Pankaj Baid

@pankajbaid17

Consultant | Investor | Analytics | Humour | IBanker | Ex-McKinsey | Ex- CS| Ex-CRISIL | Gold Medalist | Trustee | Traveler | Father | Optimist | Views are mine

ID: 28907471

https://www.linkedin.com/in/pankajbaid/ 05-04-2009 00:54:31

7,7K Tweet

11,11K Followers

488 Following

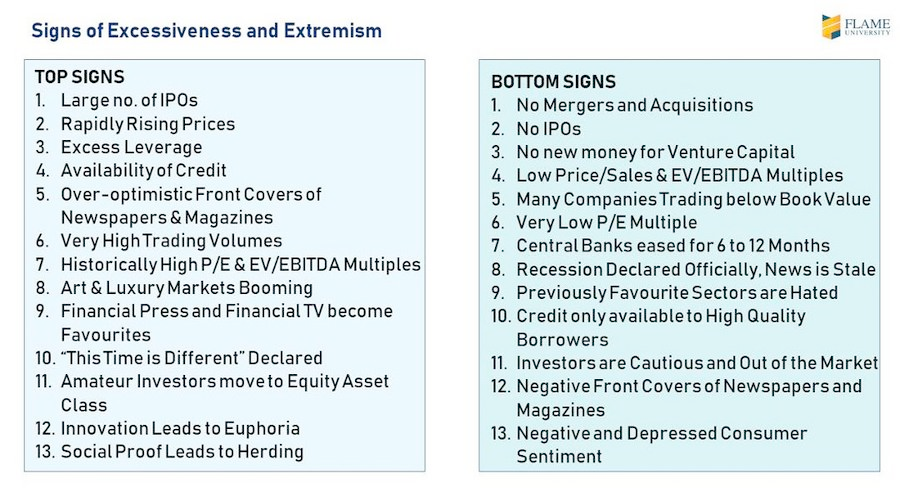

Thanks TN Investors' Assn, Shyam Sekhar, & Govindbhai for the opportunity to address the august crowd at TIA Bulletproof Investing Seminar. Shyam Sekhar gave me the dreaded task of speaking on the Art of Selling at a time when indices, gold, property, etc. are at all-time highs!