Cristina Enache

@crisberechet

Economist @taxfoundation. Secretary-General World Taxpayers Associations and @UContrib #competitividadfiscal #LiberacionFiscal #impuestos

ID: 150426122

https://www.linkedin.com/in/cristinaberechet/ 31-05-2010 22:33:16

951 Tweet

1,1K Followers

735 Following

Heartfelt congratulations to the U.S. Tax Foundation for the awesome work you are doing to debunk President Trump's insane tariff offensive. Prouder than ever to partner with you. Keep up the great work. cc: Daniel Bunn Erica York Cristina Enache

Today Tax Foundation published Cristina Enache's update to our annual report on cost recovery. Averages are above pre-COVID levels, but just barely. (Note the truncated Y axis.)

Since digital services taxes deliver limited revenue, shift the burden to European consumers, and risk provoking trade disputes, it’s time for policymakers to rethink their approach. New testimony from Cristina Enache: hubs.ly/Q03NXBJJ0

New analysis from Cristina Enache on the French proposal to double their digital services tax: taxfoundation.org/blog/france-di…

France is proposing to double the tax rate of its digital services tax (DST) to 6 percent, making the DST even more discriminatory. New from Cristina Enache: hubs.ly/Q03R8pMP0 #france #dst

Another Tax Prom in the books. It's a privilege to host the DC tax community, and I always have a good time hanging out with the Tax Foundation team. Congratulations to Senator Mike Crapo and Dennis Groth on receiving our 2025 Distinguished Service Awards! #Spreadsheets #TaxProm

Our quick look at the UK Autumn Budget, with Cristina Enache 🍂taxfoundation.org/blog/uk-budget…

.Shuting Pomerleau is organising a National Tax Assoc. webinar on carbon taxation next Monday, 8 Dec at 1pm ET. I'll contribute my bit to the panel with Dale Beugin and Edson Severnini.

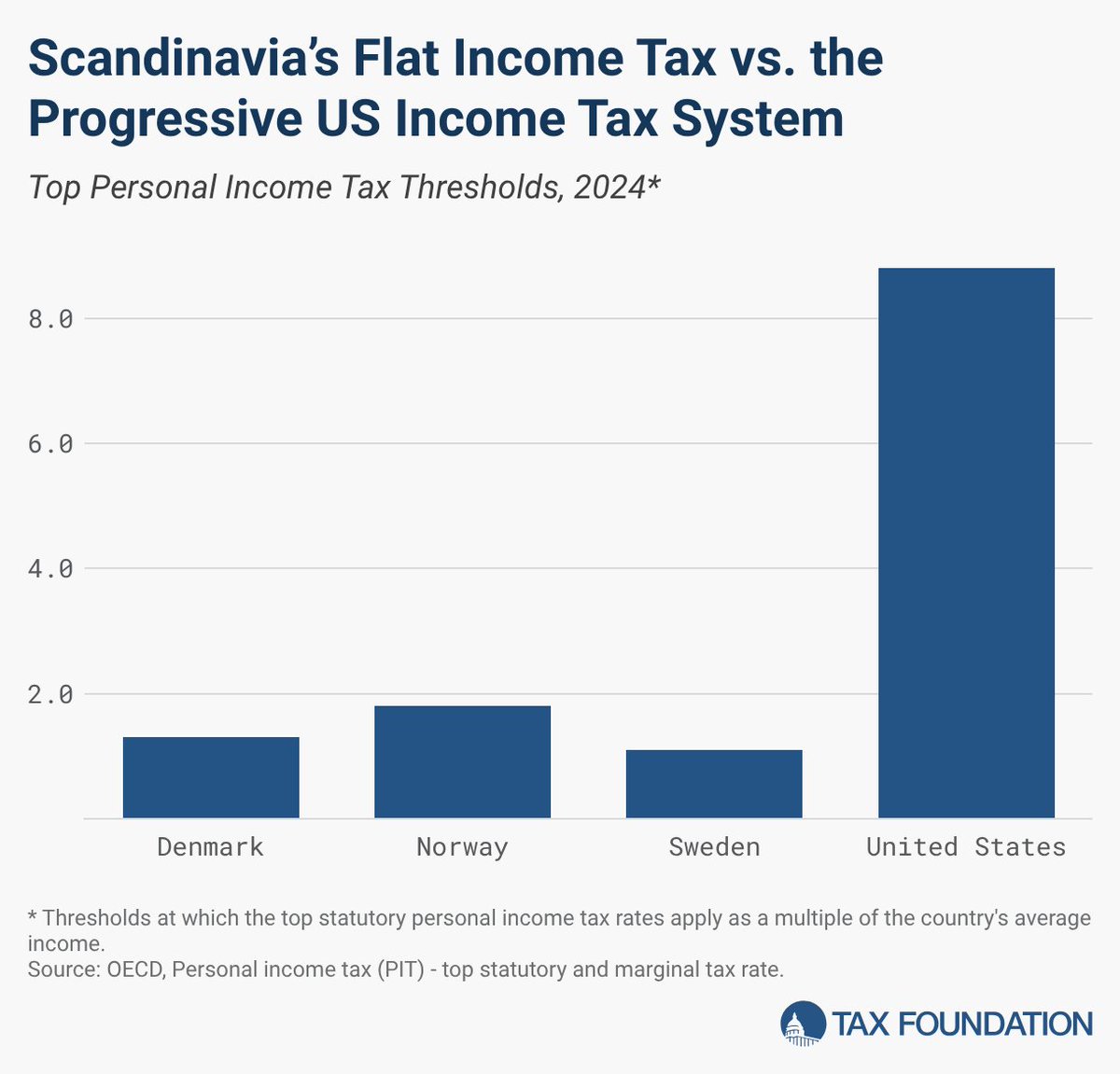

"How Scandinavian Countries Pay for Their Government Spending" - Cristina Enache Daniel Bunn Tax Foundation taxfoundation.org/blog/how-scand… "Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers."