Sebastian Schich

@sebschich

Research fellow at the São Paulo School of Business Administration and economic consultant at international public institutions.

ID: 2411187800

https://sebastianschich.mojostudio.com.br/ 25-03-2014 15:33:07

318 Tweet

140 Followers

115 Following

Perspectives on Central Bank Digital Currencies Featuring: Tom Emmer, Natalie Smolenski, Lawrence H. White Link: youtube.com/live/-Dw0K66tK…

Photo by Max Stirner shows preparations for setting up one wind turbine, which aims at achieving climate goals.

Helpful rigorous analysis of the impact of a traditional public policy instrument, that is intermediated lending. Also remarkable as the latter tends to receive less attention than the widely public guarantees for financial claims. Emily Sinnott, Wouter vanderWielen 🇪🇺🏳️🌈, Matteo Gatti European Investment Bank

Judged by Google job search trends people are already exploring new possibilities that #ArtificialInteligence might offer: sebastianschich.mojostudio.com.br/2023/07/19/art… Michael Kammes CBS Sunday Morning 🌞

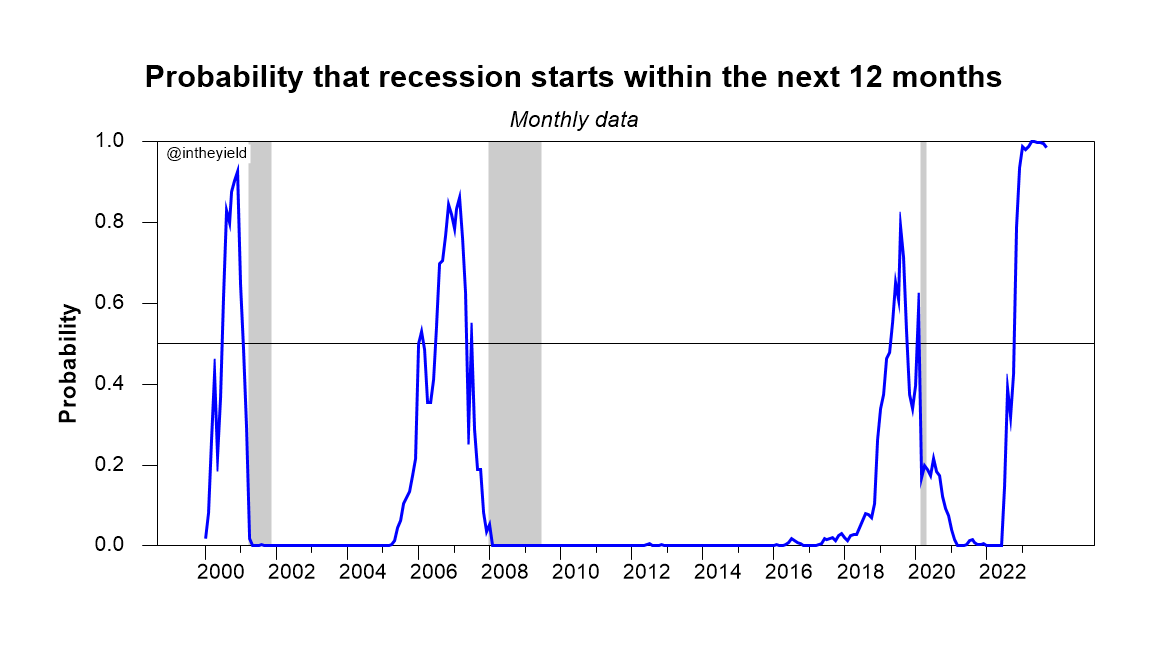

Always good to have some respect for the broad linkages that is evident in historical data, even when specific timing of links might evolve. Other suggest one should not feel lucky too soon: mises.org/library/soft-l… Arturo Estrella Mises Institute

Indeed, a very interesting chart exploiting a rich OECD dataset. Curious to see how measures of housing prices would fit in here? I guess one needs to control for population, which presumably partly drives the bubble sizes. Matthew C. Klein John Burn-Murdoch

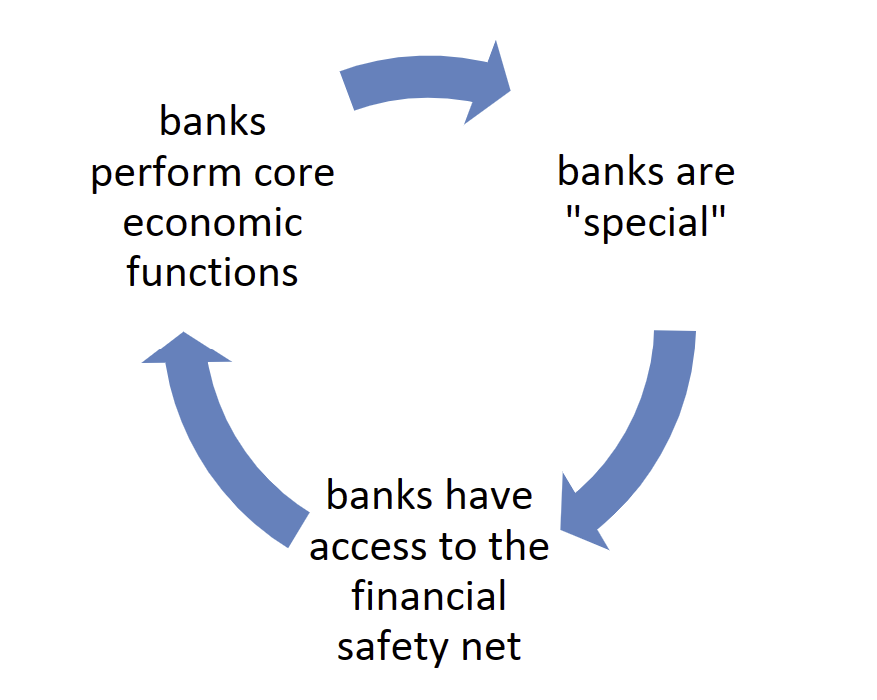

Extraordinary bank tax in Italy: As discussed at bit.ly/3PhFwl8, short-term fiscal pressures eclipse idea of levying an economic "user fee" for the extraordinary privilege granted to banks. Flavia Rotondi Zoe Schneeweiss Stefanie Schulte #GenoVerband PCCE NYU School of Law

#Decentralization meets #AI: A game-changer for local governance or a hurdle to legitimacy? Can tech surpass local knowledge? Recent Antti Moisio #COGITO blog explores: oecdcogito.blog/2023/07/06/wil…

First paper in the new OECD Artificial Intelligence 🧠 Papers series, providing governments with ⚙️ applications, policy options and risks for generative AI #ChatGPT Philippe Lorenz karine perset @jamie_berryhill oe.cd/il/GenAI

George Gammon Total nonsense. By this logic they should be subsidising imports from countries with whom they have a trade surplus?