Matthew Miskin, CFA

@matthew_miskin

Co-Chief Investment Strategist @JH_investments. Connecting the dots to formulate views across markets. Disclosure: bit.ly/2USIeSZ

ID: 1196862474

https://bit.ly/3qKjkl8 19-02-2013 12:05:26

3,3K Tweet

4,4K Followers

383 Following

A lot of talk of tariffs in yesterday's #CPI report, but per the BLS-Labor Statistics: "The index for shelter rose 0.2 percent in June and was the primary factor in the all items monthly increase." This OER print is the driver and it is not reflecting reality in the housing/rent markets.

Yesterday everyone: no rate cuts this year! Today: why did you not just cut? BLS-Labor Statistics revisions make this a totally different picture: May was revised down by 125,000, from +144,000 to +19,000, and the change for June was revised down by 133,000, from +147,000 to +14,000.

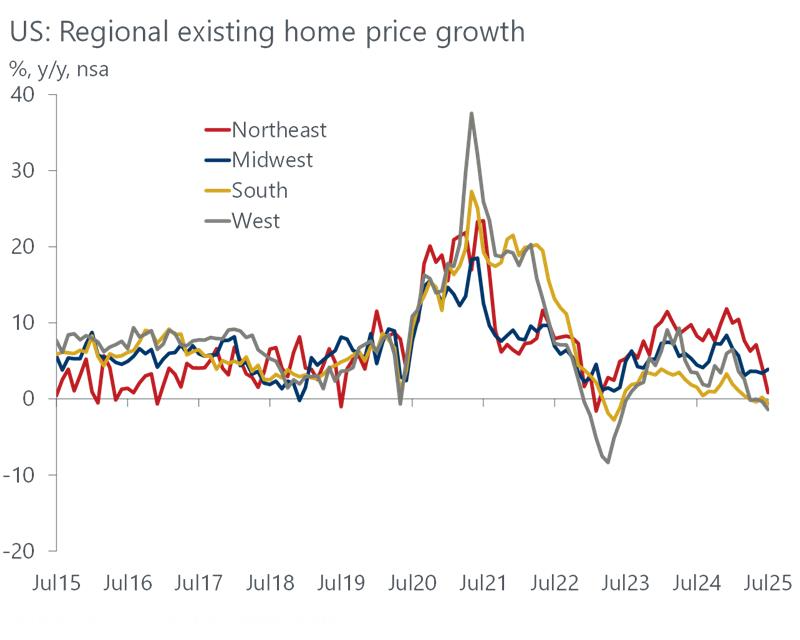

From Oxford Economics and National Association of REALTORS®: "National housing inventory in July up 15.7% y/y. Home price growth continues to be weaker." One would think that this would be disinflationary, but has not showed up in BLS-Labor Statistics CPI data.