Kayezad E Adajania

@kayezad

Editor - ET Wealth at @EconomicTimes. Previously @moneycontrolcom, @livemint, loves writing on tennis on the sidelines.

ID: 1144527326

http://www.kayezad.blogspot.com 03-02-2013 07:55:32

20,20K Tweet

24,24K Takipçi

1,1K Takip Edilen

Leaving with the most precious trophy this time 👦 Roland-Garros Rafa Nadal #family #vamosrafa #tennisphotography Canon UK and Ireland

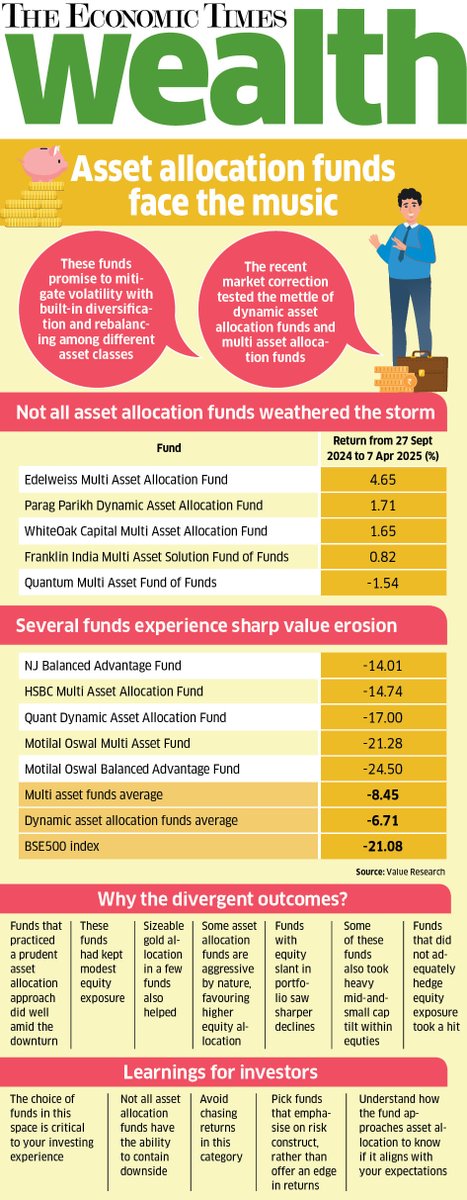

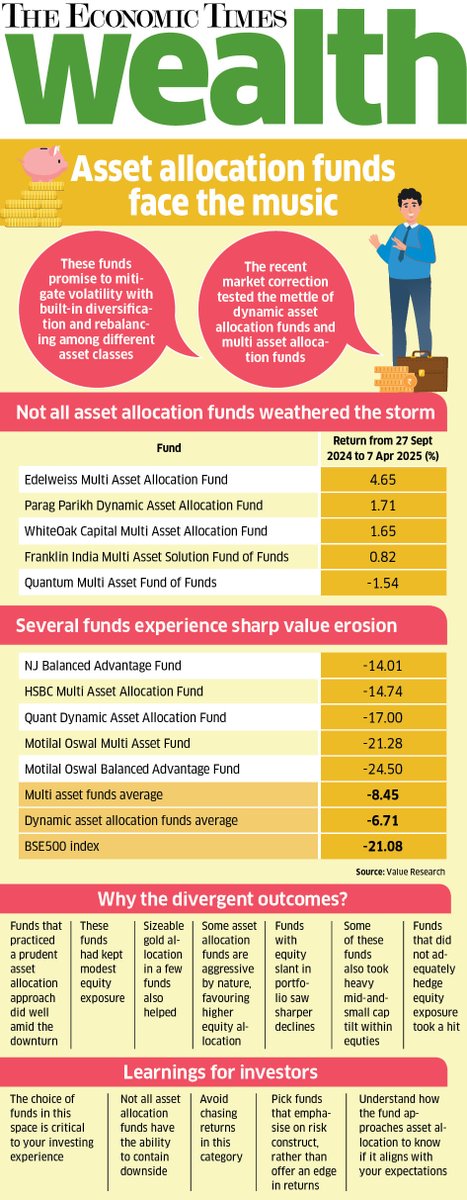

📉📈 Crash-Tested, Not All Passed! As the BSE500 tanked 21%, asset allocation funds faced their moment of truth. 🛡️ Some protected your money (Edelweiss +4.65%) 💥 Others nosedived (Motilal Oswal -24.5%) Key lesson? ✅ Risk construct > chasing returns Sanket Dhanorkar dives deep

