Jack Sharples

@jackdsharples

Senior Research Fellow on the Gas Programme at the Oxford Institute for Energy Studies

ID: 1338521732337045506

https://www.oxfordenergy.org/authors/jack-sharples/ 14-12-2020 16:30:48

180 Tweet

455 Followers

84 Following

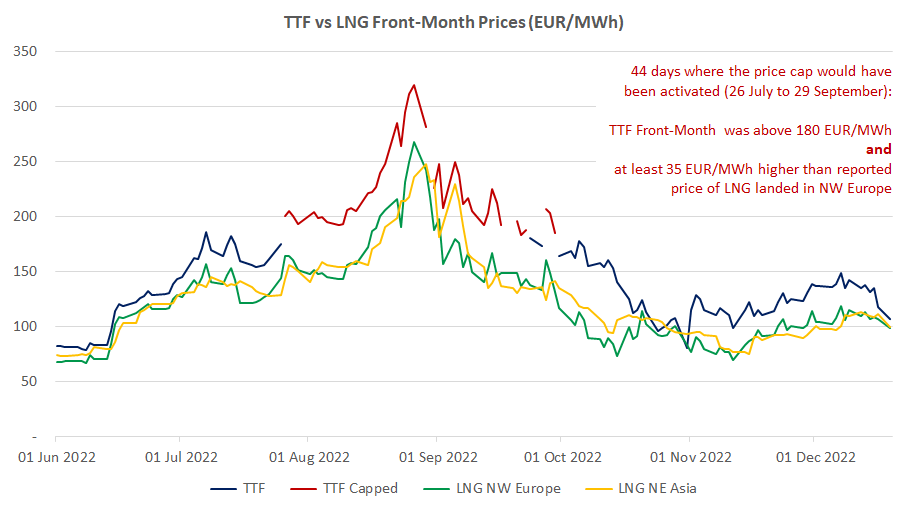

Great article by Kira Taylor on the new gas price cap. Thank you for re-tweeting my graph of historic prices compared to the old (275 EUR/MWh) & new, pre-summit (188 EUR/MWh) proposals. My conclusion of "lower cap = more likely to be used" is even truer at 180 EUR/MWh...

Coming up on RN Breakfast for the 6am hour📻📻: Jack Sharples - EU reach agreement to cap gas prices Catherine Namakula - UN delegation in Australia looking at how racism affects people of African descent LISTEN LIVE: ab.co/2GqJiZo #auspol

A pleasure to join RN Breakfast yesterday morning to discuss the EU wholesale gas price cap