LAMEDO

@_lamedoo

only private elite here!! I will mainly talk about crypto market, price action analysis etc. ONLY FOR A FEW PEOPLE MAIN ACCOUNT.@lamedoo

ID: 951666856913334272

12-01-2018 04:07:14

237 Tweet

20 Followers

241 Following

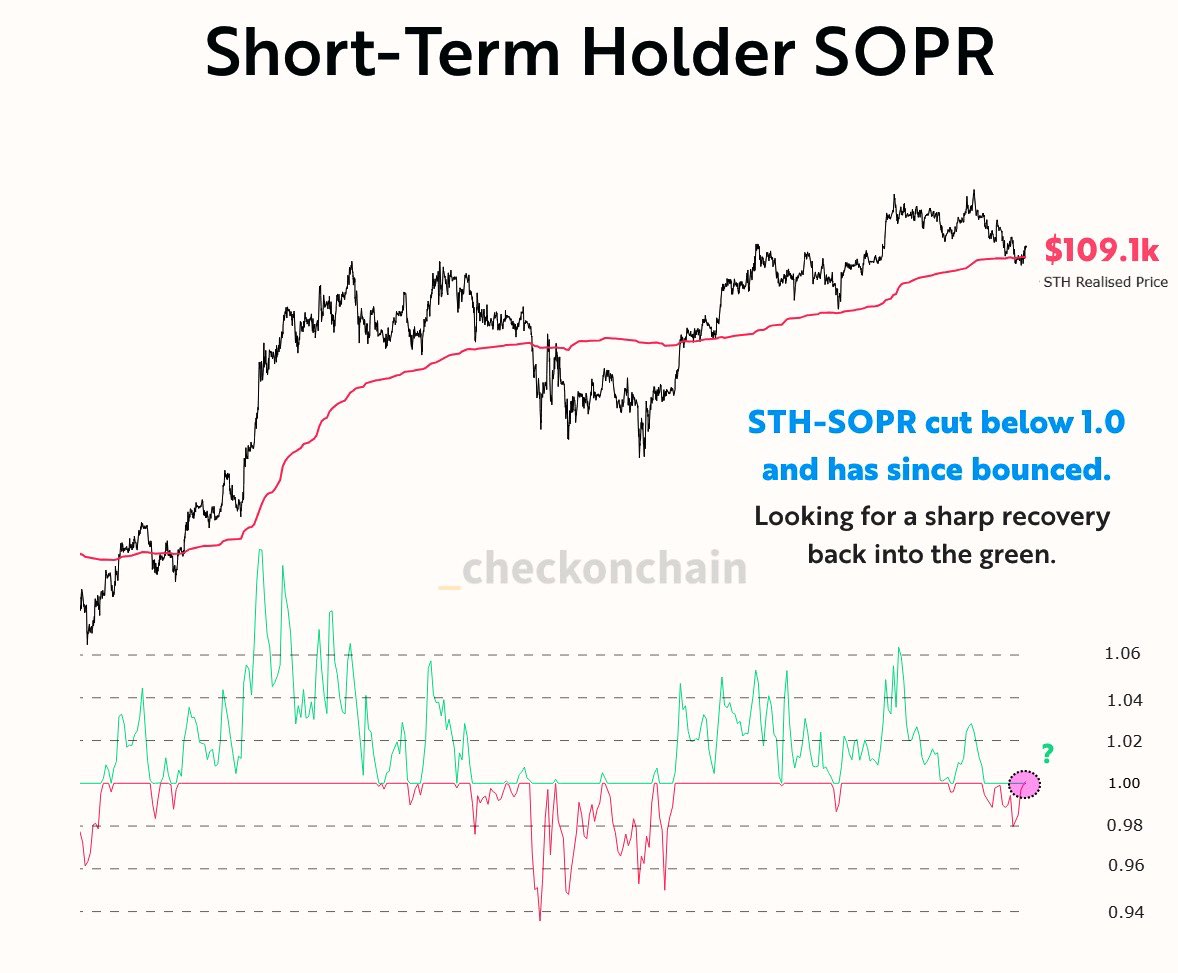

