David Rosenberg

@EconguyRosie

Founder and President of Rosenberg Research & Associates Inc.

Retweets, Likes and Follows are not endorsements.

ID:939121727581208576

https://web.rosenbergresearch.com/TWTrialRequest 08-12-2017 13:17:22

3,3K Tweets

260,4K Followers

337 Following

Follow People

I was recently on FOX Business trying to answer the question as to why the Fed doesn't listen to its own Beige Book survey.

Watch below:

foxbusiness.com/video/63512593…

Watch or listen to David Rosenberg on the latest On The Tape Podcast with Dan Nathan and Guy Adami.

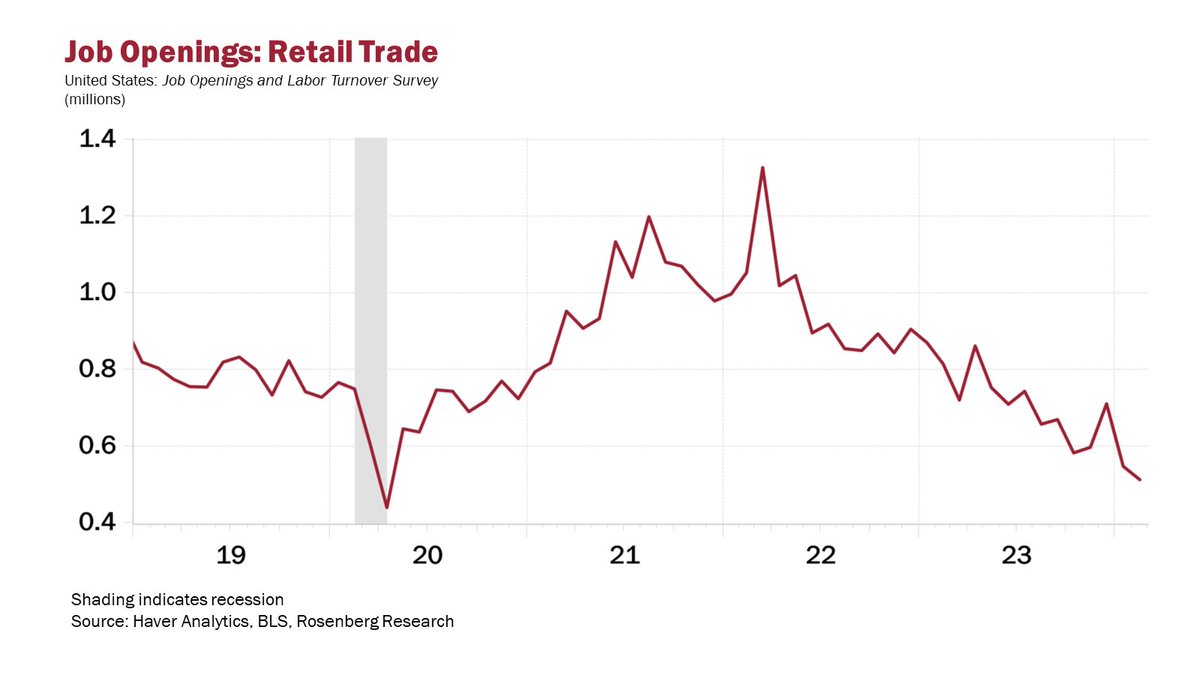

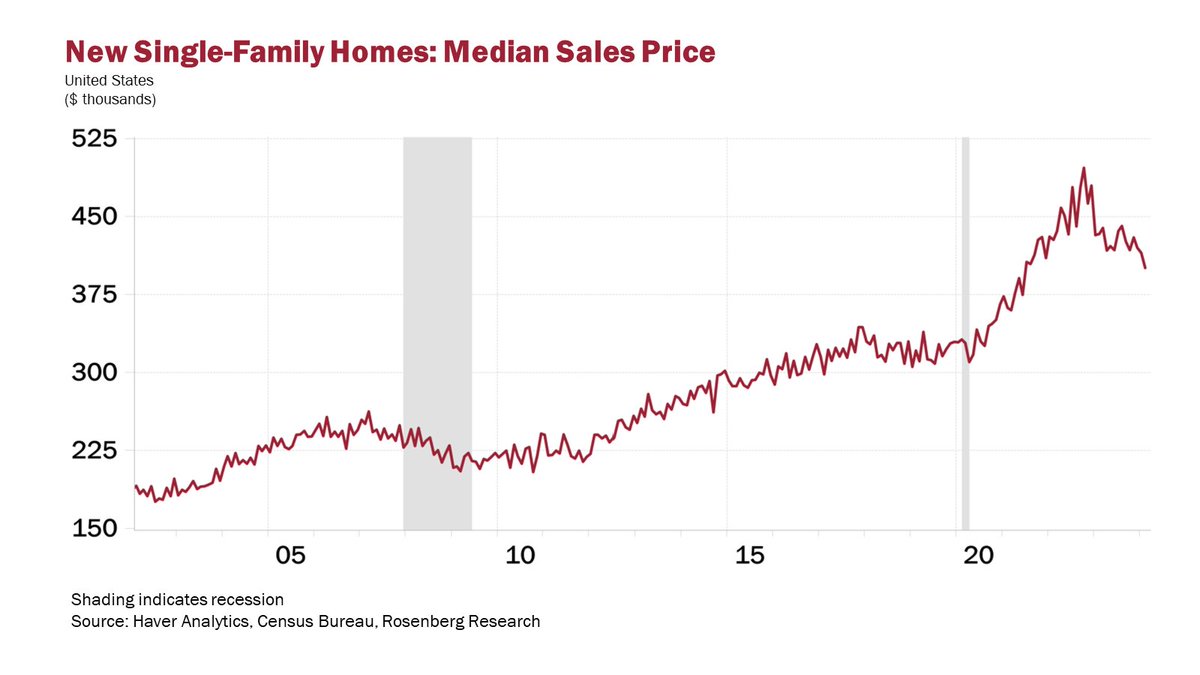

We received so much positive feedback from our client base on our recent chart package, that we decided to make a subset of it available to the public on LinkedIn.

To access the full report, please send us an email at [email protected]

web.rosenbergresearch.com/4axY5KW

On this week’s episode, we provide some color and caution regarding the ticking time bomb in the USA otherwise known as structural deficits and debts.

Tune in to the Rosenberg Round-Up to hear our thoughts and a breakdown of the latest Fed meeting.

podcasters.spotify.com/pod/show/rosen…