Ishac Diwan

@ishacdiwan

Teaches economics @PSEinfo @ENS_ULM | Director of Research @FinDevLab | Previously @WorldBank @Kennedy_School @ColumbiaSIPA

ID:391062323

https://ishacdiwan.com/ 15-10-2011 00:19:50

528 Tweets

2,9K Followers

1,0K Following

Join us this Friday 3 May to Sunday 5 May - many interesting speakers on burning topics!

Jayati Ghosh C.P. Chandrasekhar Jomo KS Dani Rodrik Matías Vernengo Mark Weisbrot Emma Burgisser

📢 New Paper! 📚 Our latest research delves into #Ecuador 's 2020 #DebtRestructuring episode amid severe liquidity constraints. Don't miss the invaluable💡insights by hamouda & former Finance Ministers 🇪🇨Simón Cueva & 🇲🇽Jose Antonio Gonzalez👇

findevlab.org/lessons-from-t…

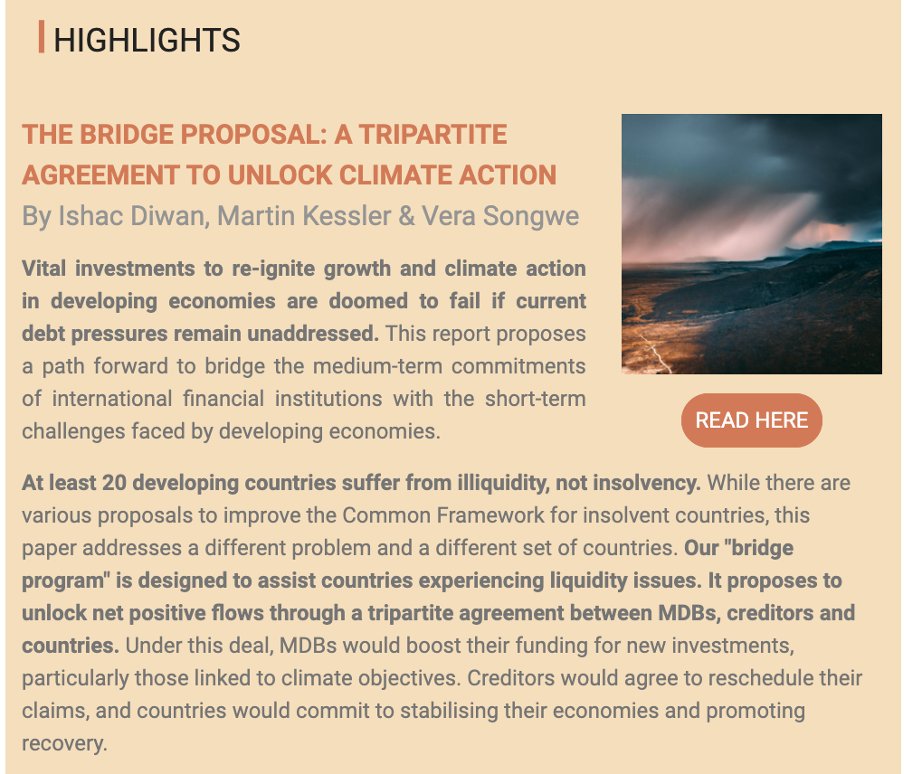

A “liquidity bridge” that enables developing economies to extend the maturity of their debts by 5-10 years and allocate resources toward green initiatives remains as necessary as ever, argue Finance for Development Lab’s Ishac Diwan and Dr. Vera Songwe. bit.ly/3w1zq2r

Important speech by Jay C. Shambaugh on the debt situations of developing countries. The gist is that the IMF should complement markets and act as lender of the last resort for countries facing short term liquidity challenges but demonstrate long term robust green growth prospects.

📢🌐 Don't miss our latest #blogpost on Gulf Bailout Diplomacy, featuring insights from Hasan T. Alhasan حسن الحسن, IISS News, and Camille Leons ECFR. 🧭Discover 6⃣ key features shaping lending practices in the region.

