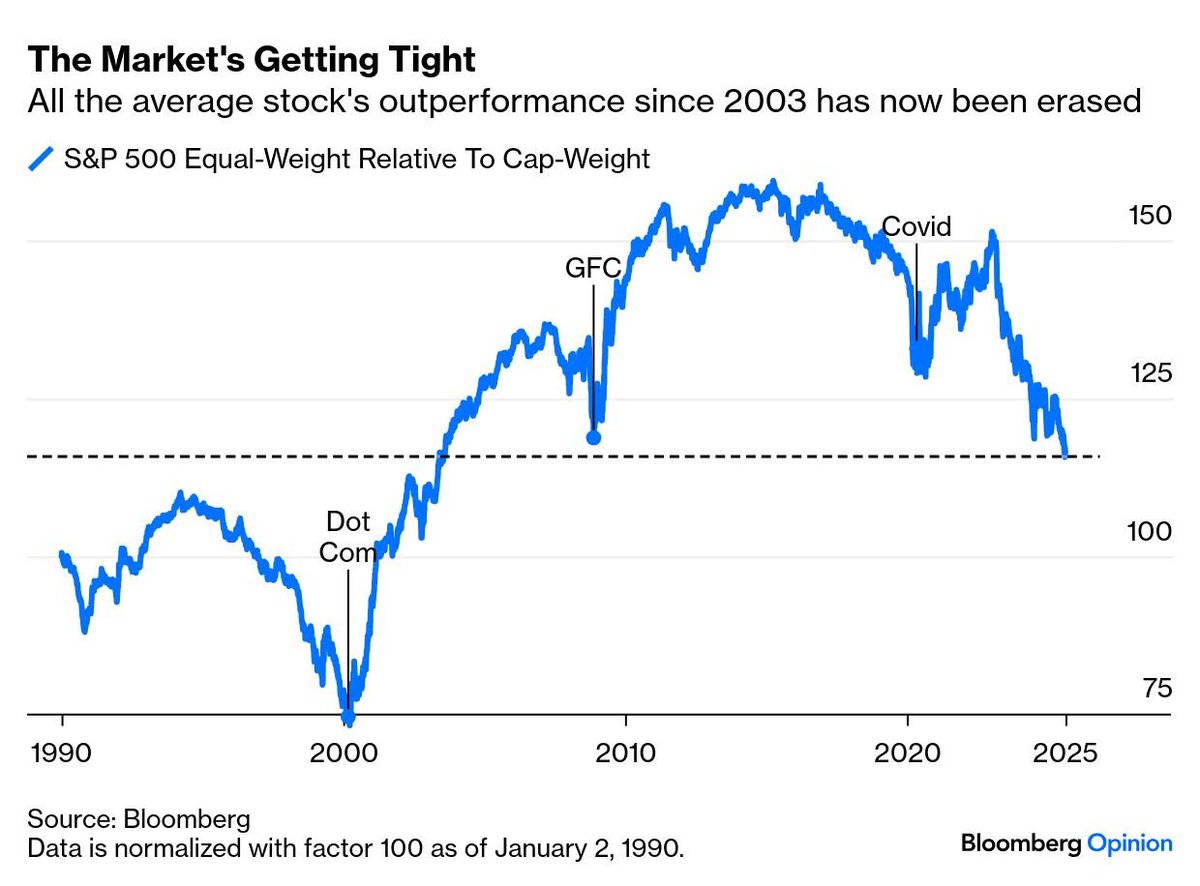

"This is as tight as the market has become in good times since the internet was taking off. The similarities, with a new technology promising huge gains in profits and revenues, are obvious. For the internet then, read #artificialintelligence now." John Authers Richard A. Abbey

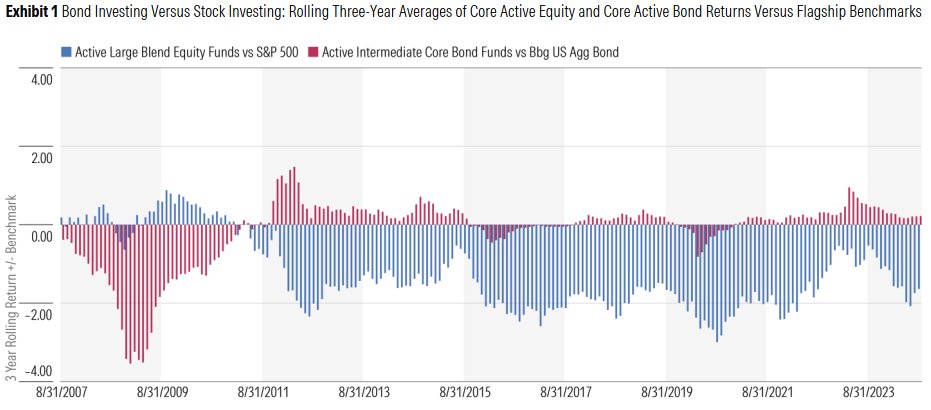

"the bond market’s structure and complexity create substantial inefficiencies so fundamental and inherent that eliminating them anytime soon would be a mammoth and improbable task.” Eric Jacobson #ActiveVsPassive morningstar.com/business/insig…

Chart of the week contender? ETF Prime Podcast Nate Geraci via Steve Johnson Financial Times Broadridge a record 75% of US ETF assets was retail owned (incl. financial advisors), up from 56% 10yrs ago, 7x increase in AUM to $8.8tn. Further, Broadridge's survey says "43% of financial