Mr Neutral Man aka "Howard Marks of REITs”

@mr_neutral_man

Value investing and leg day are both about your capacity to suffer. BBQ Dad of the Rockaways!

ID: 907746637711384577

12-09-2017 23:23:58

13,13K Tweet

9,9K Followers

1,1K Following

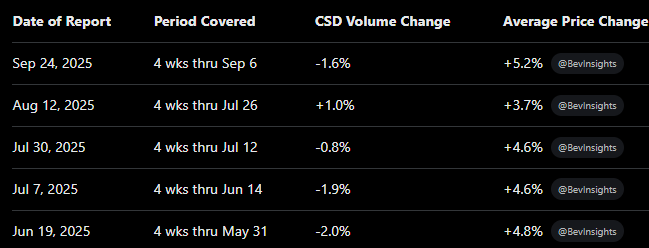

Find it interesting that slim can volume are up quite a lot this year (energy drinks) while normal 12 oz are flat/down according to Beverage Insights Energy seems to be in a price war while CSD is electing to raise prices Kind of makes sense given $BALL has traded around annual