Ukuria On-Chain⚡⚡⚡

@ukuriaoc

Eternal student.⚡BTC will change the world⚡- BSc Phys - Senior Analyst for @glassnode - Not financial advice - views my own

ID: 1397559862117142528

26-05-2021 14:26:57

2,2K Tweet

2,2K Takipçi

527 Takip Edilen

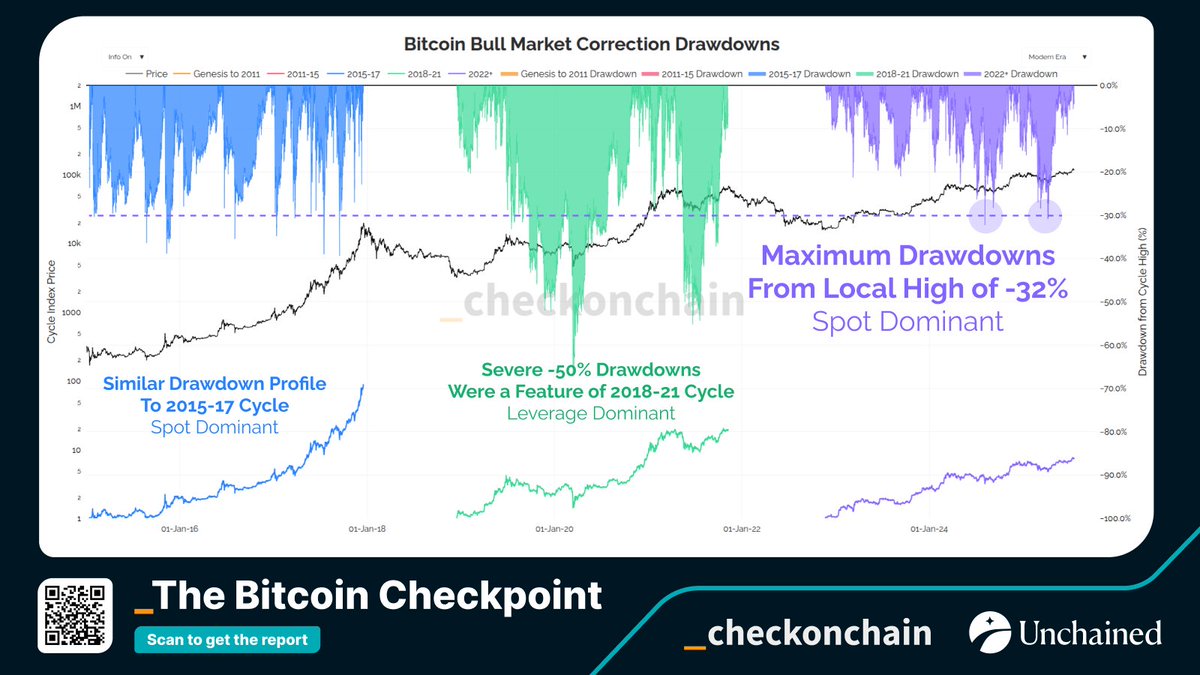

Lot's of people asking recently, is the bull run over or is bitcoin just maturing? My friend _Checkmate 🟠🔑⚡☢️🛢️ from _Checkonchain addresses this on Sep 30th at 3PM CT, along with his thesis on why bitcoin has crossed the Rubicon into being a top-tier global asset—and what that