#GulfBailoutDiplomacy #Fin4Dev

Read here 👉 findevlab.org/insights-into-…

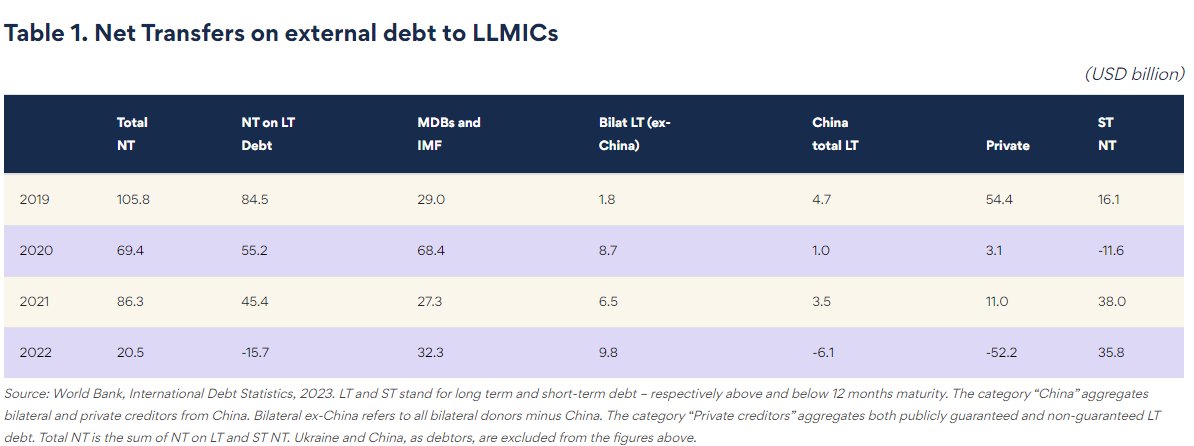

We just published a new blog highlighting a few finding from last year's World Bank International Debt statistics, by Brendan Harnoys-Vannier and Ishac Diwan.

findevlab.org/the-collapse-o…

Liquidity shortages are hampering much-needed investment in climate action by developing economies. Ishac Diwan and Dr. Vera Songwe propose a solution. bit.ly/48d3OnM

In these dark times, a rare moment of genuine pride. Warmest congratulations to Nawaf Salam نواف سلام.

A key point from Stephen Paduano

A SDR denominated, cash settled bond actually fills a very concrete, real funding need for IDA.

The G-7 and G-20 should have this on their agenda this year.

📻 Tout savoir sur les réformes en cours de la Banque mondiale et de la gouvernance financière internationale en un #podcast c'est ici avec l'interview exclusive de Ishac Diwan directeur de recherche au Finance for Development Lab Paris School of Economics École normale supérieure | PSL #Takeoff

🔗smartlink.ausha.co/take-off/s3e4-…

Liquidity shortages are hampering much-needed investment in climate action by developing economies. Ishac Diwan and Dr. Vera Songwe propose a solution. bit.ly/3SbnKRR

In this election year, policymakers face high stakes: A hard economic adjustment risks sociopolitical crisis, but without correction, Tunisia faces a future economic meltdown.

Ishac Diwan, Hachemi Alaya, and Hamza Meddeb discuss.

📚carnegie-mec.org/p-91424

📢 Check out our latest #Newsletter , featuring our 🆕 Bridge Program proposal co-authored by Dr. Vera Songwe

Ishac Diwan & Martin Kessler to address the liquidity crisis & unlock climate action in countries that are solvent but in need of some breathing space 👇mailchi.mp/196ba4996491/f…

Indermit Gill Daouda Sembene Mahmoud Mohieldin Laurence Chandy Thabi Leoka Simón Cueva . Importantly, it also builds on an op-ed by Dani Rodrik and Ishac Diwan published in September. project-syndicate.org/commentary/low…

The G20 should be the right forum for such an endeavor.

We look forward to your comments. We received incredibly useful feedback from many hamouda

Kevin P. Gallagher Masood Ahmed Center for Global Development Martín Guzmán Joseph E. Stiglitz Theo Maret Brad Setser David Ndii Marcello M. Estevão Reza Baqir