mcsquared

@0xmc2

@AllezLabs | former apple farmer | defi maximalist

ID: 1390139363456126977

06-05-2021 03:00:46

1,1K Tweet

520 Takipçi

1,1K Takip Edilen

Just a day of Kamino V2 🤌 Kamino Vaults have crossed $25M in liquidity 🦾 Over 300 suppliers joined 10 new markets are live, including: 🔋 Marinade 🛡️ just surpassed $40M market size ☁️ sanctum ☁️ >$10M 🔥 🔥🪂 SolBlaze.org | Stake with us! >$7.5M 👇 Lets recap

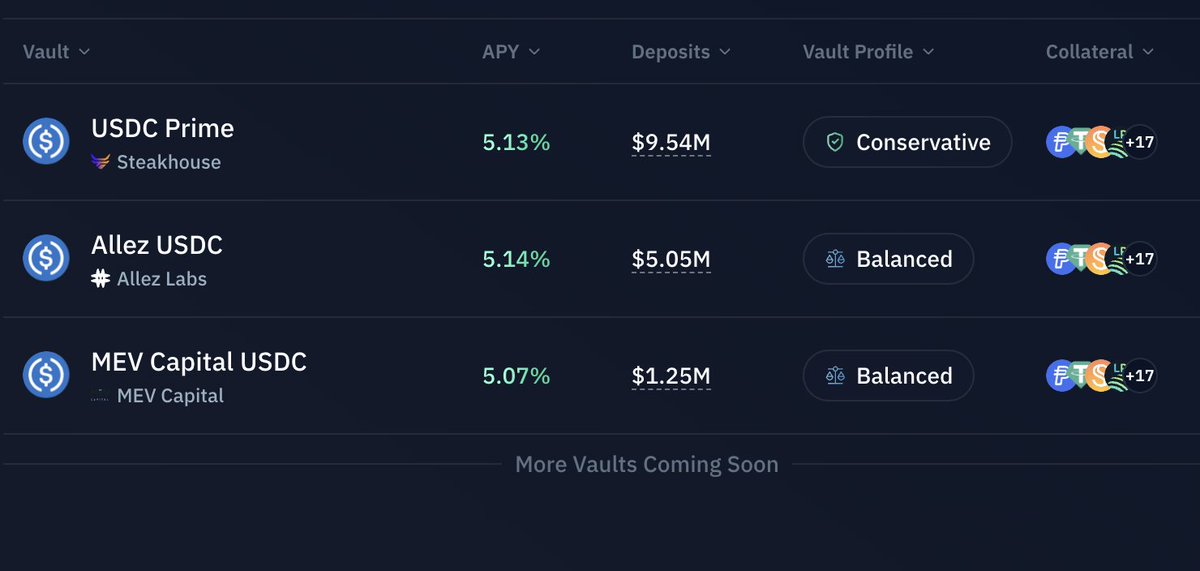

Allez Labs' USDC vault has the same exposure as Steakhouse's and MEV Capital's and is always the top yield, check anytime any day on the Kamino UI our vault is marked "Balanced" for a reason, soon we'll have different exposure than the existing vaults new high yield collateral

Thrilled for Allez Labs to support the launch of Hyperdrive, the first Hyperliquid native lending protocol where you can leverage HYPE, BTC, or ETH.

🚀 We’re thrilled to see Hyperdrive go live, the premier liquidity market on the HyperEVM. This is a significant milestone for DeFi on Hyperliquid, unlocking native yield, leverage, and on-chain credit for the ecosystem