Trader Brian Jones

@masterbjones

I have No Discord or Telegram!

Disclaimer: My tweets are 100% ONLY for educational/entertainment purposes. NOT a licenced financial professional. NOT Advice

ID: 1200948582444126208

01-12-2019 01:24:04

86,86K Tweet

58,58K Followers

0 Following

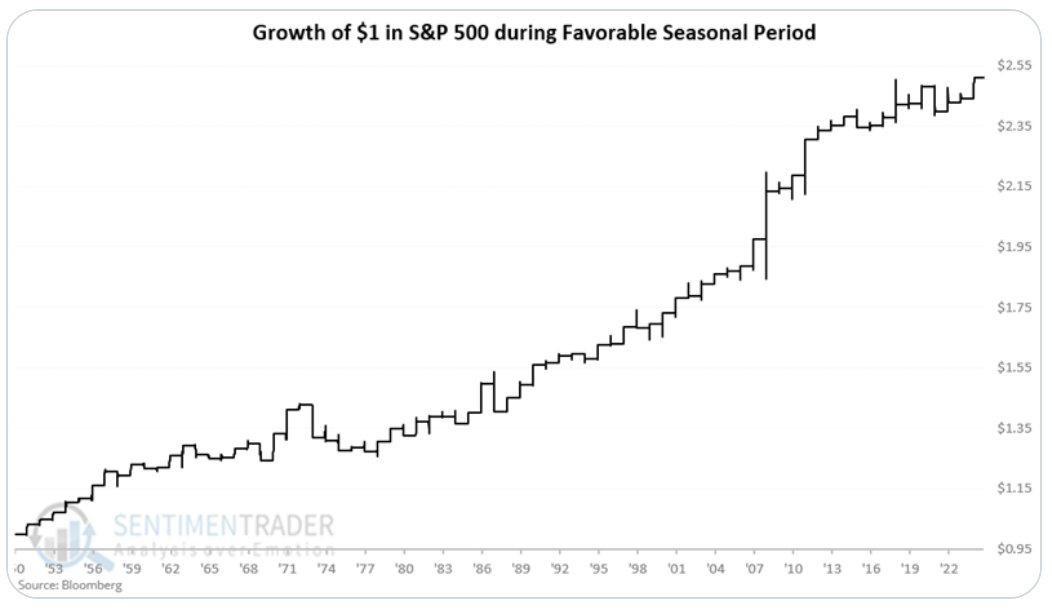

Late Nov. and early Dec. have delivered steady gains for decades. Last 6 trading days of Nov. and the first 3 of Dec. $SPX has risen in 24 of the last 26 years. Moves of 3% or > have skewed strongly to upside. $ES_F $SPY $QQQ $NYA $IWM $NVDA $AAPL $SMH h/t SentimenTrader