Liz Ann Sonders

@lizannsonders

Chief Investment Strategist, Charles Schwab & Co., Inc. Disclosures: aboutschwab.com/social-media

ID: 2961589380

http://schwab.com/ 06-01-2015 23:33:53

35,35K Tweet

454,454K Followers

720 Following

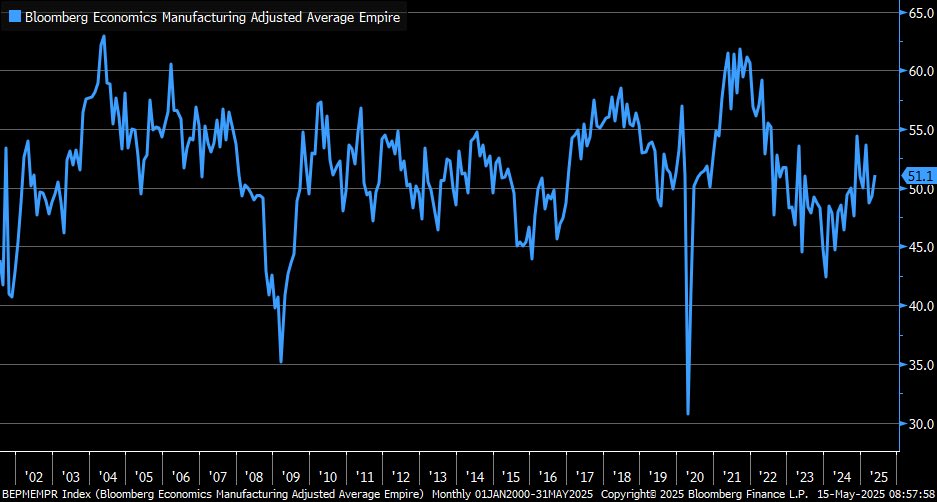

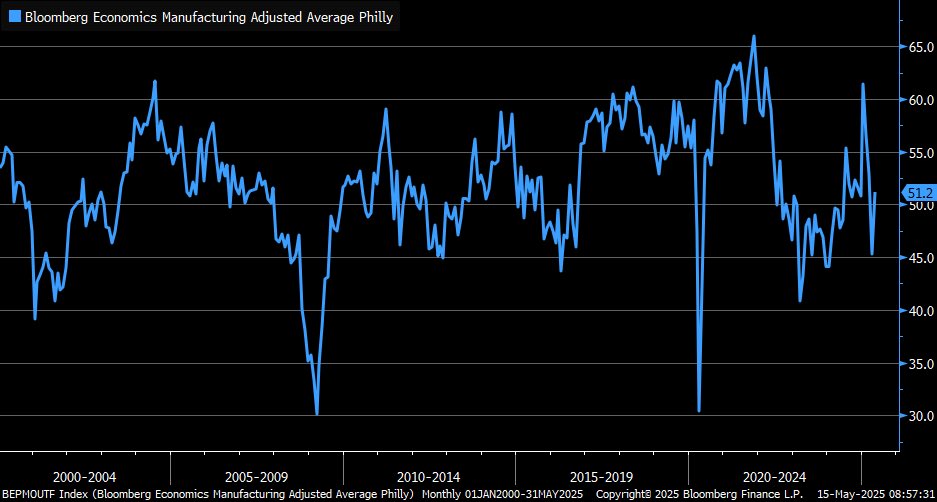

Adjusted for ISM methodology, Philadelphia Fed Manufacturing Index rose to 51.2 in May

