Scott Hodge

@scottahodge

Tax and Fiscal Policy Fellow at @Arnold_Ventures. 🏎️BMW track enthusiast and ⚾ Nats baseball

ID: 143061591

http://www.arnoldventures.org 12-05-2010 13:44:28

3,3K Tweet

2,2K Followers

182 Following

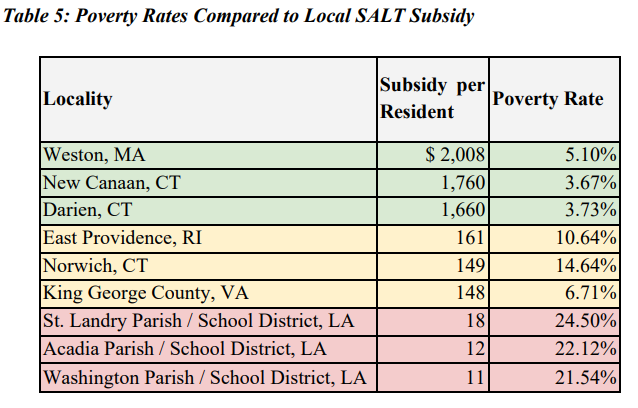

By capping the corporate SALT deduction, lawmakers can fund reforms that boost investment, jobs, and wages — all while keeping fiscal discipline front and center. Read more from AV's Scott Hodge on how this reform would level the playing field: arnoldventures.org/resources/capp…

philanthropy.com/article/meet-t… The Chronicle of Philanthropy’s Ben Gose profiles Arnold Ventures’ Scott Hodge … 1/2

thegivingreview.com/a-conversation… … who spoke w/ The Giving Review’s Michael E. Hartmann last August …. 2/2

Fascinating piece by Jessica Riedl 🧀 🇺🇦.

Excellent piece by Glenn Hubbard on the benefits of a border-adjusted cash-flow tax. It solves many of the problems Republicans are agonizing over. The GOP Tax Bill Could Solve the Tariff Problem by Glenn Hubbard wsj.com/opinion/the-go… via Wall Street Journal Opinion