Frances Donald

@francesdonald

I love charts, markets & my kids.

ID: 49714100

22-06-2009 18:20:39

7,7K Tweet

23,23K Takipçi

1,1K Takip Edilen

There's a sizeable disparity btwn the headline economic data (not to mention the stock market) and how (most) Americans are feeling about their own prospects. Charles V Payne has been on this for a while- it is one of the many reasons why joining his show is such a pleasure & privilege

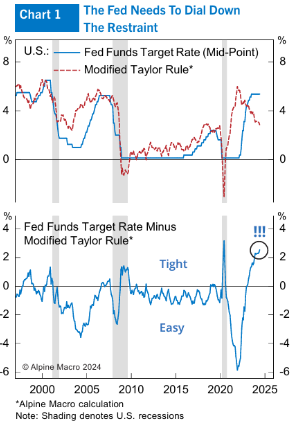

Are you ever watching your kid doing something sketchy across the room and just immediately think "Oh man, this is how accidents happen..." (Great chart/point from Alpine Macro)

I really like how Gregory Daco frames this: "...recalibrate monetary policy to today's reality". We are with Greg that a September rate cut "makes sense" and with Ian Shepherdson that the Fed is behind the curve as they look backwards not forward.

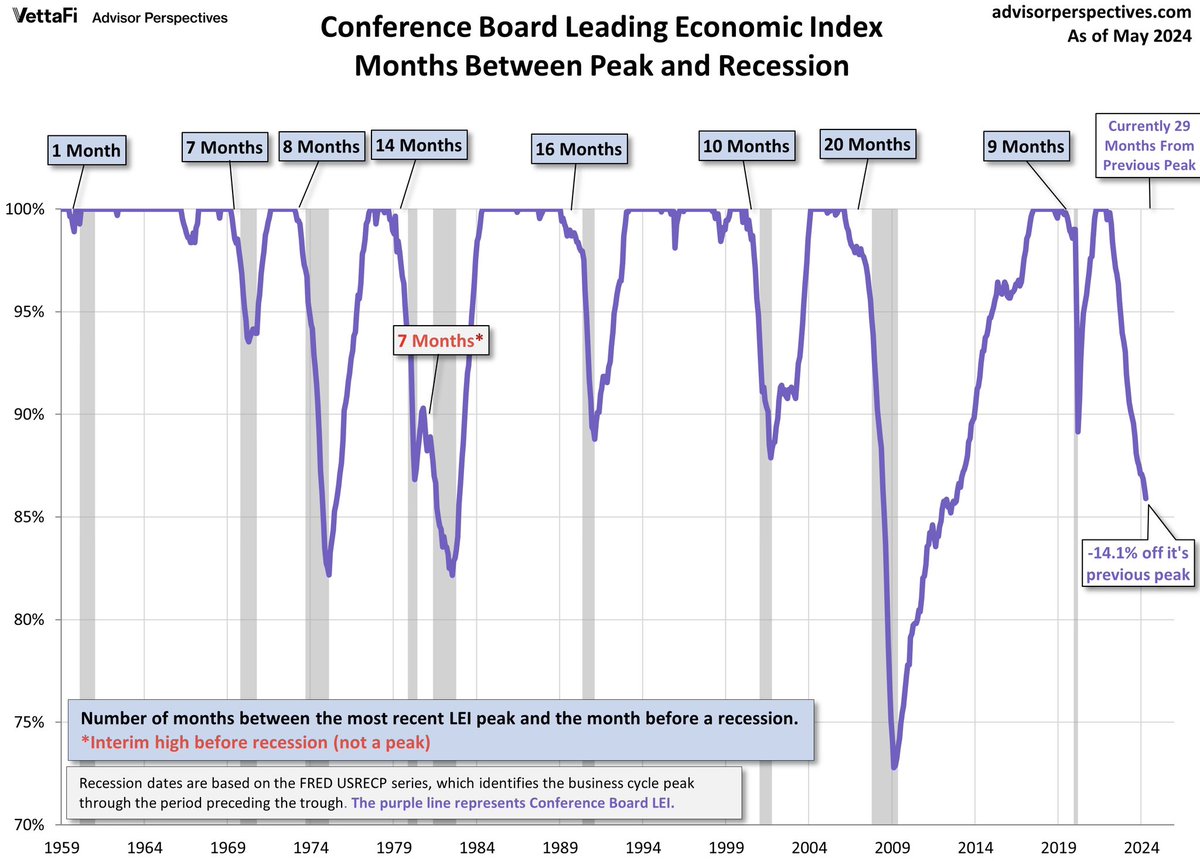

There's opinions and extrapolating... and then there's the data. David Rosenberg knows the data. Real retail sales *fell* 4.4% annualized in Q1. They are so far on track for another (small) decline. This is not a "no landing" consumer.

Oooh it feels good to be back with the BSurveillance team. And anytime I can throw in a "football mom" reference, you know I'm going to do it.