Topdown Charts

@topdowncharts

Topdown Charts is a chart-driven macro research house covering global asset allocation and economics. We primarily serve multi-asset investors and institutions.

ID:771467940168282113

https://www.topdowncharts.com/ 01-09-2016 22:01:05

14,8K تغريدات

51,8K متابعون

93 التالية

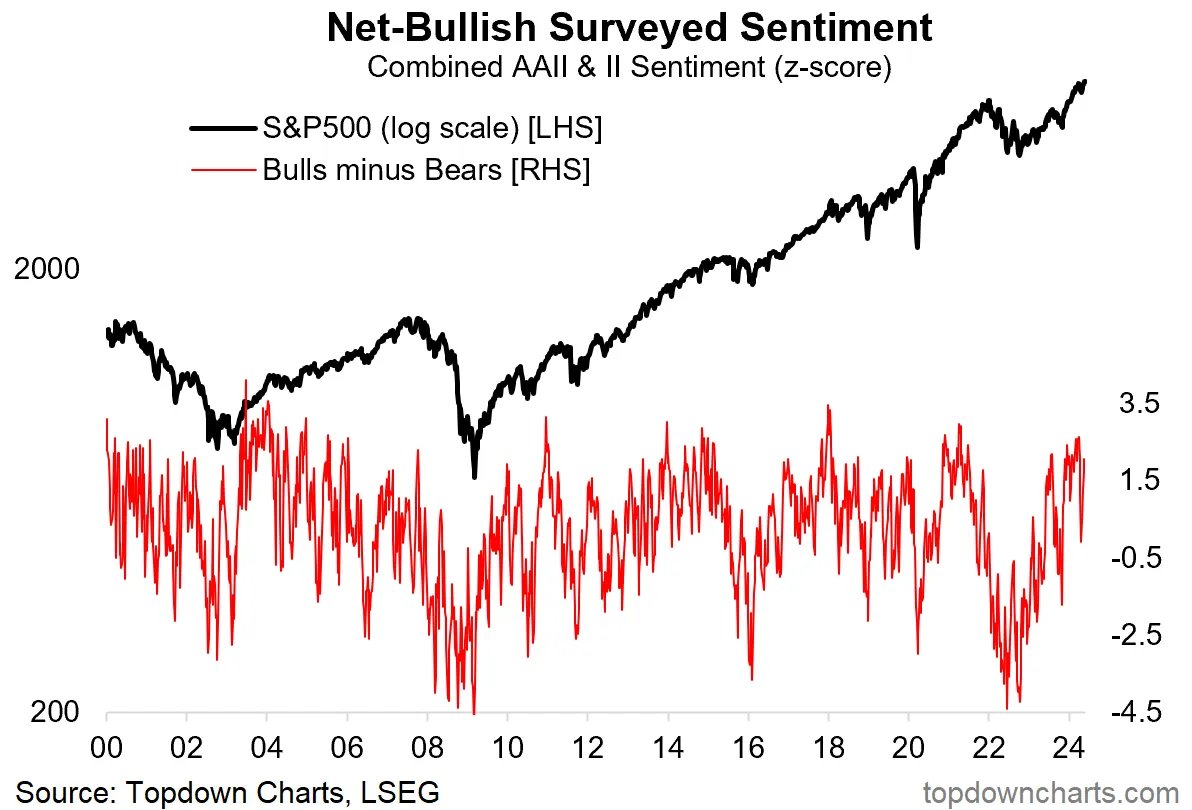

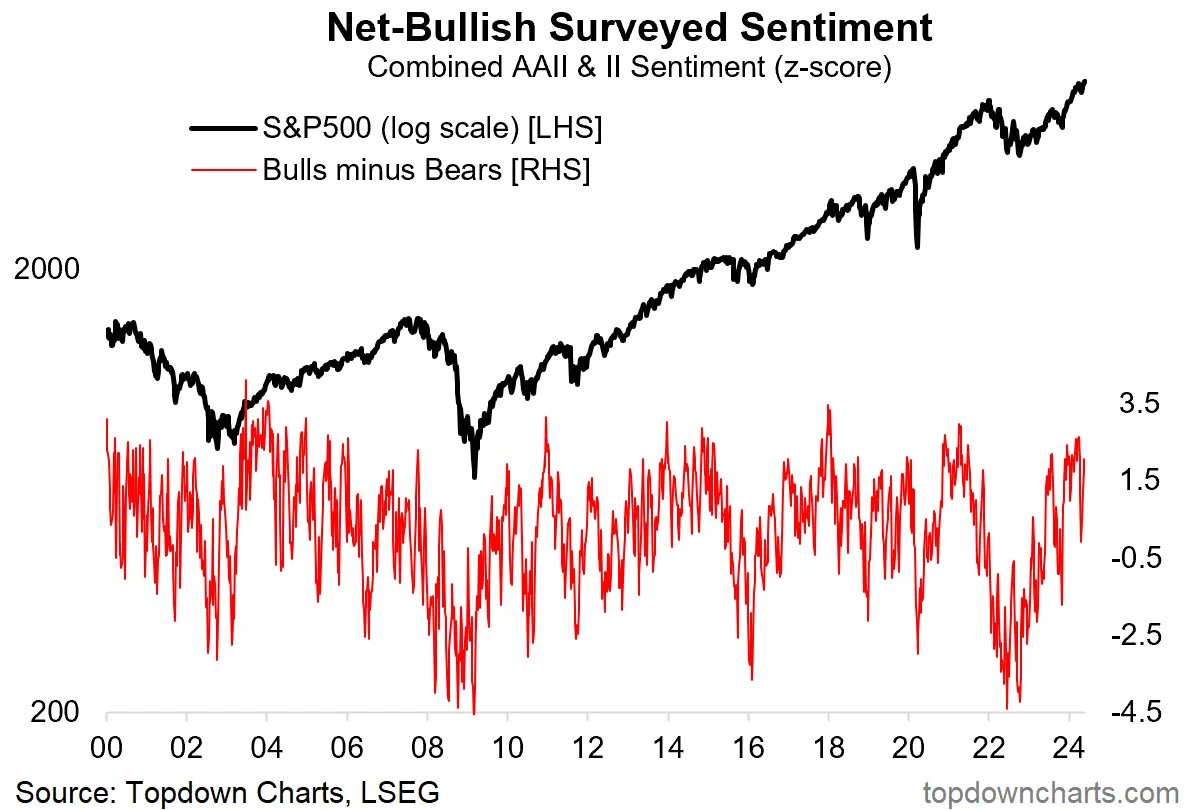

'After the April shakeout, surveyed measures of investor sentiment have bounced right back. The underlying mood is still very bullish and optimistic when it comes to the stockmarket outlook.'

Callum Thomas Topdown Charts

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

MarketCharts.com

Andrew Sarna

Topdown Charts

Kakashii

New Low Observer

The Idea Farm

Ramit Sethi

Sam Ro 📈