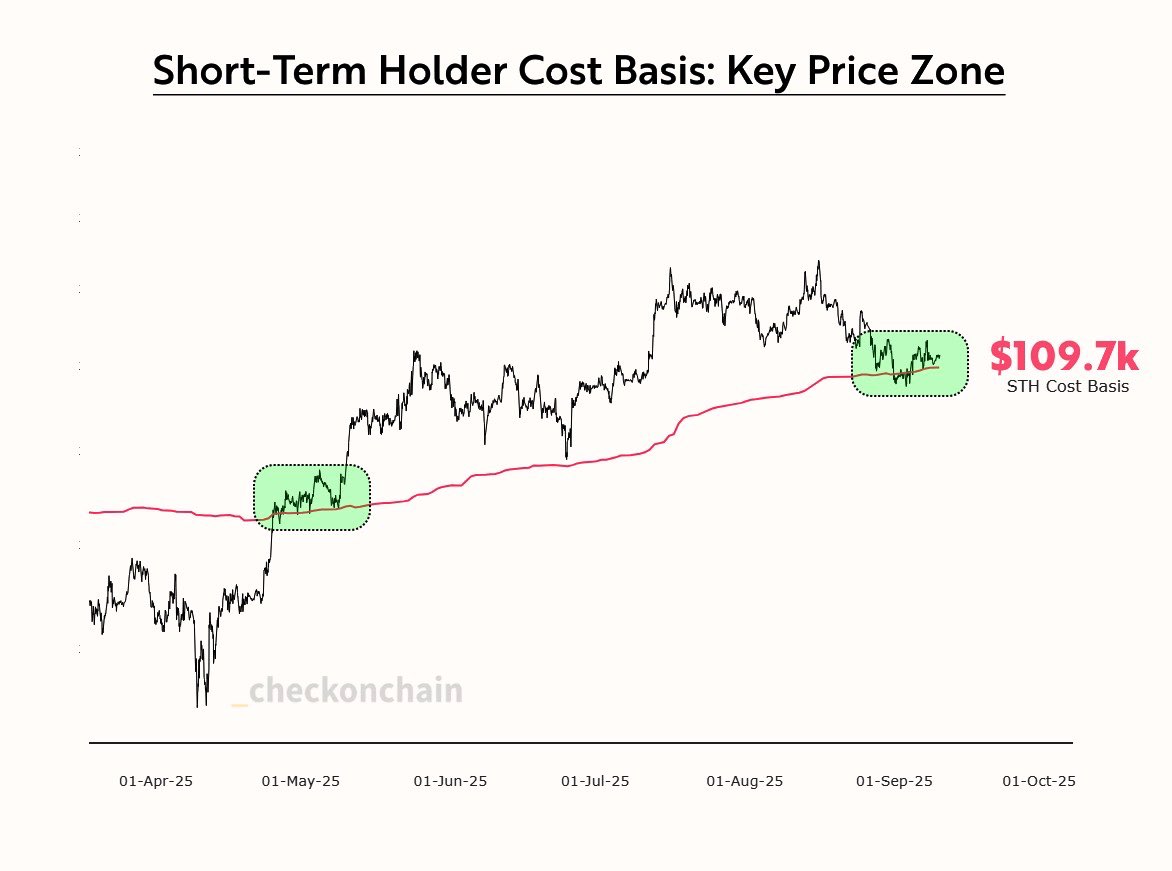

Surprising stat from recent _Checkmate 🟠🔑⚡☢️🛢️ letter: “Over 58% of all invested wealth has a cost basis above $95k.” The majority of market participants are climatized to current $BTC price levels. For most of the market, six-figure bitcoin is the norm.