Jonathan Heathcote

@jonheathcote

Economist.

ID: 4160390709

http://jonathanheathcote.com 11-11-2015 01:20:32

2,2K Tweet

5,5K Followers

1,1K Following

Super write up by Jeff Horwich of a new paper with Johannes Fleck Gianluca Violante and Kjetil Storesletten here: minneapolisfed.org/article/2025/m…

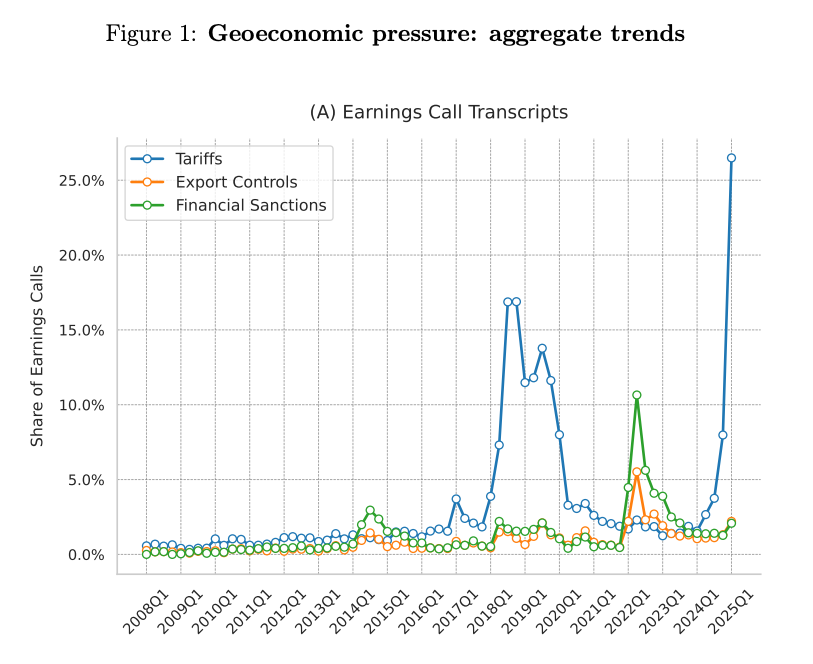

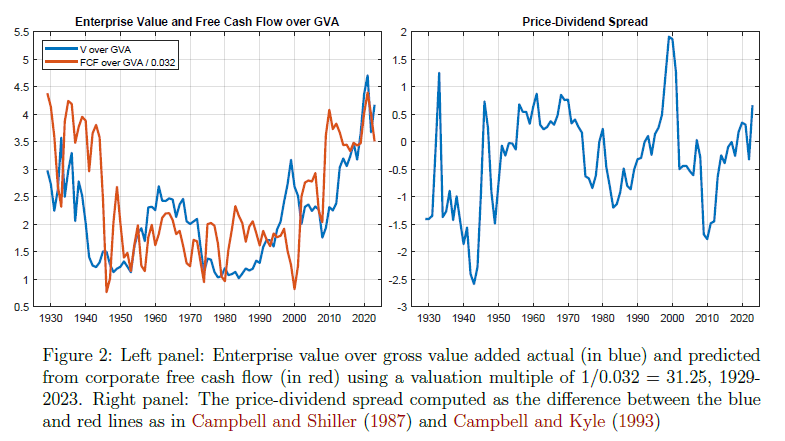

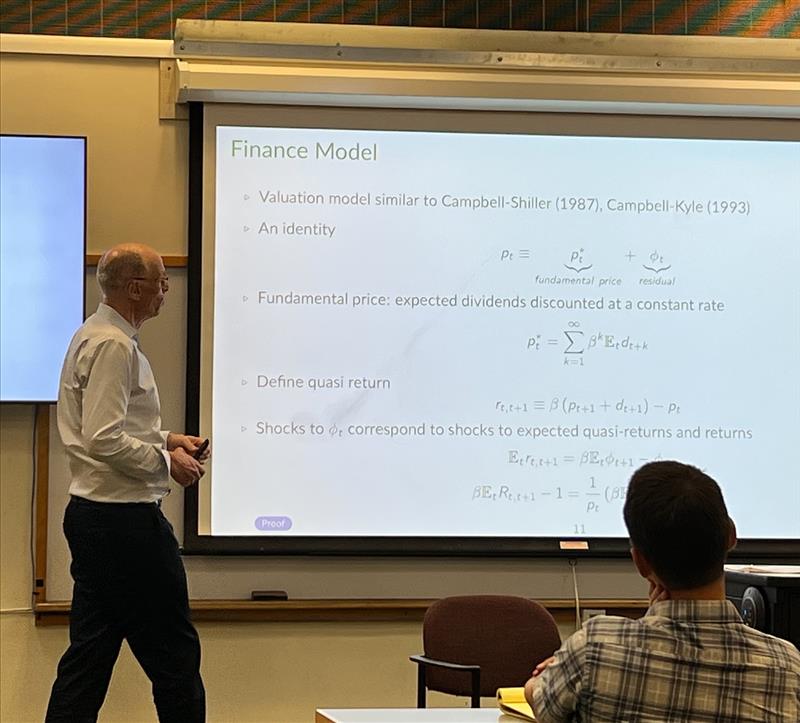

Stock market volatility since 1929 can be reconciled with the relative stability of macro variables if fluctuations in corporate valuations are attributed to changes in “factorless income” rather than expected returns. Jonathan Heathcote fabrizio perri edwardconard.com/macro-roundup/…

🚨 Call for Papers 🚨 Now accepting submissions for the 17th Annual Normac conference Keynote Adrien Auclert Juniors in macro apply! A connection to the Nordics a + but not required. Send papers or abstracts to: [email protected] by April 7, 2025 dropbox.com/scl/fi/z6nlyry…

Jon presented his work(w fabrizio perri and Andrew Atkeson) that aims to reconcile empirical observation of volatile stock market valuations with a stable capital stock within a macroeconomic model. They use a new Integrated Macroeconomic Accounts dataset developed by BEA and FRB.

The Internal Revenue Service is making plans to rescind the tax-exempt status of Harvard University Really big scoop from Evan Pérez Alayna Treene cnn.com/2025/04/16/pol…

The End of Privilege: A Reexamination of the Net Foreign Asset Position of the United States - American Economic Association Jonathan Heathcote fabrizio perri aeaweb.org/articles?id=10…