Forrest

@forrest_f_

Investing in renewables at an oil & gas company

Writing about energy, climate, and tradeoffs

ID: 1932444746686889984

http://balancingauthority.substack.com 10-06-2025 14:28:33

479 Tweet

281 Followers

44 Following

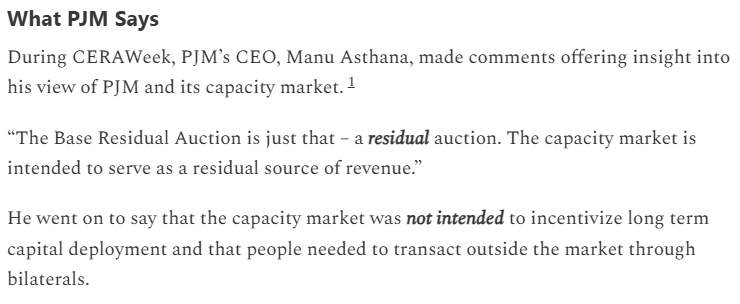

Great commentary from Constellation and great find from Shanu Mathew: Gas plants want long term fixed pricing. But it’s hard to do because of uncertainty around fuel expense. This isn’t zero marginal cost renewables where you can easily sign a 15-20 year PPA.