AZ

@albertz0502

Founder & CEO @compute_labs | ex @the_delysium, @rct_ai, & @xsolla | @UCLA @Caltech

ID: 1536253569351008256

13-06-2022 07:46:15

419 Tweet

9,9K Followers

704 Following

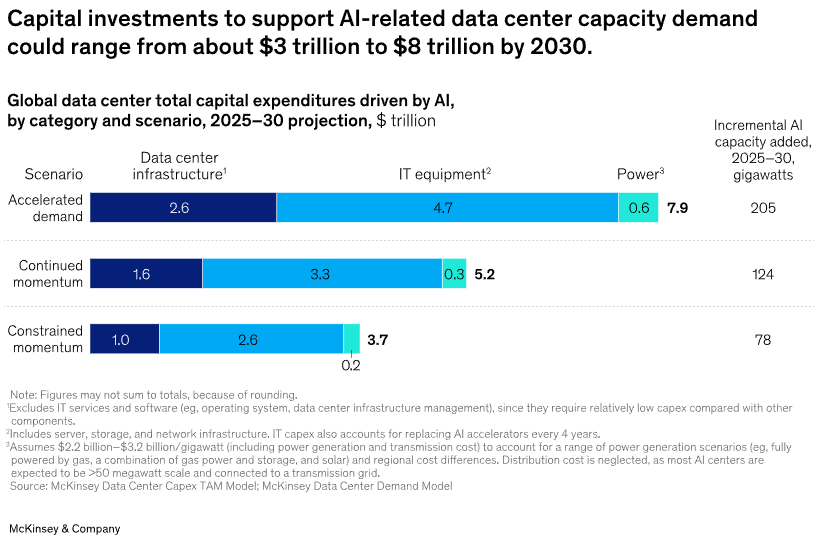

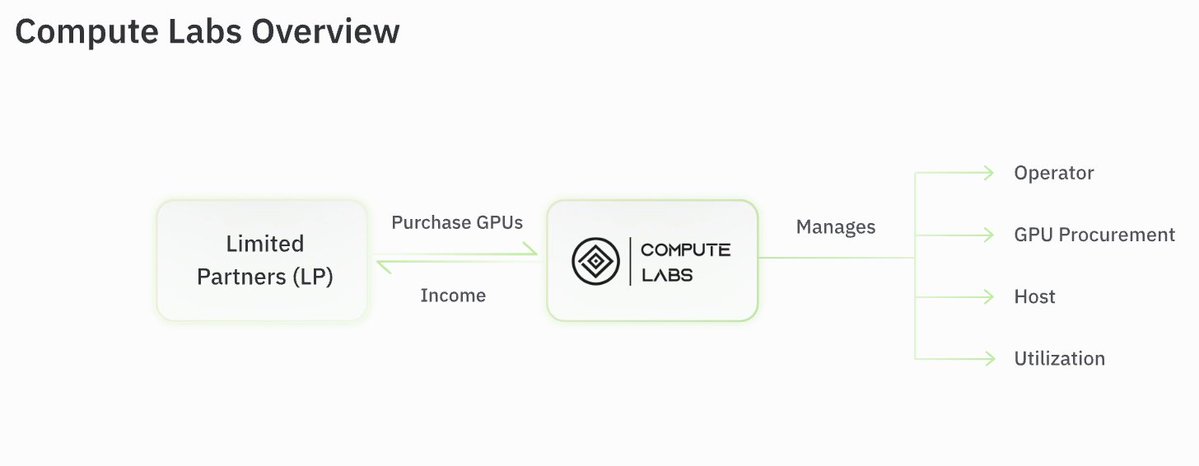

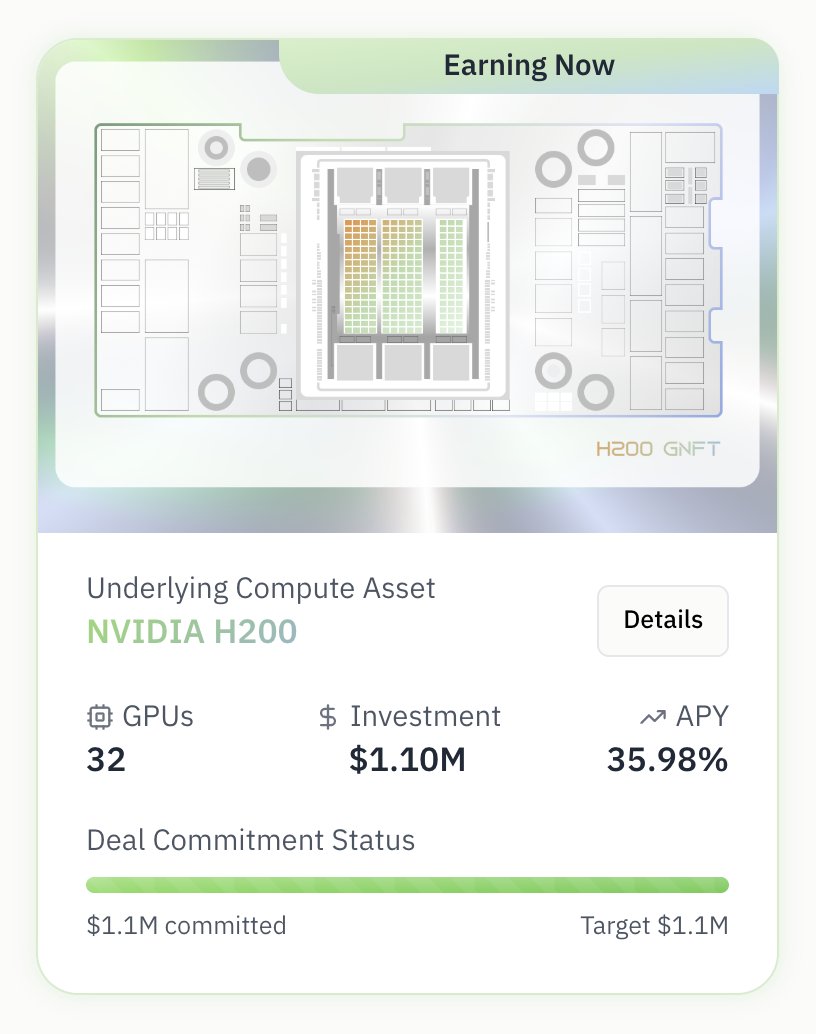

Public institutions are designing AI capacity the way we designed power: multi-year, multi-vendor, and contracted. Argonne’s ~100k Blackwell plan and DOE's AMD “AI factory” model point to a new norm of shared public-private financing for GPU compute. That’s why Compute Labs