Samantha LaDuc

@SamanthaLaDuc

Proud Founder + Mother.

Humbled Contributor: Bloomberg, CNBC, YahooFinance...

Curious Cross-Asset Analyst.

Persistent Trader on Chase, Swing + Trend Timeframes.

ID:705540042

https://laductrading.com/pricing 19-07-2012 18:22:19

45,3K Tweets

55,7K Followers

2,2K Following

Follow People

Getting closer...👇 #BounceCall

Also posted for clients yday after lunch:

'DOLLAR & YIELDS FALL - PUSHING UP STOCKS & BONDS

Market may not have realized it yesterday, but the combined efforts between Fed and Treasury actions was a form of easing. Small but with the BOJ/MOF yen…

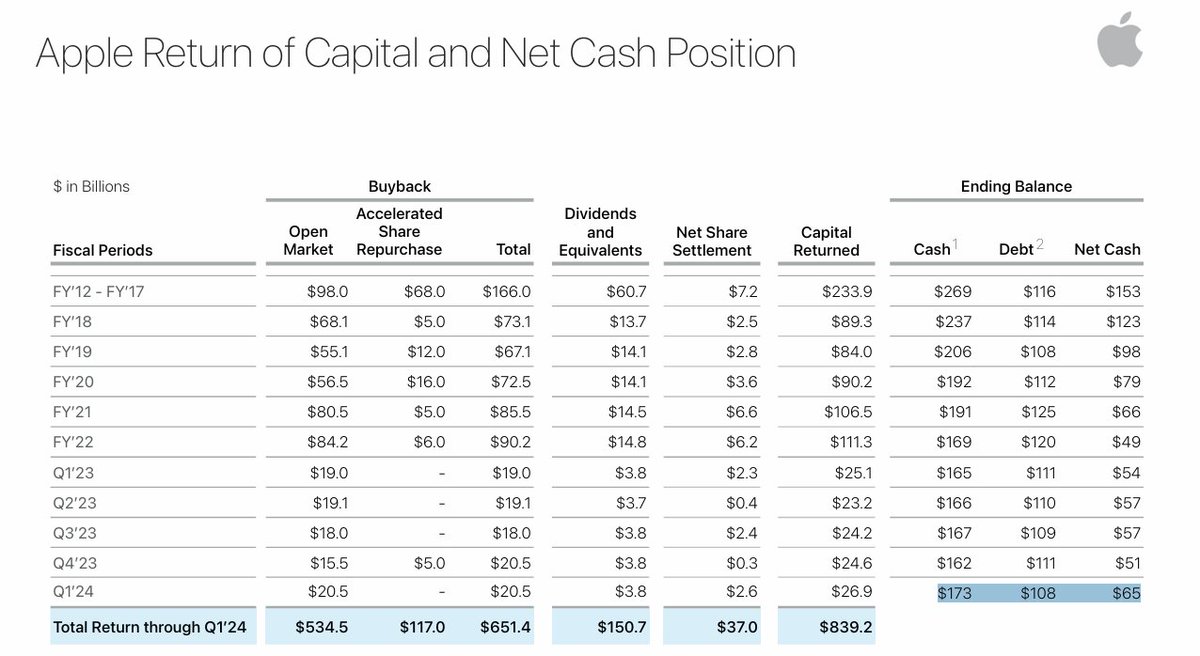

Samantha LaDuc Excellent summary. For tech, innovation is essential to continue improving and growing. To divert so much to buybacks suggests they gave up on innovation breakthroughs

Samantha LaDuc Very good analysis. I kept looking for a place to pounce on you but you didn't leave me any room. Again, very good analysis.

I love the diminishing returns input.

Dig into to our Macro-to-Micro power hour with Craig Shapiro recorded Wednesday Fed day after the market close.

Interpreting all the expectations – met and unmet – and where we go from here.

youtube.com/watch?v=2f3N9B…

Geoffrey Geoffrey Fouvry and I are Stalking A Market Top.

We discussed it Tuesday for our EDGE clients - where he serves as Economics Advisor.

His warning: Banking Contraction Will Kill Earnings

Getting closer...👇 #BounceCall

Also posted for clients yday after lunch:

'DOLLAR & YIELDS FALL - PUSHING UP STOCKS & BONDS

Market may not have realized it yesterday, but the combined efforts between Fed and Treasury actions was a form of easing. Small but with the BOJ/MOF yen…

Dig into to our Macro-to-Micro power hour with Craig Shapiro recorded Wednesday Fed day after the market close.

Interpreting all the expectations – met and unmet – and where we go from here.

youtube.com/watch?v=2f3N9B…