ConvexityMaven

@convexitymaven

Creator of $MOVE Index; $RFIX; $PFIX; $MTBA

Managing Partner @ Simplify.us

Publisher of Maven Commentary

convexitymaven.com/biography/

ID: 1184220208686256128

http://www.convexitymaven.com 15-10-2019 21:31:41

207 Tweet

33,33K Takipçi

2 Takip Edilen

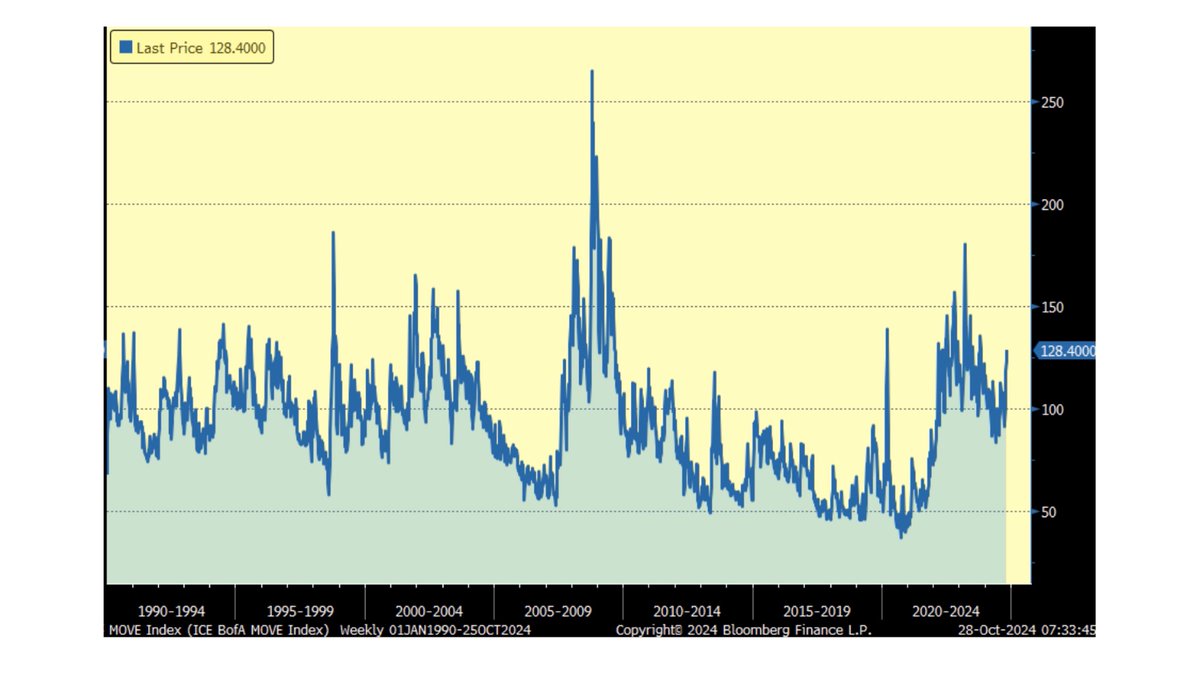

Election "break even" analysis... UST 10yr rate: 17bps; 1.33 points $MOVE now @ 136 SPX: 1.8% or 102 points $VIX now @ 20.3 Gold: 1.6% or $44 Let's hope it's a clear victory....either way Michael Green Jim Bianco Luke Gromen David Rosenberg Cem Karsan 🥐 Andy Constan

Options market forecasting - UPDATE: Bond: Implied = + /- 17bp; Actual = -16.8bp SPX: Implied = + /- 102pts; Actual = 120 pts Gold: Implied = + /- $44; Actual = -$81 MOVE prior = 130; now 117 VIX prior = 20.49; now 15.87 Good luck today. hb Michael Green

Trade like the Professionals The pro's (Michael Green) do not buy zero-coupon bonds when they want "hard" Duration, they buy the product contained in the Bond Bull It is unclear why the 25+ Zero ETF has $1.63bn AUM when the Bond Bull will crush it with 1.6x the Duration and 3.5x