Elizabeth

@elizaruns

Runner. China watcher.

ID: 1313109566876536832

05-10-2020 13:31:42

47 Tweet

2 Followers

86 Following

An analysis that follows the rise and fall of import substitution as a development idea finds that early proponents of import substitution were surprisingly cautious advocates of the policy, from Douglas Irwin nber.org/papers/w27919

The story of how China has been able to avoid crisis. Told by Senior Fellow at @CarnegieBeijing, Michael Pettis & 🇺🇸 Kyle Bass 🇹🇼. "Crisis is a balance sheet problem - but when you can restructure liabilities at will, crisis becomes very unlikely." 👉 rvtv.io/344F2IH

China's path out of Covid-19 (Part 1) creditmarketquibs.wordpress.com/2020/10/19/chi… via WordPress.com

In the new episode of Global Law and Business Podcast, I discuss my reading recommendation of the week, "China’s recovery is not what it seems” by Michael Pettis. Stream the episode today. bit.ly/33Y8D6s

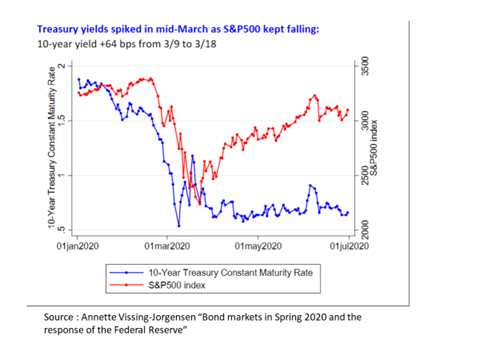

Excellent thread from Constancio .. (on the Treasury market stress back in March) lots of papers I now need to read as well h/t Iñaki Aldasoro

One of basic constraints on Chinese household consumption is that there is no substantial mechanism for distributing income to lower income or precarious households. Brad Setser Michael Pettis have both emphasize this point. From Oct 2020 Paulson Institute MacroPolo report.

China is facing its most serious Covid outbreak since the start of the pandemic in early 2020, writes Katie Stallard. newstatesman.com/world/asia/chi…