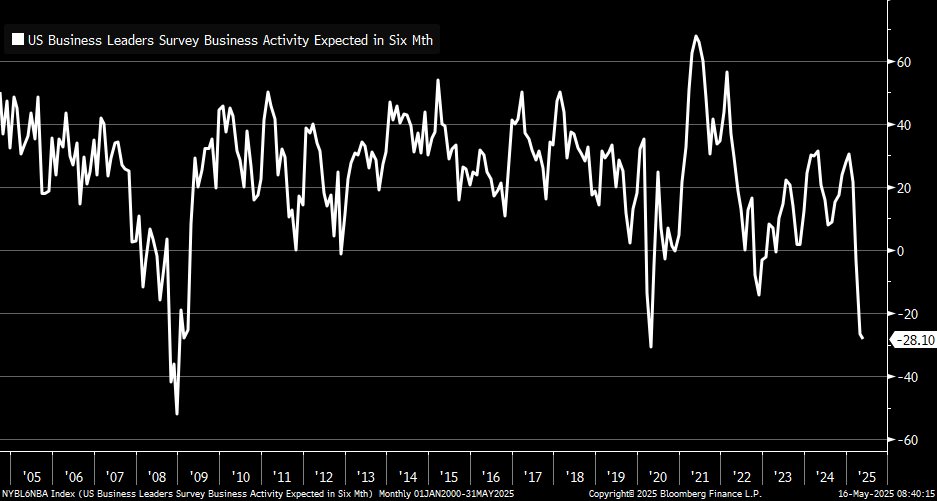

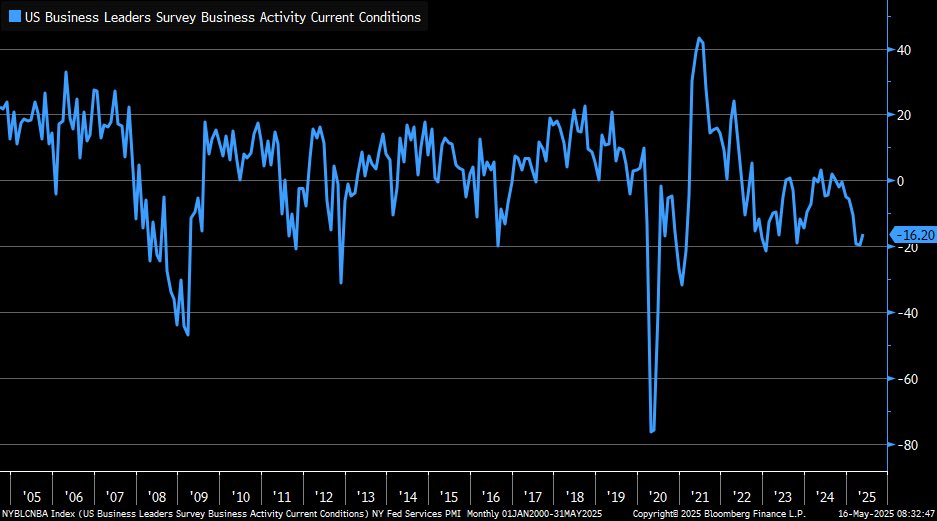

May New York Fed Services Index up to -16.2 vs. -19.8 prior … employment slipped into contraction while wages deteriorated; business climate component improved a bit (but is still in contraction)

Our latest #OnInvesting podcast episode has dropped on which Kathy Jones and I riff on markets, and Kathy sits down with our colleague Cooper Howard to discuss all things munis schwab.com/learn/story/wh…

