JC Double Taxed 🇦🇺 🇺🇸 END Double Taxation

@jcdoubletaxed

End unjust 🇺🇸 #doubletaxation of #AmericansAbroad. The 🇦🇺 tax treaty should prevent it. #FBAR & #FATCA forces discrimination based on U.S. nationality.

ID: 2783925840

https://www.taxfairnessabroad.org/ 01-09-2014 11:27:48

68,68K Tweet

1,1K Takipçi

926 Takip Edilen

Ed Krassenstein Barack Obama Neither do the Democrats! What about the 9 million US citizens working abroad are really hammered down because of the #fatca bill introduced by Barack Obama as a stealth tax to finance the HIRE-act. Also the lives of 300000 EU lives with US indicia are hurt. They don’t care!!

Adrian Pandev Which is why US citizens should (if possible) arrange for their children to be born outside the USA. Consider also the citizenship(s) of your choice of marriage partner.

What's it cost to be an American abroad? In addition to paying more in accounting fees, some Americans now have to pay their banks more because of high U.S.-dictated compliance costs. Read our latest blog: taxfairnessabroad.pulse.ly/zghlugu3ns #EndDoubleTaxation #TaxFairnessNow #FATCA #FBAR

American Iron Curtain cerule dave lawrence 🐟🐟🐠 Rob Moore Unsurprisingly, cerule blocked me. As you say, before he/she decides that the US system is a good way to prevent tax avoidance, they should learn the reality of #CBT #FATCA #PFIC etc and how it is clearly a stain on humanity and human freedom.

IRSMEDIC | Anthony E. Parent, Esq. It's worse than you describe. (Did the OBBB make specific amendments to Sec. 250 or leave is the same?) Either way, they also eliminated the exclusion from GILTI (now called Net Tested CFC Income) for the 10% return on fixed assets. Bottom Line: More CFC income will be taxed!

Democrats Abroad Canada 🇺🇸🇨🇦 Rebecca Abroad Treasury Department Democrats Abroad Taxation Task Force Why are Americans abroad the only citizens in the developed world taxed twice for the “privilege” of a passport? We pay local taxes. We get no services. This isn’t patriotism—it’s punishment. End citizenship-based taxation. 🇺🇸✈️ #FATCA #TaxReform #AmericansAbroad

Chris gaggo Democrats Abroad Canada 🇺🇸🇨🇦 Rebecca Abroad Treasury Department Democrats Abroad Taxation Task Force And now swiss banks are charging extra. Which country is next i wonder?

Solomon Yue #fatca #rbt Americans Abroad Tax Fairness for Americans Abroad youtu.be/LrQCFZHgQr0?si…

JC Double Taxed 🇦🇺 🇺🇸 END Double Taxation John Richardson - Counsellor for US persons abroad IRSMEDIC | Anthony E. Parent, Esq. Wont this hit small businesses fairly hard?

Interesting Latife Hayson discussion of @citizenshiptax and #FATCA covering a range of expat tax issues focussing on #Americansabroad living in Australia. Shoutout to SEATNow.org - Stop Extraterritorial American Tax at the 1:34:00 mark. Acknowledgement of the Darin LaHood bill at 1:23:03 mark. youtu.be/66fWArnjvhg?si…

Speaker Mike Johnson Speaker Mike Johnson NONE of this BBB impact is true for U.S. Double Taxed and over-regulated Americans Overseas-where they live! EXCEPT taking double taxation from them to pay for it. ✅ More take-home pay ✅ More jobs ✅ A booming economy x.com/SpeakerJohnson…

Elon Musk Pierre Ferragu Re: America Party. Elon Musk Pls include a DOGE like mission to end harmful U.S. over-regulation. Pls consider Americans tax resident abroad. The U.S. wants to double tax them, require heaps of forms & provide zero resident services in exchange. x.com/elonmusk/statu…

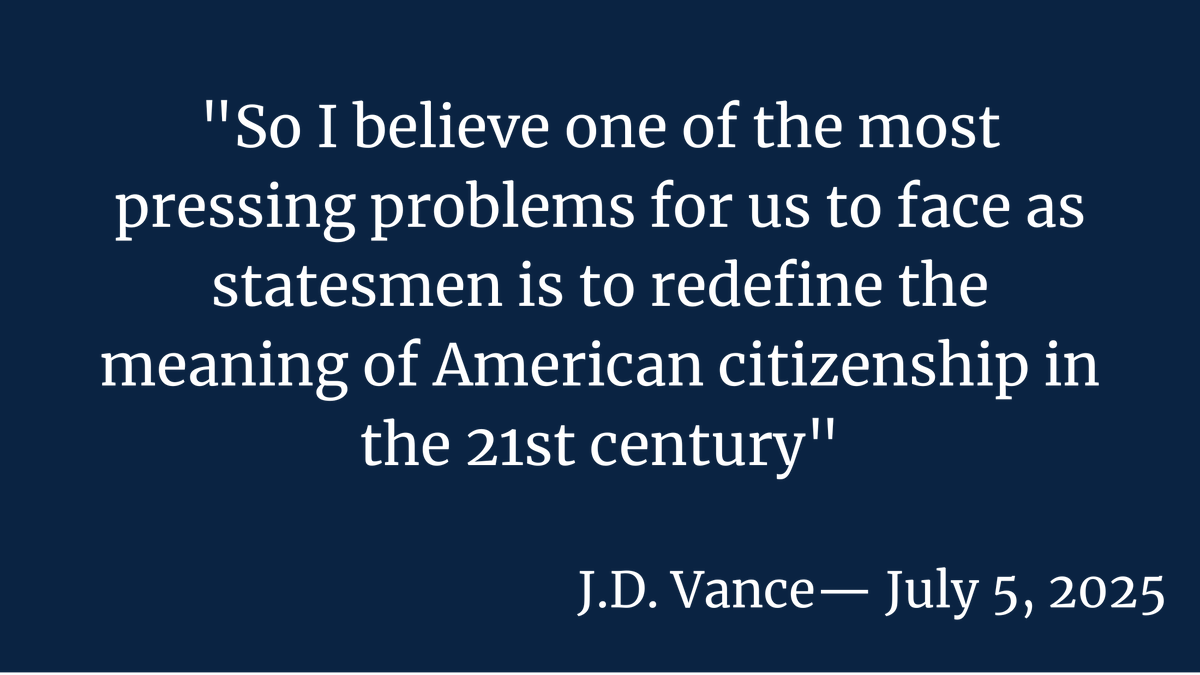

“So I believe one of the most pressing problems for us to face as statesmen is to redefine the meaning of American citizenship in the 21st century.” Vice President JD Vance JD Vance We agree. Let’s start with those born on U.S. soil by chance — living their lives outside America, not speaking