_Checkmate 🟠🔑⚡☢️🛢️

@_Checkmatey_

Helping navigate #Bitcoin's volatility

Newsletter https://t.co/omfQHUqMjb

Onchain Analyst @_checkonchain

Charting Suite https://t.co/5DH6Z9lWT1

ID:951920334831173632

https://checkonchain.com 12-01-2018 20:54:28

35,7K Tweets

89,5K Followers

1,3K Following

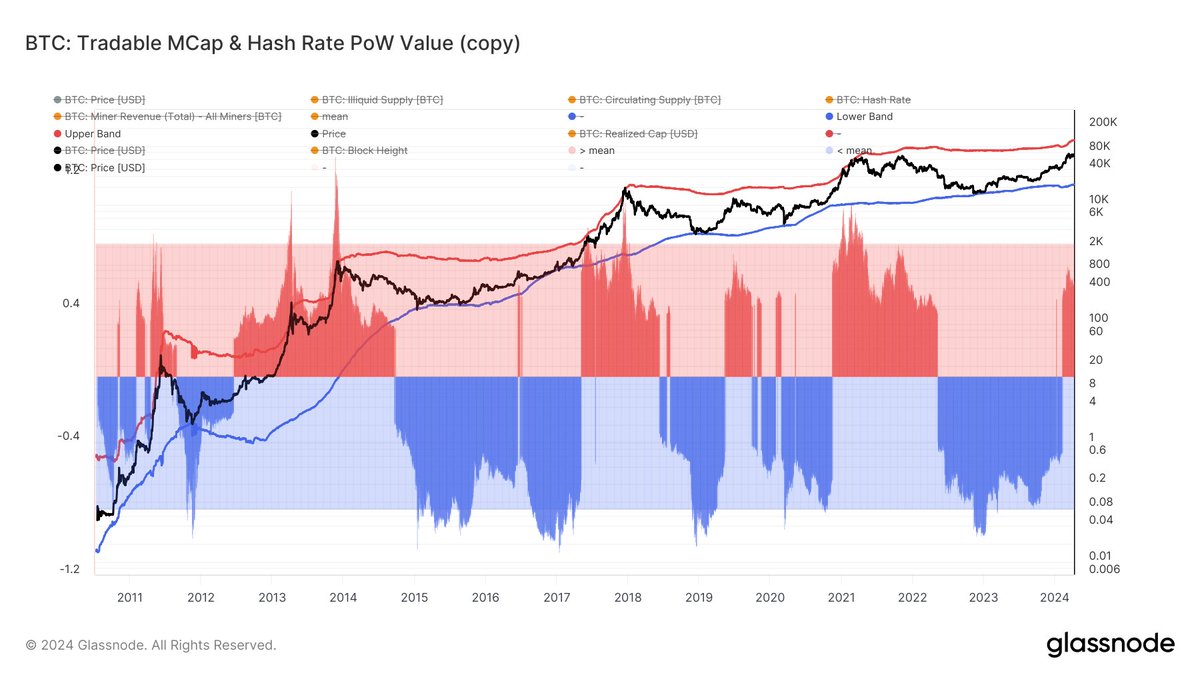

Make sure you read the latest glassnode Week Onchain edition folks, it is an absolute cracker.

The insights CryptoVizArt.₿ | ZiCast 🎙 describes about the momentum of spot trade volumes, and patient buyers absorbing sell-side in 2023 is remarkable.

World class

insights.glassnode.com/the-week-oncha…

Bob Loukas 🗽 On-Chain College glassnode David Puell Further to this, watch for divergences late cycle. Explored here (works for both MVRV and AVIV)

insights.glassnode.com/mastering-the-…