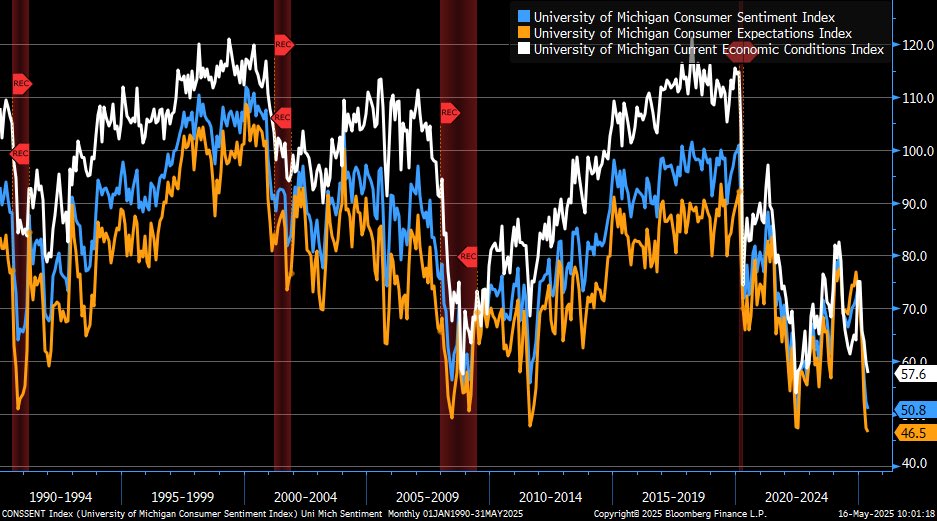

May University of Michigan Consumer Sentiment index down to 50.8 vs. 53.5 est. & 52.2 prior … current conditions down to 57.6; expectations down to 46.5

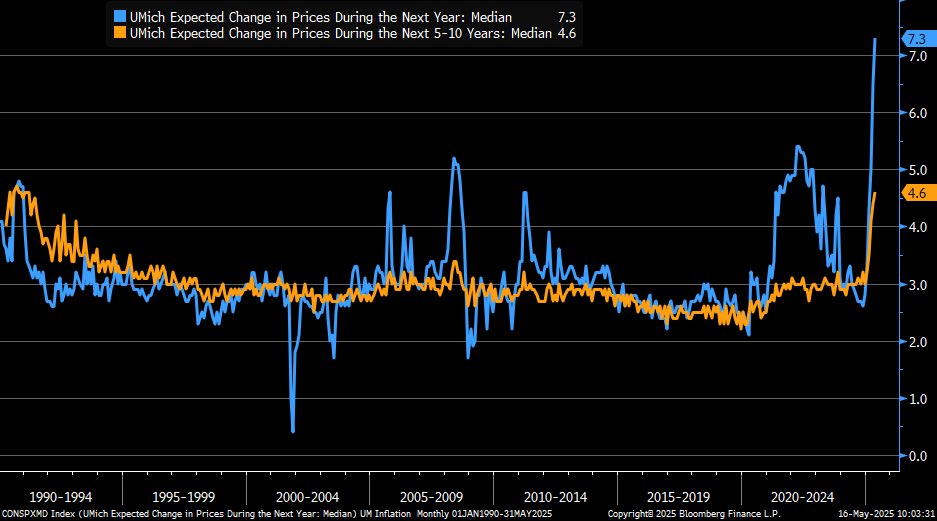

As of May, University of Michigan 1y inflation expectations up to 7.3% vs. 6.5% prior … 5-10y inflation expectations up to 4.6% vs. 4.4% prior

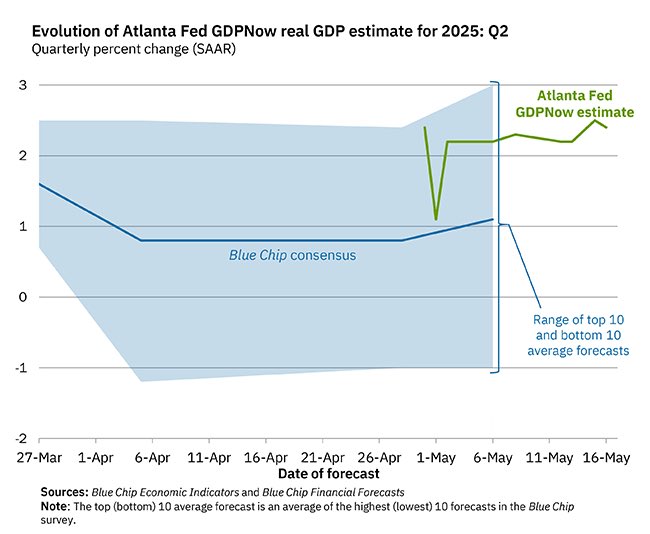

GDPNow model from Atlanta Fed at +2.4% (q/q ann.) for 2Q2025 … strength driven by consumer spending and business investment … net exports and private inventories subtracting most at this point