Solve Nettug

@mypreciousilver

I'm the man of the silver mountain

ID: 1796852996287954944

01-06-2024 10:35:28

2,2K Tweet

1,1K Followers

866 Following

For my Norwegian followers: Sløseriombudsmannen is a guy everyone ahould follow!

Updated weekly charts: #silverinventories Shanghai Futures Exchange (SFE) and Shanghai Gold Exchange (SGE), based on Bai, Xiaojun 's excellent reports. 🚨 SFE fell with another 46 metric tons this week. SGE fell 8 metric tons (Monday’s number). For a longer time range, check

He is confirming what my source in China told me. 🔥🔥🔥 #Silver 🔥🔥🔥 My source told me not to say anything “yet”. Now the cat is out of the bag. It is open season. VBL’s Ghost was one of the first to know.

SGE (Shanghai Gold Exchange) fell another 48 metric tons last week. Also SFE (Shanghai Futures Exchange) continues to fall, bringing the Shanghai vaults to a new historic low. As Bai, Xiaojun also says: "Silver vaults levels before 2015 are meaningless"

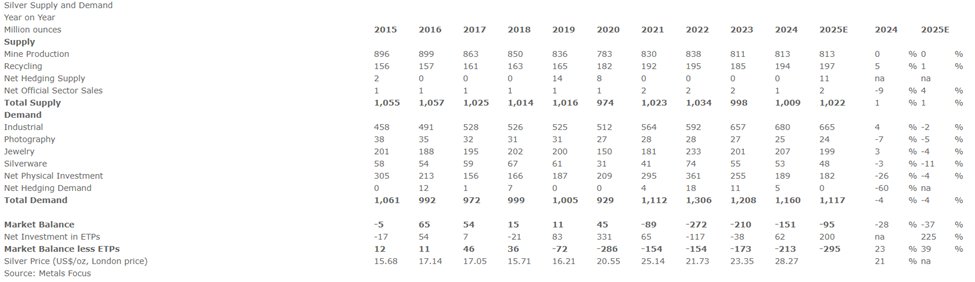

Surprised to see The Silver Institute has blocked me. Last time I wrote with them I thanked them for clarifying "military usage" was included in their "other" category. I have said I disagree with some of their numbers on the demand side, but I never used "strong" words like