brmoneyseeker

@brmoneyseeker

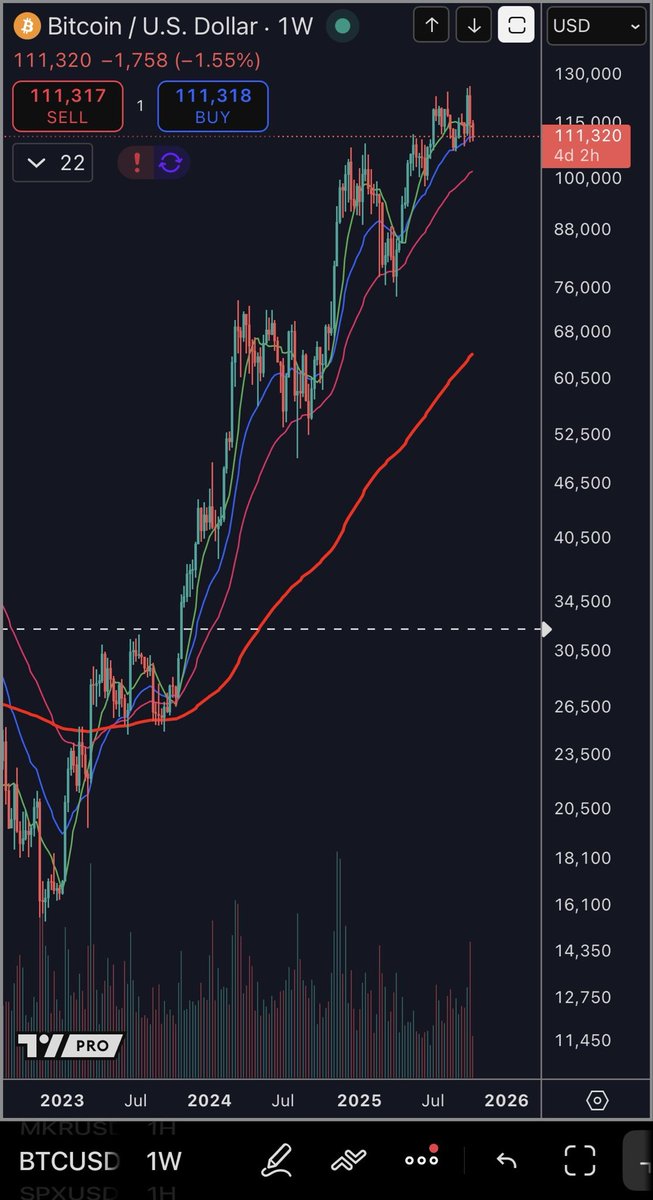

#bitcoin

ID: 1095633788036616194

13-02-2019 10:40:25

1,1K Tweet

77 Takipçi

216 Takip Edilen

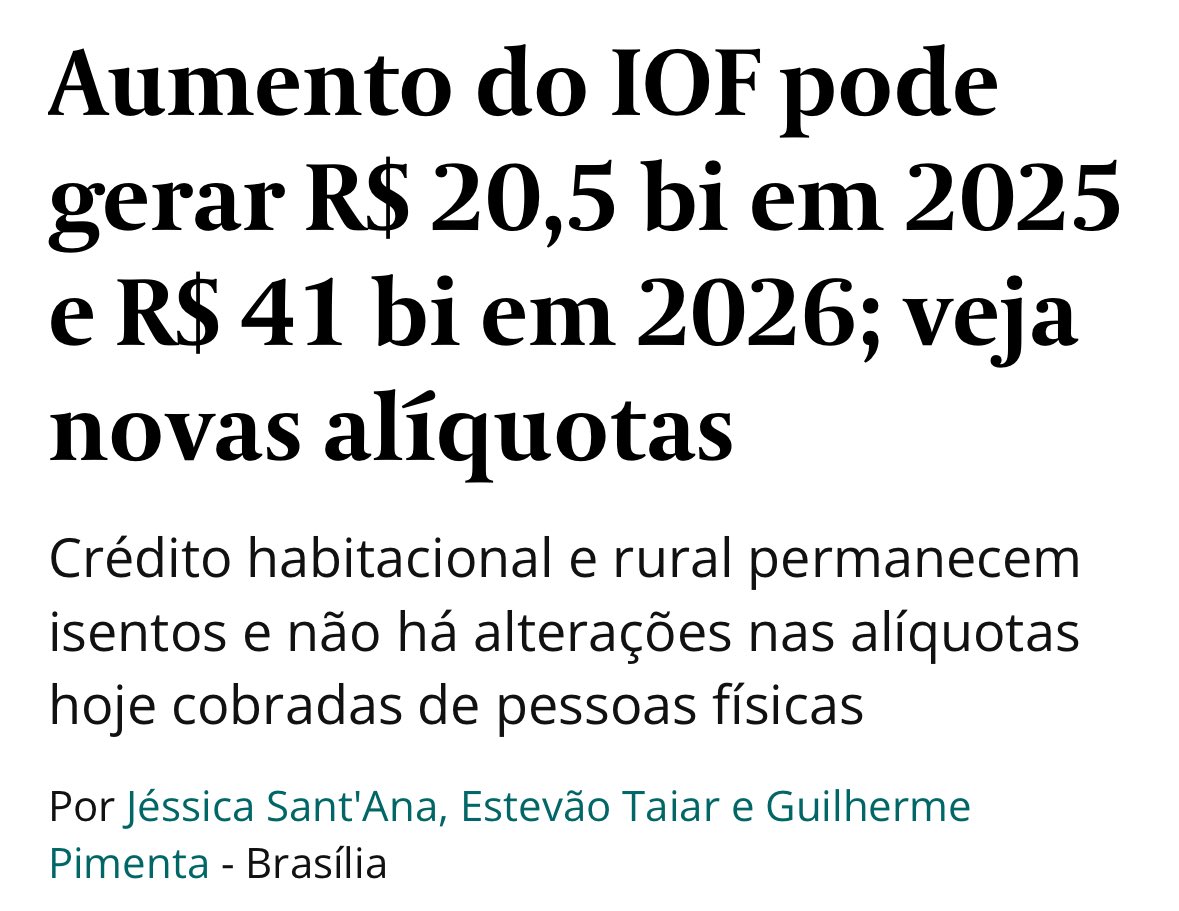

Galera do Ministério da Fazenda porra em 14 horas, eu tenho certeza que vocês conseguem explicar como 0,38 virou 1,1% e permanece "igual". Rola corrigir esse comunicado aí ou explicar o certo meus lindos? Sério deixa de caos.