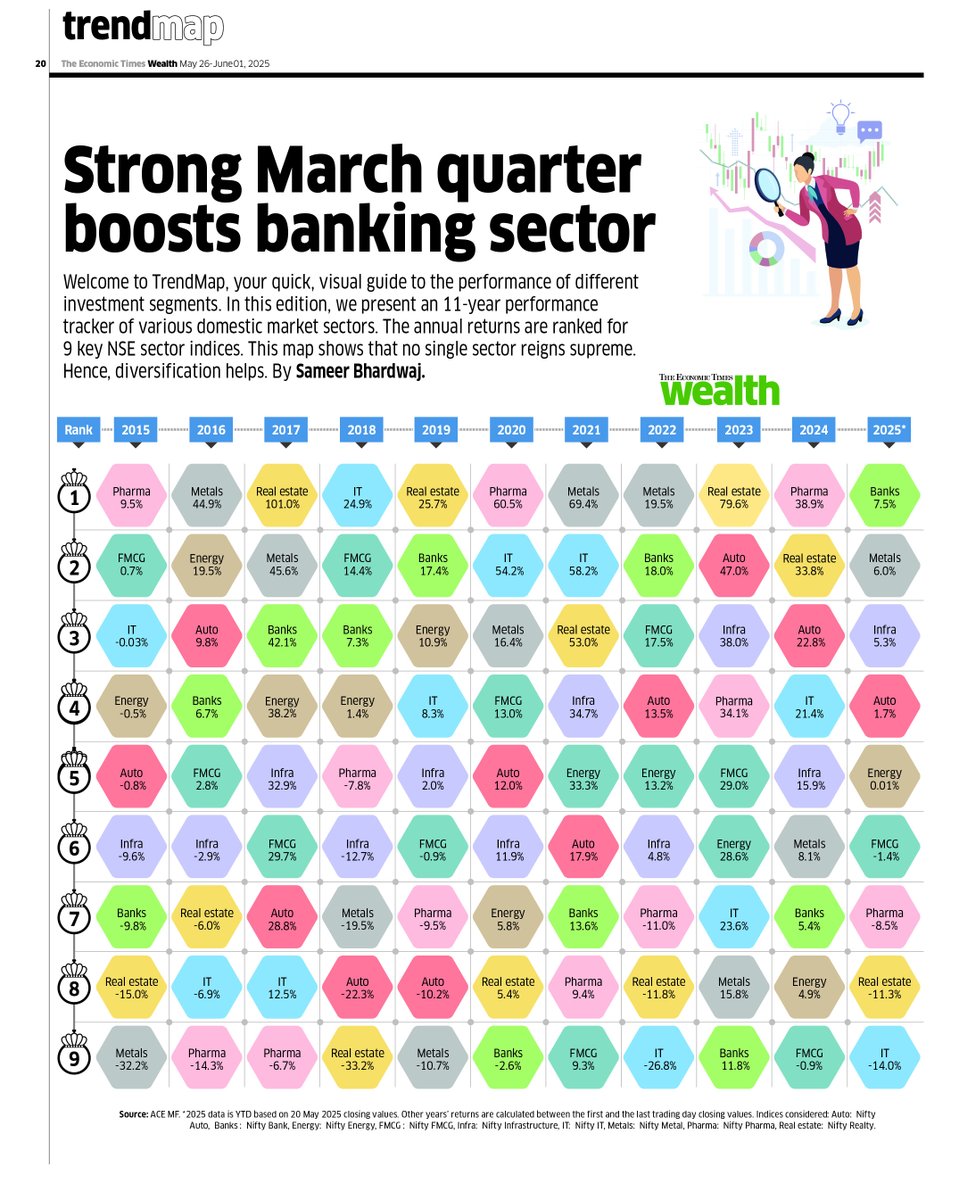

Sectors rotate Which is why you need to diversify, be among asset classes or sectors or categories. Our weekly TrendMap brought to you by Sameer Bhardwaj ET Wealth Economic Times

Meet Victor Martinez, more famously known as Victor Barber, more notoriously know as Carlos Alcaraz ‘s barber. Ben Rothenberg chased him down at Roland-Garros to ask him about his new celebrity status. A really entertaining story. Do read. open.substack.com/pub/benrothenb…

The wait for this headline for me has been almost 20 years. From Indian Express to Outlook Money and then Mint, me and my team relentlessly pointed to these horrific sales, fraud and manipulation by banks. Nirmala Sitharaman and Ministry of Finance will need to mandate ReserveBankOfIndia to make it a bank

The impact of a securities market clean up of mutual fund regulations by SEBI_Awareness over the past 20 years, an innovative and hungry industry and some hard working distributors made retail investors trust and use funds for long term wealth creation. As I hear global experts talk